Blog /

Labour Force Survey for June 2022: Surprise drop in monthly employment, but another record low unemployment rate, and wage pressures building

Labour Force Survey for June 2022: Surprise drop in monthly employment, but another record low unemployment rate, and wage pressures building

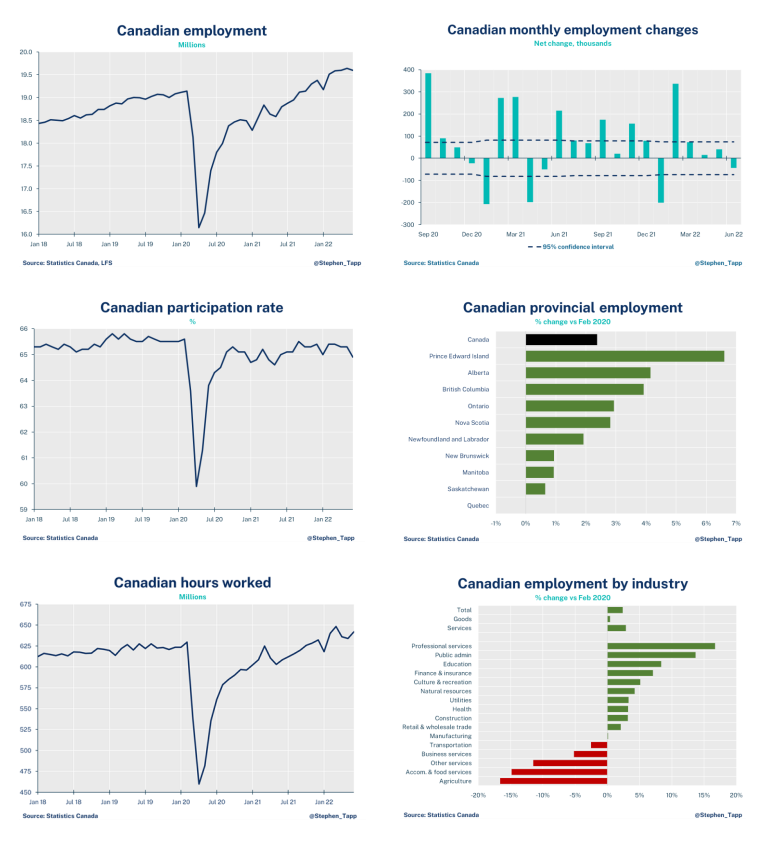

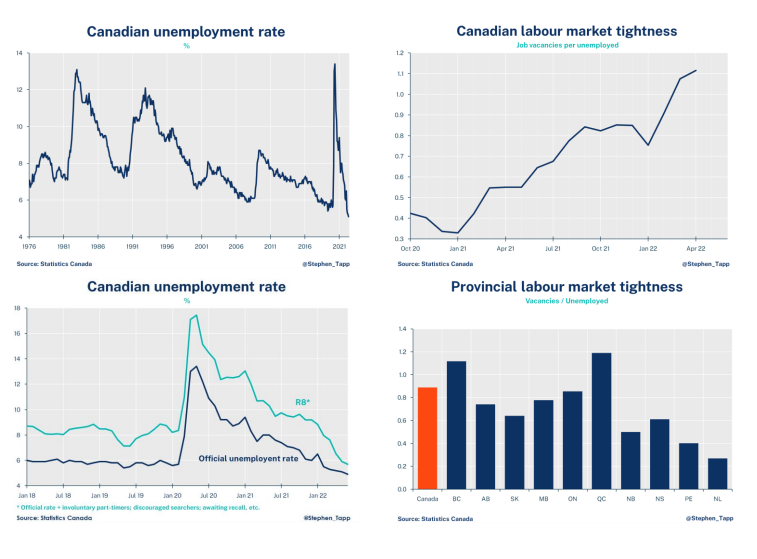

Despite the unexpected drop in employment in June, Canada's labour market is still running very hot. Employers are looking to fill over one million job vacancies, at a time when the unemployment rate fell below 5% for the first time in monthly data.

Despite the unexpected drop in employment in June, Canada’s labour market is still running very hot. Employers are looking to fill over one million job vacancies, at a time when the unemployment rate fell below 5% for the first time in monthly data. Wage pressures are building — they accelerated to 5.2% year-over-year in June, up notably from 3.9% a month earlier. This will only add to broader cost pressures for Canadian businesses, and the numbers will likely keep rising in the context of even higher inflation. This will make things particularly tricky for small and medium sized businesses who are already facing significant hiring challenges.

KEY TAKEAWAYS

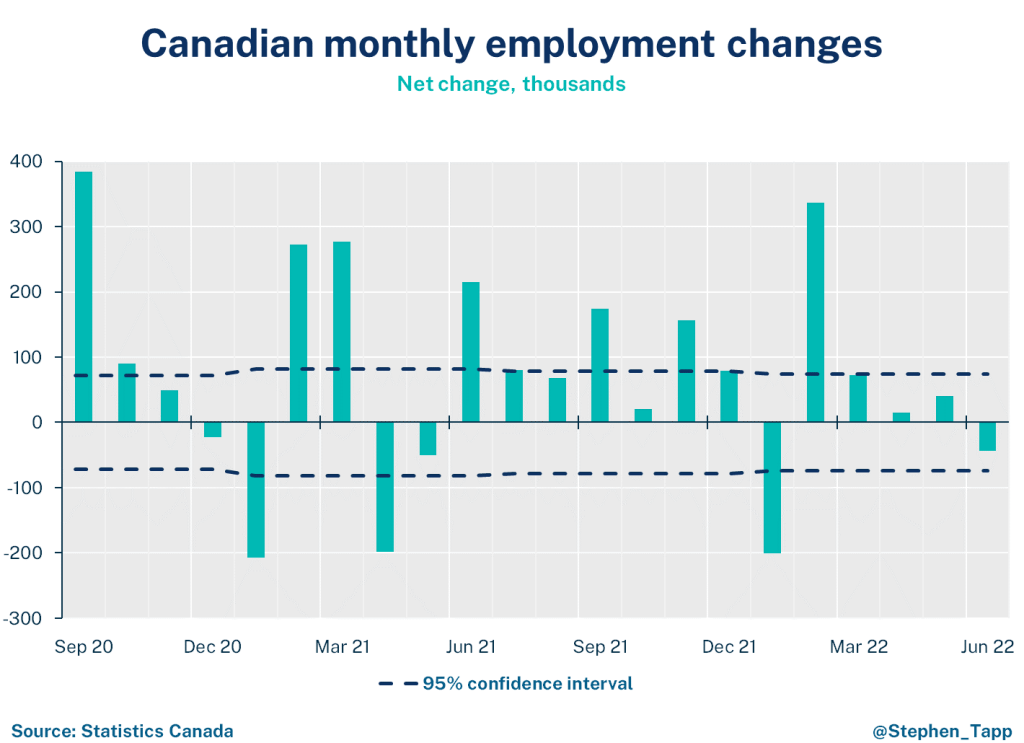

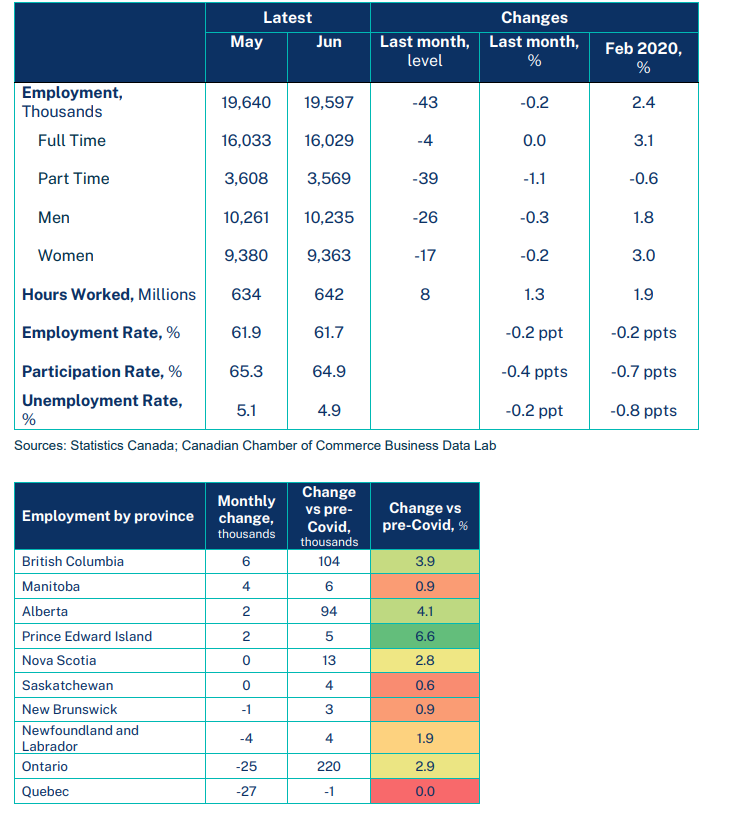

- Canadian employment unexpectedly fell by 43,000 jobs in June, more than offsetting May’s job gain. This was the first monthly employment fall that wasn’t related to tighter public health restrictions during the pandemic.

- The good news is that hours worked finally bounced back in June (+1.3%) after two disappointing months, related to elevated work absences due to illness. On an annualized basis, hours grew 1.1% in Q2.

- The unemployment rate fell below 5% for the first time since the monthly data began in 1976.

- Employment in June was down almost entirely due to part-time position (-39k), while full-time employment was off only 4k. By industries, services sectors (-76k) were the source of broad-based weakness, especially in retail trade (-58k, -2.5%). Goods sectors were up 33k — mostly related to a bounce back in manufacturing (+26k) and construction (+23k). By gender, employment was down for both men (-26k) and women (-17k).

- Labour markets remain very tight. With employers looking to fill over one million job vacancies, and new signs of faltering labour supply, wage pressures are clearly building — they accelerated to 5.2% year-over-year in June (up notably from 3.9% a month earlier), and are likely to continue rising, in the context of catching up to even higher inflation (7.7%). Wages for non-unionized workers are up 6.1% vs. only 3.7% for unionized (which may be held back so far, until more collective agreements expire and are renegotiated).

- The student labour market has been strong so far this summer, with the student employment rate (53.2%) now above pre-pandemic levels (51.2%).

- Provincial employment movedin a “statistically significant way” last month in a few provinces: falling in Newfoundland and Labrador (-1.9%) and Quebec (-0.6%), with gains in Prince Edward Island (+1.9%) and Manitoba (+0.6%).

- In June, 3.3 million workers (18%) did so exclusively remotely.

SUMMARY TABLES

ENJOY MORE LABOUR CHARTS!

For more economic analysis and insights, visit our Business Data Lab.

Related News

Time to put reports into action, Chamber tells House Agriculture Committee

2022 Q3 Canadian Survey on Business Conditions: Inflation is the top issue. Labour pains intensifying, but price pressures and supply chains issues are improving