Blog /

The Bank of Canada is behind the curve, starts raising rates more aggressively to control inflation

The Bank of Canada is behind the curve, starts raising rates more aggressively to control inflation

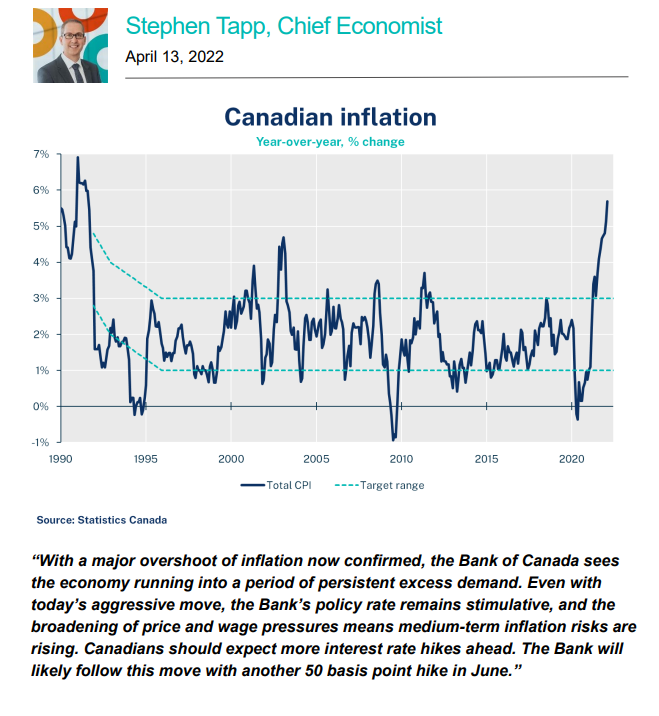

With a major overshoot of inflation now confirmed, the Bank of Canada sees the economy running into a period of persistent excess demand. Even with today’s aggressive move, the Bank’s policy rate remains stimulative, and the broadening of price and wage pressures means medium-term inflation risks are rising.

Related News

Time to put reports into action, Chamber tells House Agriculture Committee

On February 17, 2022 the Canadian Chamber’s Senior Director, Transportation, Infrastructure & Regulatory Policy, Robin Guy, appeared at the House...

2022 Q3 Canadian Survey on Business Conditions: Inflation is the top issue. Labour pains intensifying, but price pressures and supply chains issues are improving

According to the latest CSBC survey, Canadian businesses continue to see inflation as their biggest near-term obstacle. A whopping 60% of firms expect inflation to be a challenge, the highest response rate in the history of the survey.

Canadian GDP for July: Defying expectations, a stronger start to the third quarter than anticipated, but a slowdown remains in clear sight

The writing has been on the wall for Canada’s real GDP as slowdown has been underway in the third quarter with falling housing prices and three consecutive months of job losses. July’s data gave Canadians slight reprieve with a surprising real GDP edging growth of 0.1%.