Blog /

Unyielding Security: How MDR Keeps Your Business Safe 24/7

Unyielding Security: How MDR Keeps Your Business Safe 24/7

This blog was provided by our partners at F12.net

This blog was provided by our partners at F12.net

Introduction

In the ever-evolving landscape of cyber threats, having a robust security system is crucial. Even the best security measures can fall short if not actively monitored and maintained around the clock. This is where 24/7 security monitoring becomes indispensable. F12’s Managed Detection and Response (MDR) service provides continuous, real-time protection, ensuring your business is always safe from cyber threats.

Constant Vigilance

One of the most significant advantages of MDR is its ability to provide continuous monitoring. In today’s digital age, cyber threats can strike at any moment, and downtime, even for a few hours, can be devastating for a business as many businesses do not know what their potential loss is per hour/day. Continuous monitoring ensures that any suspicious activity is detected and addressed immediately, minimizing potential damage.

MDR teams operate 24/7, vigilantly watching over your digital environment. They monitor network traffic, analyze system logs, and use advanced tools to detect any signs of malicious activity. This constant vigilance means threats are identified and neutralized before they can escalate into full-blown attacks.

Advanced Threat Detection

F12’s MDR service employs a variety of advanced technologies to detect threats. One key component is behavioral analysis, which monitors the normal behavior of systems and users to identify deviations that might indicate a threat. For instance, if an employee’s account suddenly begins accessing sensitive data at unusual hours, this could be an indicator of compromise.

Another critical aspect of MDR is threat intelligence. This involves gathering and analyzing information about emerging threats from various sources, including global threat databases, campaigns and security research. F12 also uses information from campaigns that have been caught that may pose additional risks to small and medium businesses. By staying ahead of the latest threats, MDR teams can proactively defend against new and sophisticated attack methods.

Examples of Threats Detected by MDR:

- Phishing Attacks: Attempts to steal sensitive information by masquerading as a trustworthy entity.

- Ransomware: Malicious software designed to block access to a computer system until a sum of money is paid.

- Crypto Jacking: Unauthorized use of someone else’s computer to mine cryptocurrency.

- Information-Stealing Malware: Programs that secretly collect sensitive information from a system.

Rapid Response to Incidents

Detection alone is not enough; the ability to respond quickly to incidents is equally critical. When a potential threat is identified, the MDR team springs into action to contain and mitigate the risk. This rapid response is crucial in preventing small issues from becoming significant problems.

Real-World Scenario

Consider a scenario where a manufacturing company was targeted by a sophisticated phishing attack aimed at stealing proprietary data. The MDR team detected the unusual activity within seconds and immediately began their response protocol. They isolated the affected systems, conducted a thorough investigation, and worked with the company’s IT staff to remediate the issue. Thanks to this rapid response, the company was able to prevent any data loss and avoid significant downtime.

Frequently Asked Questions

- What is MDR and how does it differ from traditional antivirus software?

- MDR, or Managed Detection and Response, is a comprehensive security service that goes beyond traditional antivirus software. While antivirus software scans for known threats and blocks them, MDR provides continuous monitoring, advanced threat detection, and rapid response to incidents.

- How quickly can MDR respond to a detected threat?

- MDR teams are on standby 24/7 and will respond to detected threats within seconds. The rapid response protocol includes isolating affected systems, conducting thorough investigations, and working with your IT staff to remediate the issue.

- What kind of technologies does F12’s MDR use to detect threats?

- F12’s MDR employs advanced technologies such as behavioral analysis and threat intelligence from global databases and security research to stay ahead of emerging threats and proactively defend against sophisticated attack methods.

- How does F12’s MDR handle false positives?

- F12’s MDR uses advanced filtering techniques and expert analysis to reduce false positives. The MDR team thoroughly investigates potential threats to confirm whether they are legitimate, ensuring genuine threats are addressed promptly while minimizing unnecessary disruptions.

- Can MDR help with compliance requirements?

- Yes, F12’s MDR can help businesses meet various compliance requirements by providing continuous monitoring, threat detection, and incident response. The service can generate detailed reports and logs required for regulatory compliance.

- What types of threats can F12’s MDR detect?

- F12’s MDR can detect a wide range of threats, including phishing attacks, ransomware, crypto jacking, and information-stealing malware.

- Is MDR suitable for businesses of all sizes?

- Yes, MDR is suitable for businesses of all sizes. Whether you are a small business or a large enterprise, F12’s MDR service can be tailored to meet your specific security needs.

- How does F12 ensure the confidentiality and security of my data?

- F12 adheres to strict security protocols to ensure the confidentiality and security of your data. The MDR service uses encrypted communication channels, secure data storage, and stringent access controls.

- What is the cost of implementing F12’s MDR service?

- The cost varies depending on the size and specific needs of your business. F12 offers flexible pricing plans. For a detailed quote, contact F12 directly.

- How can I get started with F12’s MDR service?

- To get started, contact F12’s sales team to schedule a consultation. They will assess your business’s security needs and guide you through the implementation process.

Conclusion

The benefits of having 24/7 protection through MDR are clear. Continuous monitoring, advanced threat detection, and rapid response capabilities ensure that your business is always one step ahead of cyber threats. With F12’s MDR service, you can have peace of mind knowing that your digital environment is under constant watch by a team of security experts.

Don’t leave your business vulnerable to cyber-attacks. Take advantage of our MDR Promo 50% OFF (f12.net) to provide the round-the-clock protection you need. Contact us today to learn more about how we can keep your business safe 24/7.

Related News

Employee Education is a Critical Defence Against Cyber Attacks

How Your Organization Can Quantify and Reduce Your Cyber Risk

A Front Row Look at the Celebration of Toronto Business Legends

Blog /

Interview With DEI Leader, Yasmin Razack

Interview With DEI Leader, Yasmin Razack

This blog was provided by our partners at York University School of Continuing Education

This blog was provided by our partners at York University School of Continuing Education

A combination of personal and professional experiences led Dr. Yasmin Razack to understand the power of diversity, equity and inclusion in action and pursue it as her career. Yasmin has nearly two decades of progressive experience in senior leadership roles focused on diversity, equity and community inclusion. She is currently the Dean of Equity, Diversity, Inclusion and Belonging at Humber College where she works across the college to promote EDIB in teaching, learning, and organizational culture and actively contributes to advancing the principles and values of EDIB through education, training, mentorship, and open dialogue with students, staff, faculty, and alumni groups.

Recently, Yasmin lent her expertise to helping design the School of Continuing Studies’ new Certificate in Diversity, Equity and Inclusion in Action as a program advisory council member. We spoke to Yasmin about this new program, and how it will allow leaders and professionals to bring DEI practices and strategies to their organizations.

Thanks for taking the time to speak, Yasmin! For those unfamiliar with the term, could you explain what diversity, equity, and inclusion mean?

I appreciate the definition that Kojo Institute uses because it’s based on disparity and disproportionality. When you think about under-representation, that’s grounded in disproportionality, where are you seeing disproportionate numbers of communities who can’t get access to resources and services—who experience systemic inequities. And then when you think about disparity, that has to do with impact. What is the impact of their educational attainment on their ability to thrive across different industries? DEI is programs, initiatives and strategies that disrupt and work to address these issues across various industries in the workplace to achieve equitable outcomes.

What benefits does an organization experience by implementing DEI initiatives?

I think one of the things where it benefits all organizations is that it’s grounded in innovation. If you are applying and integrating the DEI lens, if you’re addressing systemic inequities, you are introducing new ways of working. You’re introducing new ways of building strategies and connecting with communities in more deeply impactful ways, which can result in increased innovation.

What types of professionals will benefit from taking this program?

If you are a leader managing people, this certificate will build your capacity, your literacy, and your understanding of how to integrate DEI with intentionality, build diverse teams, and adopt inclusive leadership traits to advance strategic initiatives, integrate inclusive hiring practices and lead sustainable organizational inclusion.

If you’re currently in a role in an organization where DEI has consistently come up—this is anywhere from marketing executives, healthcare professionals, IT, public affairs, government, any not-for-profit, all of that. If you are currently within a role that requires the integration of DEI this is for you.

And then finally if you want to be a DEI practitioner, full-time. If you want this to be your role within an organization or you want to start a consultancy in DEI, this program would highly benefit you because it gives you a framework, gives you tools, and gives you resources to integrate and apply this work, utilizing proven strategies.

What kind of projects will students participate in in this program?

We will work with you to develop a DEI action plan for your organization. An example is, and again, thinking back to the roles I just suggested, what does a DEI maturity assessment look like? How do you engage in that work and what is required to do this work successfully? Given the fact that DEI requires metrics and requires an understanding of what those metrics are, this is a tool that we’re going to introduce that will allow people to understand ways in which to measure progress.

Another is the SEEDS model and the ACE model. These are models that hiring managers, talent acquisition specialists and leaders— anyone involved in hiring—could apply to understand ways in which we potentially have biases that is grounded in all of the “isms”, whether it’s sexism, racism, or ableism. We are going to help students understand ways in which to build systemic practices and processes that disrupt that cycle of bias within the recruitment, hiring, and retention process.

What kind of interpersonal skills are crucial for someone working in DEI?

First and foremost is empathy, what is also known as radical empathy. Through active listening, humility, compassion, empathy, and communication we understand each other more deeply, and realize the impact of systemic inequities that have persisted across all levels of society. As a working professional, communication is the most important skill as you have to be disarming and connect with a broad range of people. And I think navigating these systems that are largely based on colonial principles, and the program will help students understand ways in which the system operates. And doing so does require a high level of patience, but it’s grounded in collective action.

It’s about bringing people together. Building relationships, and effective communication, grounded in radical empathy. Compassion also I think speaks volumes to the success of any DEI practitioner.

Related News

Employee Education is a Critical Defence Against Cyber Attacks

How Your Organization Can Quantify and Reduce Your Cyber Risk

A Front Row Look at the Celebration of Toronto Business Legends

Blog /

Immigration as a Key Economic Driver: Highlights from the Roundtable with the IOM and Canadian Business Leaders

Immigration as a Key Economic Driver: Highlights from the Roundtable with the IOM and Canadian Business Leaders

We were honoured to host a roundtable at the end of June with a delegation from the International Organization for Migration (IOM).

We were honoured to host a roundtable at the end of June with a delegation from the International Organization for Migration (IOM) that included Director General Amy Pope and Deputy Director General for Operations Ugochi Daniels. Members of the Canadian Chamber Network, as well as representatives from Canadian employers and industry associations, joined us in-person and virtually to discuss how we can better align immigration with Canada’s current labour market and economic realities.

Canada has a long tradition of being multicultural and immigration is a key driver of our country’s economic growth. But in the past couple of years, the public perception of immigration in Canada has shifted dramatically. A recent survey by the Association of Canadian Studies and the Metropolis Institute found that 50% of Canadians think that too many immigrants are coming into the country.

This negative perception is unlikely to change unless Canada’s approach to immigration policy addresses the realities of today’s labour market and of the future economy too, while also considering the needs of immigrants, communities and businesses.

Insights from the Roundtable

A broad range of topics were discussed during the roundtable, with participants providing their unique experiences and perspectives on everything from temporary foreign workers to jurisdictional barriers.

Collaboration Among Stakeholders

Better collaboration among stakeholders who are currently working in silos is critical. All levels of government need to work in closer alignment while also proactively involving local communities and employers in program design, implementation and assessment.

Aligning Immigration with Labour Market Needs

Canada is built on immigration and has greatly benefited from the contributions of migrant workers. Amid demographic shifts, including low birth rates and imminent record retirements, today’s labour challenges and skills gaps will continue to grow and impact every Canadian’s wellbeing. The solution is ensuring better alignment between the skills, education and certifications that immigrants bring into the country and the current and future demands of the labour market. As part of this, improved skills assessment and expedited foreign credential recognition are necessary to ensure immigrants successfully integrate into the labour market and can meaningfully contribute to the economy right away.

Sector and Region-Specific Solutions

Our economy needs high- and low-skilled labour to operate and grow. However, creating more beneficial and efficient labour pathways requires careful examination of each sector or region’s challenges and needs. For instance, ttemporary foreign workers are indispensable for some sectors of the economy, including agriculture, construction, tourism and food manufacturing.

We need to do a better job of supporting immigration to rural communities that face persistent labour challenges and skills gaps. Small and medium-sized businesses also require better support to address their talent needs and leverage the economic potential of immigration.

Did you know Canada was one of the founding members of IOM? Learn more about the work of the IOM and IOM Canada.

Related News

Employee Education is a Critical Defence Against Cyber Attacks

How Your Organization Can Quantify and Reduce Your Cyber Risk

A Front Row Look at the Celebration of Toronto Business Legends

Blog /

Leading for Mental Health

Leading for Mental Health

This blog was provided by our partners at Cenovus.

This blog was provided by our partners at Cenovus.

Mental health has profound implications for employees and their workplaces.

We all have a critical role in contributing to the conditions for positive mental health – people are influenced by everyone around them, but leaders can have an outsized impact. And, while leaders don’t have to be anyone’s therapist, they do need some basic understanding of how a person’s job affects their mental well-being.

Recent data from The Workforce Institute at UKG , a leading international HR management firm, suggests almost 70% of people feel their manager has more of an impact on their mental health than their therapist or doctor— equal to that of their partner. The stakes for leadership have always been high but may feel even more important when we recognize addressing employees’ mental health is part of that.

At Cenovus, we foster the following approaches for our leaders to protect, promote and support positive mental health.

Normalize Conversations

Stigma is a serious barrier to people speaking up or getting help. Having open conversations about mental health in the workplace is an evidence-based way to reduce stigma.

Team meetings, one-to-one check-ins, storytelling – these are all ways to ask people how they’re doing and encourage dialogue. Tune in when you see they may be out of sorts or when they may need support.

Constructive feedback and positive reinforcement are cornerstones of a healthy and respectful workplace. Regularly engage employees in developing realistic and positive solutions that increase psychological safety in the workplace.

Connect to Meaningful Support

The job of a leader isn’t to uncover or diagnose mental illness.

But being observant brings an opportunity to intervene in a supportive manner and connect the employee to the right resources. Problem-solve to remove roadblocks and streamline processes to get employees connected.

Build Knowledge

Building mental health literacy is crucial for fostering a supportive work environment. By understanding mental health issues, leaders can identify early signs of distress, offer support, and create a culture of openness and acceptance.

Also help your team members connect with others in the organization. Connection is critical to well-being and happiness. Help them find mentors, encourage collaboration across departments and consider sponsoring volunteer efforts for team members to serve the community together.

Address Psycho-social Hazards

Leaders have a role in mitigating psychosocial hazards to create a supportive environment. This includes:

- Identifying risks, such as excessive workload, lack of job control, poor communication, and workplace bullying.

- Implementing policies – establishing and enforcing policies that address these hazards, such as clear job descriptions, fair workload distribution, and zero-tolerance for harassment.

- Promoting work-life balance – encouraging practices that support work-life harmonization, including flexible working hours, remote work options, and promoting the use of vacation time.

- Fostering a positive culture – cultivating an inclusive, respectful, and supportive organizational culture where employees feel valued and heard.

Encourage Disconnection

Giving employees the opportunity AND permission to disconnect from workcan support their mental health and make them more engaged on the job. Encourage employees to use time away from work to avoid burnout.

Prioritize Your Own Mental Health and Well-being

Many leaders try to shield team members from stress by taking on the toughest work—or the extra work—themselves. People watch how leaders manage workload and personal well-being and model their own habits accordingly.

Leaders are human too and need to plan for self-care. It doesn’t need to be complicated but they must ensure healthy behaviours are actioned consistently. These include eating well, resting and also engaging with the people you love, while having some fun each day. Being aware of energy boosters and energy drains will help keep their batteries charged. This builds leadership capacity, providing the necessary energy to fuel good decision-making, sharpen focus and maintain a steady pace. This has a direct impact on the health and culture of the team & organization because high performing, resilient leaders inspire others to follow their example.

At Cenovus, a pillar of our approach to mental health is promoting those open conversations to reduce stigma and perceived stigma. To see whether our approach and actions are resonating with our people, we use our organizational health survey to check in and track our progress.

Prioritizing mental health directly impacts employee well-being, productivity, and overall organizational success. When leaders focus on mental health, they create a supportive and inclusive work environment where employees feel valued and understood. Ultimately, a mentally healthy workforce is more engaged, innovative, and resilient, driving better business outcomes and a more positive organizational culture.

Leora Hornstein,

Well-Being Specialist, Human Resources,

Cenovus

Related News

Employee Education is a Critical Defence Against Cyber Attacks

How Your Organization Can Quantify and Reduce Your Cyber Risk

A Front Row Look at the Celebration of Toronto Business Legends

Blog /

Stop, Start, Continue: How We Can Regain Canada’s Competitive Advantage

Stop, Start, Continue: How We Can Regain Canada’s Competitive Advantage

Instead of focusing on how we ended up here, let’s look at what we can stop, start and continue doing to grow our competitiveness once again.

A stop, start, continue analysis is often used to determine how a team or individual in a workplace can improve their performance. But it’s also a useful exercise for figuring out how we can get Canada’s economic competitiveness back on track.

What is economic competitiveness?

Economic competitiveness is Canada’s ability to compete against other global players for international talent, trade and investment. It’s also linked to a country’s wealth and prosperity, which determine standard of living.

What happened to Canada’s competitiveness?

There are a lot of factors that have contributed to our decline in this area — low productivity, high inflation, unreliable supply chains, nation-wide skills gaps, not enough housing… But instead of focusing on how we ended up here, let’s look at what we can stop, start and continue doing to grow our competitiveness once again.

Stop

- Stop adding taxes. The way to fix Canada’s economic competitiveness is not through more spending on government programs — spending fuelled by new taxes — it’s by enabling private-sector businesses to do business because government spending simply cannot replace private-sector innovation or investment. The government frequently talks about encouraging business investment, yet at the same time, adds new rules, regulations and taxes that make it more time-consuming and costly to do so.

In the 2023 International Tax Competitiveness Index, Canada ranked 24 out of 38 countries for corporate taxes. Under our complex tax system, businesses have less resources to invest back in their business (hiring more people or producing better products for Canadians) because they’re putting their time and money towards making sure they’re paying the right amount of tax to the government. Government shows no sign of reducing the tax burden or simplifying the system, choosing instead to move forward with the retroactive Digital Services Tax. - Stop ignoring threats to our supply chains. Strikes at ports, railways, airports and borders halt the flow of goods to market, damaging Canada’s economy and hurting our reputation as a reliable place to do business, both of which make us less competitive on the global stage. Yet government has voted for more frequent and longer strikes by rushing to pass the anti-replacement worker legislation that prevents organizations in sectors like trucking, rail, ports, telecom and air transportation to provide a basic level of service, preserving critical functions for Canadians.

- Stop the misalignment between immigration and regional and sectoral labour needs. A report from RBC found that, despite the fact that immigration has been responsible for all labour force growth in the past decade, it hasn’t been able to counteract the impact of Canada’s aging population or the shortages in the job markets because the skills immigrants are bringing with them and the fields of study international students are choosing are not in alignment with the long-term needs of our economy. To address this misalignment, government and educational institutions need to work with businesses and communities to determine which skills, credentials and education should be prioritized.

Start

- Start applying an economic and competitiveness lens to regulations. When creating and implementing new regulations, sufficient consideration isn’t given to how they will impact businesses. If an economic lens were applied, regulations would become more manageable for businesses, supporting economic growth and our global competitiveness by increasing investment, growth and jobs.

- Start investing in long-term trade infrastructure. We need reliable ports, bridges, roads and railways to transport our goods to Canadians and our customers abroad. Committing to a strategy like the Canada Trade Infrastructure Pan will help us build and maintain our trade infrastructure, ensuring the smooth flow of goods and services.

- Start expediting foreign qualification recognition for immigrants. After all, it doesn’t make sense to choose individuals based on the skills, education and credentials they possess and that our economy needs if we then prevent them from working in their fields upon arrival. Expedited recognition will help address the urgent labour needs of priority sectors like agriculture, childcare, construction, healthcare and transportation, and allow qualified newcomers to fully participate in our economy right away.

Continue

- Continue reducing interprovincial barriers. It’s easier for Canadian businesses to trade with Europe or the United States than within Canada. While the government has made progress streamlining internal trade and removing interprovincial barriers, more needs to be done. Especially considering that we stand to benefit from a potential 8% increase in GDP growth if this issue is addressed.

- Continue incentivizing business adoption of AI. Given AI’s potential to help address our productivity problems, Canadian businesses should be at the forefront of adoption — not sitting on the sidelines. Government can help stimulate adoption by ensuring our AI regulation is proportionate and risk-based, and by fully leveraging private sector partners when allocating the new $2.4 billion in AI funds announced in the 2024 Budget.

- Continue being open to the movement of people. It may be time for a new strategy, but there’s no doubt that Canada needs immigration. Given our low birth rates and aging demographics, immigration is the only way we’ll be able to fill our skills gap and grow our economy.

Overall, the most important things the government can do to help Canada’s competitiveness is to stop getting in the way of businesses doing business, start focusing on growth driven by the private sector, and continue collaborating and partnering with Canada’s vibrant business community.

Related News

Employee Education is a Critical Defence Against Cyber Attacks

How Your Organization Can Quantify and Reduce Your Cyber Risk

A Front Row Look at the Celebration of Toronto Business Legends

Blog /

Highlights from the Canadian Chamber of Commerce’s Calgary Stampede Mixer

Highlights from the Canadian Chamber of Commerce’s Calgary Stampede Mixer

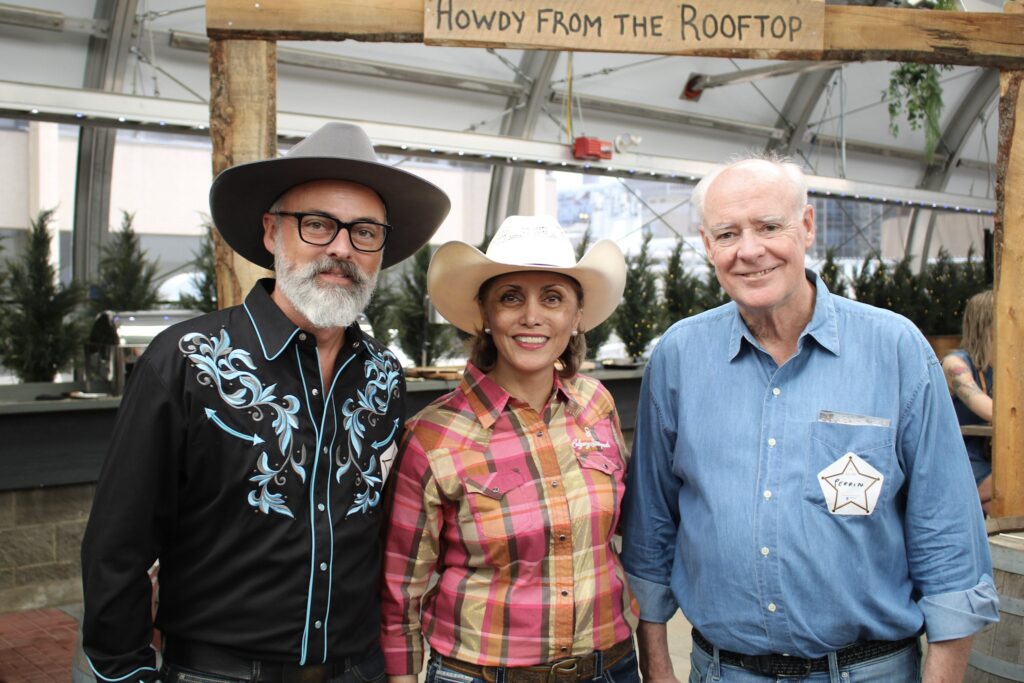

We welcomed political and business leaders from Western Canada and beyond to network, connect and enjoy some food and entertainment.

On Saturday, July 6 we hosted an afternoon reception in Calgary in tandem with the annual Stampede festivities. We welcomed political and business leaders from Western Canada and beyond to network, connect and enjoy some food and entertainment.

View the Full Photo Album.

We were very happy to host this year’s event at the Rooftop YYC. They provided us with stellar food, a great atmosphere and some fun tunes from their DJ!

We would like to extend a heartfelt thank you to everyone who attended the event throughout the afternoon and got to connect with fellow members of the Canadian business community!

About the Western Executive Council

The Canadian Chamber of Commerce’s Western Executive Council is composed of Chief Executive Officers from a cross section of companies that are committed to building a stronger Western Canadian economy, and by extension a more successful and sustainable economy for all of Canada.

The Council plays a leading role in developing and advocating sustainable, positive policies that include uniquely Western perspectives for the benefit of all Canadians.

Thank You to Our Event Sponsors

Related News

Employee Education is a Critical Defence Against Cyber Attacks

How Your Organization Can Quantify and Reduce Your Cyber Risk

A Front Row Look at the Celebration of Toronto Business Legends

Blog /

Choosing to take our responsibilities

Choosing to take our responsibilities

This featured blog post was provided by our partners at Energir. On June 26, Corporate Knights released its ranking of...

This featured blog post was provided by our partners at Energir.

On June 26, Corporate Knights released its ranking of the Best 50 Corporate Citizens in Canada. Based on publicly available data, and combining ESG and sustainable economy performance indicators, Énergir has earned a spot on the list for the past seven years.

This year, Énergir ranks 16th across all sectors and 2nd out of 103 organizations in its business group. This recognition reflects our organization’s efforts to move toward a more sustainable business model.

A necessary shift

As an energy company primarily involved in gas distribution in Quebec, we realized a few years ago that the future of our company would depend on the relevance of our activities in a world that is—and rightly so— moving toward decarbonization in a sustained manner.

Our business model is literally being transformed. With an eye to the long term, it now calls for us to think of energy not as a product, but as a service that must best meet various needs, including reducing GHG emissions in order to move toward a lower-carbon economy. It is based on two main objectives: reducing the volume of fossil natural gas distributed and developing sustainable energy solutions.

Consistency rewarded

One of the Corporate Knights indicators where Énergir stands out is the one measuring the link between compensation and sustainability—the “Sustainability Pay Link.” To ensure that our transformation is fully implemented and that employees take ownership of it, a portion of executive officers and managers as well as professionals compensation is now tied to the achievement of our strategic plan targets, including those for reducing GHG emissions.

All 1,600 employees are therefore working in the same direction. Obviously, this has led to a complete transformation of certain roles. For example, our sales team, which once aimed to sell more volumes, is now an energy solutions team working to put in place decarbonization measures for our customers.

In a shift as major as the one Énergir is undergoing, consistency is definitely key to moving the needle faster and achieving our goals of a 30% reduction in GHG emissions from the buildings we serve by 2030, and carbon neutrality for the energy we distribute by 2050.

Progress regarding our targets and indicators, as well as projections, are published every year in our sustainability performance and climate resiliency reports.

Sustainability in the balance

In its ranking, Corporate Knights strongly emphasizes sustainable revenue and investments. By diversifying its activities in the renewable energy sector through our subsidiaries, particularly in the northeastern United States, Énergir is succeeding. Of our $10 billion in assets, half are in renewable energies.

In Quebec, our affiliate Énergir Development Inc. (EDI) is working with Boralex and Hydro-Québec on what could become Canada’s largest wind farm, with 1,564 MW of installed capacity. The project represents a potential investment of some $1.5 billion.

In addition to investing in the development of energy loops, EDI is focusing on the production of renewable natural gas, in partnership with Nature Energy. While EDI’s data is not included in the Corporate Knights analysis, its activities point to where Énergir is going.

Toward our focus: Value

This recognition from Corporate Knights confirms, once again, that we’re moving in the right direction. While we’re proud of how far we’ve come, we’re also aware that there’s still a long way to go. We continue to move forward with confidence and humility, determined to create value for the future of our communities.

Philippe Lanthier

Director, Sustainability, Climate Change and Public Policy, Énergir

Member, Canadian Chamber of Commerce Net-Zero Council

Related News

Employee Education is a Critical Defence Against Cyber Attacks

How Your Organization Can Quantify and Reduce Your Cyber Risk

A Front Row Look at the Celebration of Toronto Business Legends

Blog /

York University School of Continuing Studies Launches New DEI Program for Leaders Looking to Bring Positive Change to Their Organizations

York University School of Continuing Studies Launches New DEI Program for Leaders Looking to Bring Positive Change to Their Organizations

This blog was provided by our partners at the York University School of Continuing Studies. This fall, the York University...

This blog was provided by our partners at the York University School of Continuing Studies.

This fall, the York University School of Continuing Studies will launch its new Certificate in Diversity, Equity and Inclusion in Action, a 6-month part-time program for mid-career professionals and business leaders. Learners who enrol in the program will gain the necessary knowledge and skills to transition into diversity, equity and inclusion roles or implement DEI initiatives within their workplaces.

“Over the past few years, we’ve seen a major shift and emphasis toward prioritizing diversity, equity and inclusion efforts in the corporate world. This program is another step forward to ensuring a future workforce that is more diverse and inclusive,” says Denine Das, financial services DEI leader and advisory committee member for the program. “Through the real-life experiences from the program instructors and invaluable insight into the success and areas of opportunities with regards to DEI, this program will provide students the necessary skills and abilities to understand the imperatives organizations require to succeed in the global market.”

Canadian organizations are implementing DEI strategies at an increasing rate, recognizing that promoting diversity, equity and inclusion is crucial for both their workforce and broader societal success. This has created a growing need for adept leaders capable of championing and successfully implementing DEI initiatives.

Between 2018 and 2022, DEI job postings have increased by 56% in the GTA, 63% in Ontario and 71% nationally[i]. The School of Continuing Studies’ Certificate in Diversity, Equity and Inclusion in Action aims to fill this talent shortage by providing professionals with the knowledge, skills and experience in current DEI practices to match their passion.

“The York University School of Continuing Studies is proud of its commitment to diversity, equity and inclusion to our community members including staff, students and instructors. DEI is at the heart of everything we do, from our objective of removing barriers to education for learners to the design of our new building,” says Christine Brooks-Cappadocia, assistant vice president of continuing studies at York University. “That’s why we are excited to launch this new program which responds to what DEI professionals are telling us is needed to support their work — a formal education credential that ensures graduates have practical experience in implementing DEI practices.”

The program’s curriculum was created in partnership with Canadian business leaders who specialize in DEI. Students in this program will gain hands-on practice engaging in activities like:

- Conducting a real-world examination of the processes and workflows of DEI professionals through an end-to-end DEI action plan project

- Interpreting data analytics to identify DEI trends and measure the effectiveness of initiatives

- Making evidence-based decisions to foster an inclusive and equitable work environment

Instructors who work full-time in senior-level DEI roles will support students through projects and classes and will bring their real-world expertise and insights to every course.

For more information on the Certificate in Diversity, Equity and Inclusion in Action launching in September 2024, visit the School of Continuing Studies webpage.

[i] According to Lightcast data

Related News

Employee Education is a Critical Defence Against Cyber Attacks

How Your Organization Can Quantify and Reduce Your Cyber Risk

A Front Row Look at the Celebration of Toronto Business Legends

Blog /

Strengthening Tech Ties: Gateway to MENA -Jordan ICT Delegation to Canada

Strengthening Tech Ties: Gateway to MENA -Jordan ICT Delegation to Canada

This event aimed to enhance collaboration between the technology sectors of Canada and Jordan, emphasizing Jordan's prominence as an ICT hub in the Middle East and North Africa (MENA) region.

On June 19, the Canadian Chamber of Commerce and Jordan’s Ministry of Digital Economy and Entrepreneurship, through the Jordan Source program, hosted the “Gateway to MENA” event at Hotel X in Toronto.

This event aimed to enhance collaboration between the technology sectors of Canada and Jordan, emphasizing Jordan’s prominence as an ICT hub in the Middle East and North Africa (MENA) region. The event drew over 120 business attendees and notable speakers from various local, regional, and international ICT companies.

The delegation from Jordan, led by the Ministry of Digital Economy and Entrepreneurship and the Jordan Source program, showcased Jordan’s vibrant ICT sector through presentations, discussions, and panels. These sessions emphasized the strategic advantages of Jordan’s location, its skilled workforce, and its supportive regulatory environment that has attracted numerous multinational tech companies.

Pre-event session: Small Group Engagement with Canadian Sector Leaders

The day began with a Small Group Engagement featuring Canadian sector leaders from The Dias, Microsoft, and Google. Karim Bardeesy, Executive Director of The Dias, provided an overview of Canada’s ICT sector, highlighting the tech economy and workforce. Marlene Floyd, Senior National Director of Corporate Affairs at Microsoft, discussed Canada’s generative AI opportunity. Abed Ibrahim, Principal Architect at Google Cloud, presented on unlocking the promise of AI.

Event Highlights

The main event kicked off with welcoming remarks from Catherine Fortin LeFaivre, Vice President of Strategic Policy & Global Partnerships at the Canadian Chamber of Commerce, where she highlighted the Chamber’s Gateway to the World program — which assists Canadian businesses in international trade and investment. Following her, Jordanian Ambassador in Canada, Sabah Al Rafie, underscored Jordan’s stability and its emergence as a key ICT hub in the MENA region, driven by strategic investments and a conducive business environment.

Jordan Technology Sector: Incentives & Opportunities

Dana Darwish, Jordan Source Program Manager, opened the first session with a presentation on the investment incentives offered by the Jordanian government. She showcased the opportunities available for the Jordanian technology delegates, providing valuable insights into the sector’s growth. Nidal Bitar, CEO of The Information and Communications Technology Association of Jordan (int@j), followed with a presentation titled “Jordan as a Hub for IT & Business Process Outsourcing,” highlighting Jordan’s strategic position in the ICT landscape.

Unlocking Opportunities: Canadian Tech Businesses & the Jordan Youth, Technology & Jobs Project

This dynamic discussion featured leaders from the Youth, Technology & Jobs (YTJ) Project at the Ministry of Digital Economy and Entrepreneurship. They discussed initiatives aimed at cultivating a skilled digital workforce, unlocking market expansion opportunities, and fostering a collaborative digital future. The session provided insights into how Canadian tech businesses can leverage these opportunities for mutual benefit.

Success Stories in Action: Showcasing Successful Canadian Businesses Operating in Jordan

The panel discussion centered on the experiences of Canadian businesses operating in Jordan. Panelists shared their insights on market understanding, partnering with local entities, establishing a presence, lessons learned, and strategies for success in Jordan and the MENA region. These success stories provided valuable takeaways for attendees considering expansion into the region.

To close off the event, Mohamad Sawwaf, Chair of The Canada Arab Business Council, highlighted the Jordanian government’s investments in creating a conducive environment for ICT growth, including several incubators and accelerators supporting over 600 startups and small enterprises. Ziad Aboultaif, MP and Chair of the Canada-Jordan Inter-Parliamentary Friendship group, emphasiezed the opportunity for Canadian and Jordanian tech businesses to share capabilities, learn from each other, and forge lasting partnerships.

Networking Reception

The event concluded with a networking reception, providing participants from Jordan and Canada an opportunity to connect in a relaxed, informal setting. This facilitated deeper discussions and the exploration of potential collaborations.

Jordanian Delegation

The Jordanian delegation, led by the Jordan Source team, showcased a diverse spectrum of expertise in the ICT sector. Representatives from 99brightminds, Enjez, Ideal Innovation House, Mawdoo3, Jordan Ahli Bank, Progressive Generation, Safeer, SIS, True Markets, and int@j were present, highlighting Jordan’s strength in technology, innovation, and entrepreneurship.

The “Gateway to MENA” event successfully highlighted the growing potential of Jordan’s ICT sector, offering unparalleled opportunities for information technology outsourcing (ITO) and business process outsourcing (BPO). With significant investments, an impressive growth rate in foreign market ICT revenue, and attractive tax incentives, Jordan stands as a highly sought-after outsourcing hub. The event not only showcased Jordan’s capabilities but also opened new avenues for Canadian businesses to explore and capitalize on the opportunities in the MENA region.

For more information on future events and initiatives, visit our events page and stay connected with our Gateway to the World program.

In Collaboration With

Supporters

Jordanian Corporate Delegates

Related News

Employee Education is a Critical Defence Against Cyber Attacks

How Your Organization Can Quantify and Reduce Your Cyber Risk

A Front Row Look at the Celebration of Toronto Business Legends

Blog /

4 Ways Businesses Are Using AI To Empower Innovation and Enhance Productivity

4 Ways Businesses Are Using AI To Empower Innovation and Enhance Productivity

If we can get more Canadians on board with AI, we can get more businesses on board too, and that’s good news for our economy.

Canadians interact with artificial intelligence (AI) every day — often without realizing. AI refers to technology that can perform tasks that typically require human intelligence, such as visual perception, speech recognition, language translation, etc. From showing us more of the content we like on social media to popping up as a chat bot that helps us find the answer to our question faster, AI is now part of our everyday lives.

Not only does it make the daily activities of Canadians easier and possible, but it also makes businesses better at doing business by empowering innovation and enhancing productivity.

But compared to other countries, Canada is slower to adopt AI and Canadians are less knowledgeable and more nervous about it. Public interest and attitudes toward AI are likely positively correlated with a country’s business adoption rates. So, if we can get more Canadians on board with AI, we can get more businesses on board too, and that’s good news for our economy.

AI, Business and You

First, let’s dispel the myth that businesses want to use AI to replace workers. In fact, only 13% of businesses are interested in this outcome, with most businesses using AI to simplify and streamline operations and create better outcomes for customers.

Here are some the most common reasons that businesses are using AI and why it’s a good thing for Canadians:

1. To accelerate the development of content

By far the most popular business use for AI is creating content. Social media is an excellent and popular connection point between business and customer, as well as an important source of information on promotions, events, special offers, hours, etc. But it’s also a huge time commitment and can often be neglected due to other pressing priorities. By using AI to create content faster, businesses can produce more of what their customers want.

2. To increase automation in tasks

Workers often have to manage daily tasks that, while urgent or necessary, are of lower value to the overall business goals, such as tracking sales metrics or monitoring suppliers. Being able to hand these sorts of tasks off to AI frees workers up for more strategic and profitable work — like improving products for consumers.

3. To improve customer experience

AI-powered chat bots are an example of how businesses are improving customer experience. By using a chat bot to answer common queries, businesses can cut down on wait times for customers, leading to greater customer satisfaction instead of frustration.

4. To make data-driven decisions

Data allows businesses to make informed decisions but sifting through the data for insights — especially for micro firms with four employees or less — isn’t always possible. Using AI to assist with finding and delivering insights is a win-win for businesses and their customers. Better decisions make for better products, service and delivery.

Empowering Innovation, Enhancing Productivity

Labour productivity is the amount of gross domestic product (GDP) created per hour worked. Productivity is closely related to a country’s prosperity and long-term standard of living. Rising productivity improves wages, lowers prices, and increases the tax revenue that supports the public services that Canadians rely on. But Canada is in the middle of a productivity emergency. We haven’t experienced productivity growth in the past six years.

More businesses adopting AI will empower innovation and enhance productivity across our economy. Our Business Data Lab’s recent report on generative AI adoption by Canadian businesses found that, depending on how fast businesses adopt AI, we could improve our productivity levels by up to 6% over the next 10 years!

While 14% of businesses are early adopters of AI, almost three-quarters of businesses are hesitant. To see the economic benefits, more businesses need to start implementing AI, and fast.

What can businesses do to get started?

- Try out AI with small pilot projects first and measure the before and after performance for accurate comparisons.

- Align adoption with overall business goals. Identify where AI can enhance existing processes, improve customer experience and drive innovation.

- Leverage public resources like the federal government’s guide on the use of generative AI or tap available funding.

But most importantly, businesses should experiment!

The Canadian Chamber’s Work

The Canadian Chamber’s Future of Artificial Intelligence Council plays a leading role in advocating for policies that will establish AI as a positive economic force through the responsible development, deployment and use of AI in business.

Related News

Employee Education is a Critical Defence Against Cyber Attacks

How Your Organization Can Quantify and Reduce Your Cyber Risk