Blog /

2022 Q3 Canadian Survey on Business Conditions: Inflation is the top issue. Labour pains intensifying, but price pressures and supply chains issues are improving

2022 Q3 Canadian Survey on Business Conditions: Inflation is the top issue. Labour pains intensifying, but price pressures and supply chains issues are improving

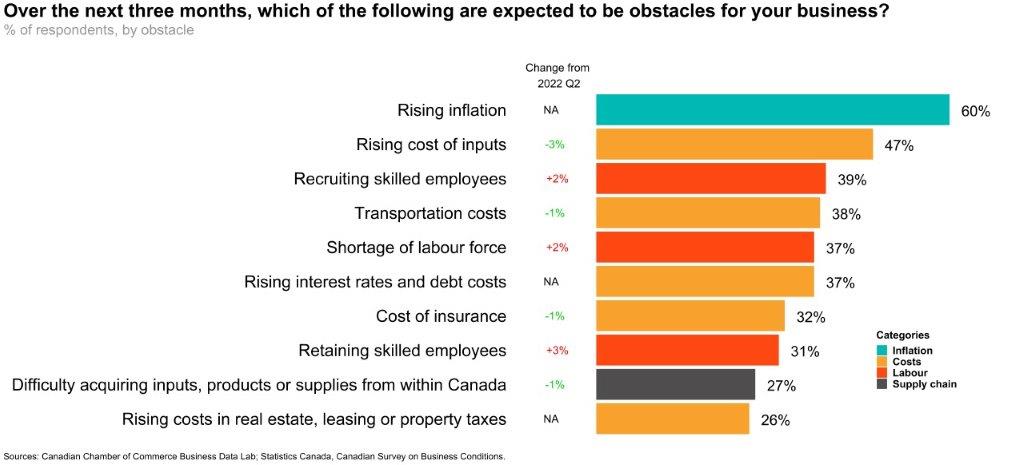

According to the latest CSBC survey, Canadian businesses continue to see inflation as their biggest near-term obstacle. A whopping 60% of firms expect inflation to be a challenge, the highest response rate in the history of the survey.

According to the latest CSBC survey, Canadian businesses continue to see inflation as their biggest near-term obstacle. A whopping 60% of firms expect inflation to be a challenge, the highest response rate in the history of the survey. This does not come as a big surprise, given how this issue has dominated news coverage and business discussions over the past year.

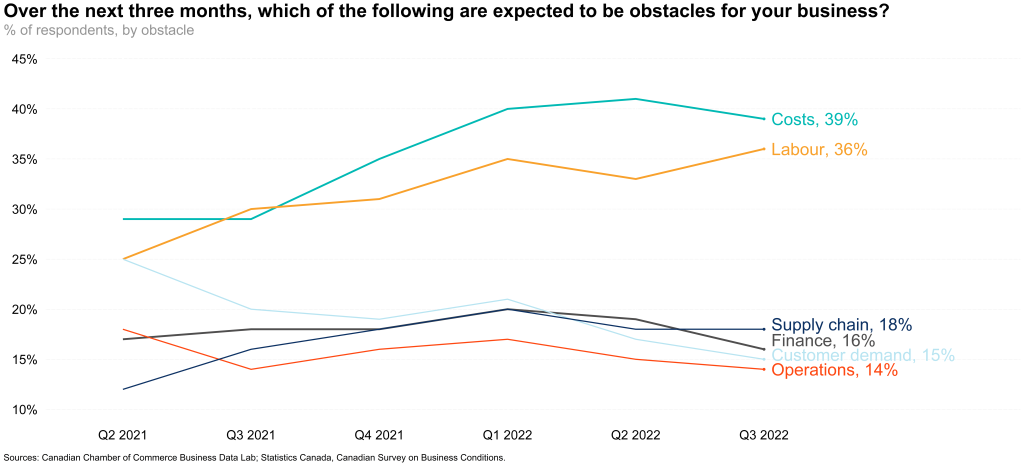

More generally, the survey shows that Canadian businesses continue to struggle with rising input costs related to the high inflation environment, hiring workers in a very tight labour market, and lingering supply chain challenges.

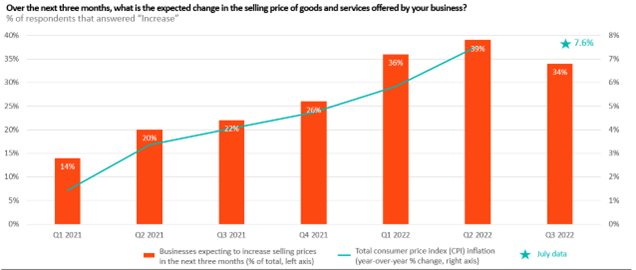

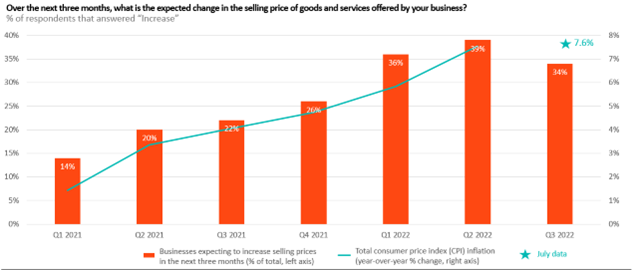

In the midst of these widespread inflation concerns, it’s encouraging to see the first signs of improvement on this front: consumer price inflation finally edged down in July (to 7.6%, down from 8.1% due to falling gas prices), and for the first time since 2021, the share of businesses that say they expect to raise prices in the coming quarter has dropped (to 34% in this survey, down from the record 39% last survey.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

- Canadian business expect rising inflation to be the top obstacle they face over the next quarter. This issue was cited by the majority (60%) of respondents, representing the highest response rate in the history of the survey.

- Similarly, the second biggest near-term obstacle is rising inputs costs, cited by almost half (47%) of businesses, down slightly from the last survey (50%). Costs pressures are highest for businesses in agriculture (72%), manufacturing (72%) and accommodation and food services (70%).

- Thankfully, there were some tentative signs of improvement on the inflation front. Over the next quarter, 34% of businesses expect to raise prices (down fromthe record39% last quarter), consistent with inflation continuing to slow from its four-decade highs.

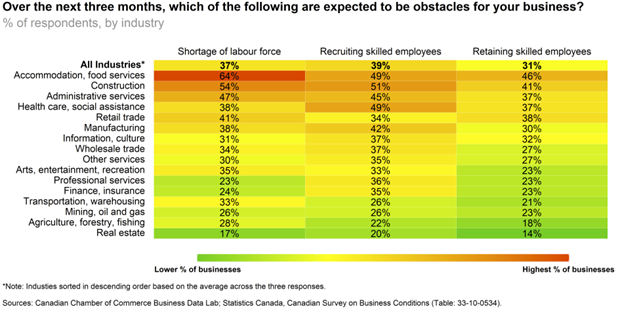

- Labour pains continue to intensify: Labour markets are extremely tight, making it hard for businesses to recruit and retain skilled employees. These concerns are relatively widespread, but most acute in accommodation and food services, construction, health care and retail. Of businesses that expect near-term labour obstacles, almost two-thirds (62%) reported that challenges related to recruiting and retaining staff have worsened from 12 months ago.

- Supply chains still a problem for firms, but showing signs of improving: A slightly smaller share of firms expect difficulties acquiring inputs and/or managing inventories. This is happeningalongside the modest improvements in global supply chains in recent months.

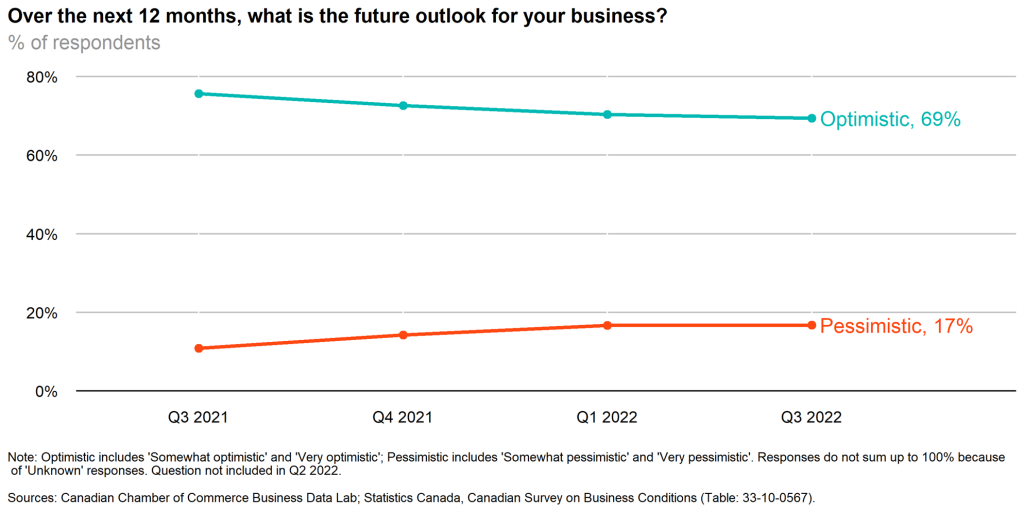

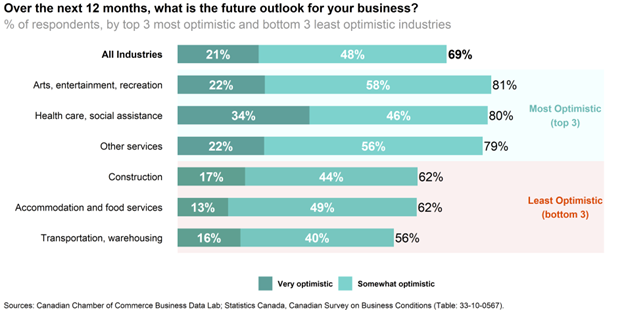

- Outlook for slowing growth: With economic growth expected to slow in the second half of the year, in the context of a weakening global economy and higherinterest rates,Canadian business optimism faded, but only slightly. The most optimistic sectors include arts, entertainment and recreation, and “other services” — both enjoying a rebound thanks to pent-up demand for hard-to-distance activities that were shut down earlier in the pandemic. The least optimistic sectors are construction, accommodation and food services, and transportation, who are dealing with an on-going housing market correction (for construction) as well as significant labour market challenges.

Rising inflation is the top business concern for 2022 Q3

Cost and labour concerns are in a league of their own

Price pressures have turned the corner

Accommodation, food services and construction most impacted by labour challenges

Canadian businesses are signaling slower growth in sales, employment and investment, shrinking profit margins in 2022 Q3

Canadian business optimism fades slightly going into 2023

Things are looking up for arts, entertainment and recreation

About the Canadian Survey on Business Conditions

Survey Objectives: The Canadian Survey on Business Conditions (CSBC) was created in Spring 2020 by Statistics Canada in partnership with the Canadian Chamber of Commerce to provide timely, relevant data on business conditions in Canada, as well as business expectations and views on emerging issues. These survey responses are used by governments, chambers of commerce, business associations and analysts to monitor evolving business conditions and devise policies to support Canadian business.

Survey Period: The 2022Q3 CSBC was collected from July 4 to August 8, 2022.

Survey Approach: The survey was conducted by Statistics Canada via electronic questionnaire using a stratified random sample of business establishments with employees. Population totals are estimated using calibration weights. The survey is based on responses from 17,013 businesses.

Business Data Lab (BDL)

Our Business Data Lab (BDL) provides future-focused, real-time data and insights for companies of all sizes, sectors and regions of the country. The BDL brings together data from a variety of sources to track evolving market conditions, providing Canadian businesses with critical information to help them make better decisions and improve their performance. Learn more.

Related News

Time to put reports into action, Chamber tells House Agriculture Committee

Canadian GDP for July: Defying expectations, a stronger start to the third quarter than anticipated, but a slowdown remains in clear sight