Blog /

Labour Force Survey for May 2022: Unemployment rate hits another record-low; wage growth finally starting to rise

Labour Force Survey for May 2022: Unemployment rate hits another record-low; wage growth finally starting to rise

KEY TAKEAWAYS Canadian employment rose by a respectable 40,000 jobs in May, led by full-time jobs, after having a slower...

KEY TAKEAWAYS

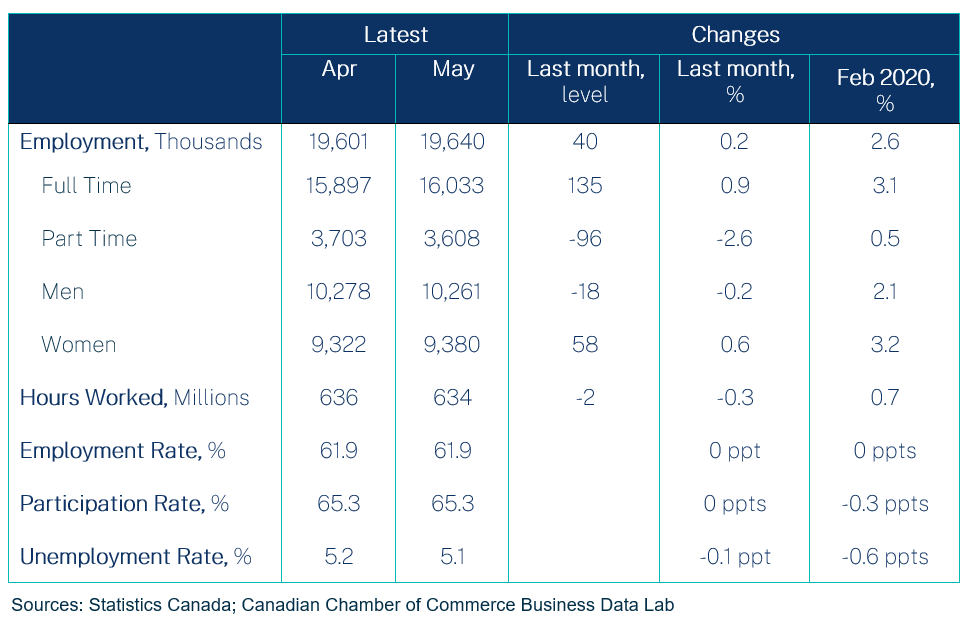

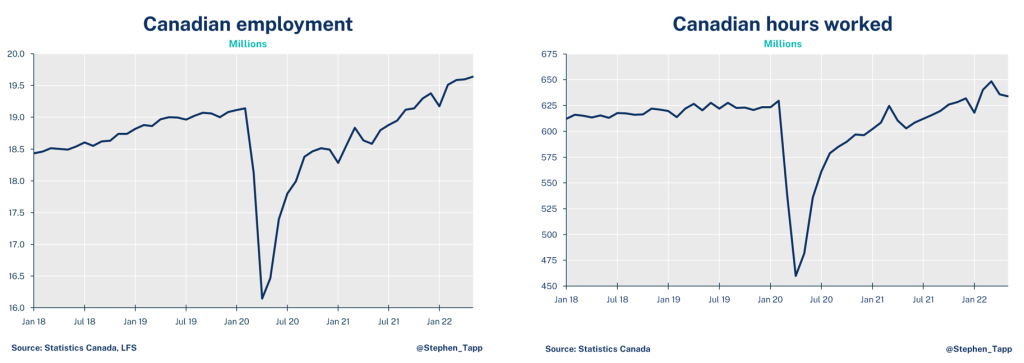

- Canadian employment rose by a respectable 40,000 jobs in May, led by full-time jobs, after having a slower gain of 15,000 net new jobs in April.

- Hours worked failed to bounce back in May and continue to disappoint, falling by 0.3%, as employee absences remain higher than before the pandemic. Hours fell by 1.9% in April, again due to increased work absences due to illness, which affected 9% of employees.

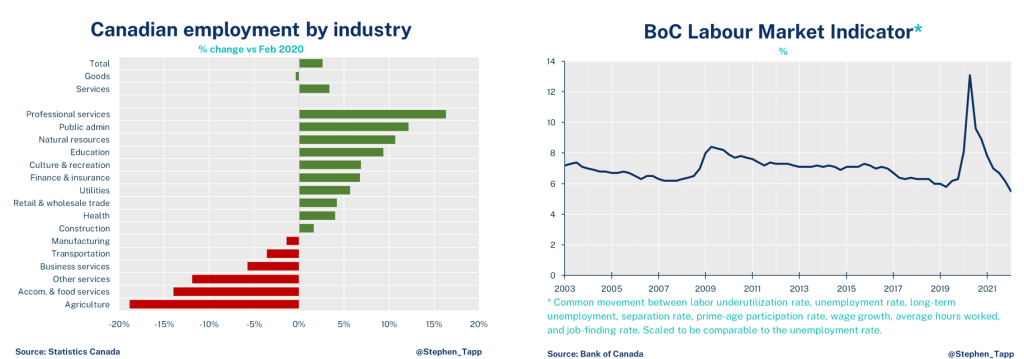

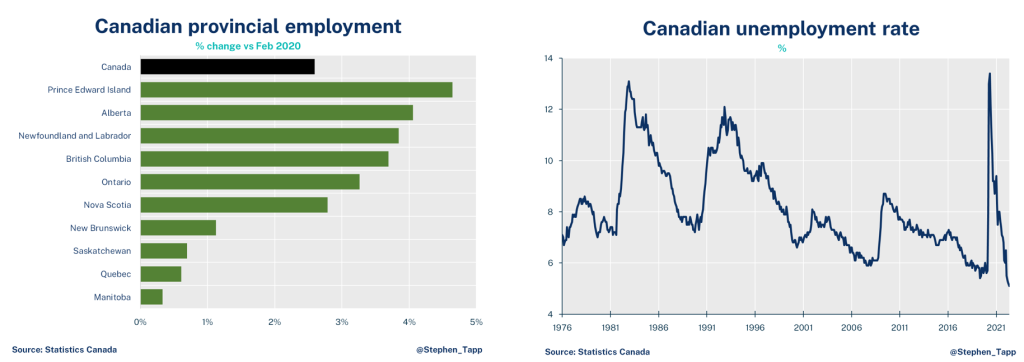

- The unemployment rate continued to edge down, reaching a new monthly record low of 5.1%. The Bank of Canada’s composite “Labour Market Indicator” also recorded its best performance (at 5.5% in 2022 Q1) since the series began in 2003.

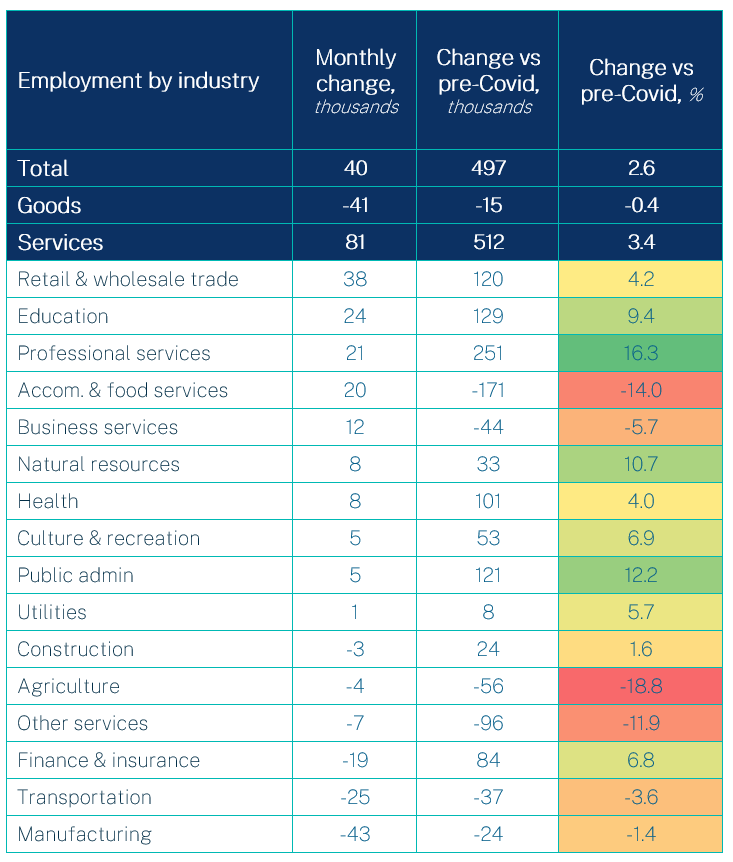

- Employment in May was led by full-time positions (+135k, 0.9%), while part-time employment was down 96k (-2.6%). Services sectors (+81k) were a source of broad-based strength, while goods sectors were down 41k — mostly related to weakness in manufacturing (-43k). By gender, employment was up for women (+58k), but down for men (-18k).

- Labour markets remain very tight. We’ve been waiting a while for stronger signs of wage pressures. In today’s report, average hourly wages accelerated to 3.9% year-on-year, up from only 3.3% in April. Wage growth was strongest for non-unionized (5.1%) and permanent (4.5%) employees. Of course, wages are still playing catch-up, and remain well below the current rate of inflation (6.8%).

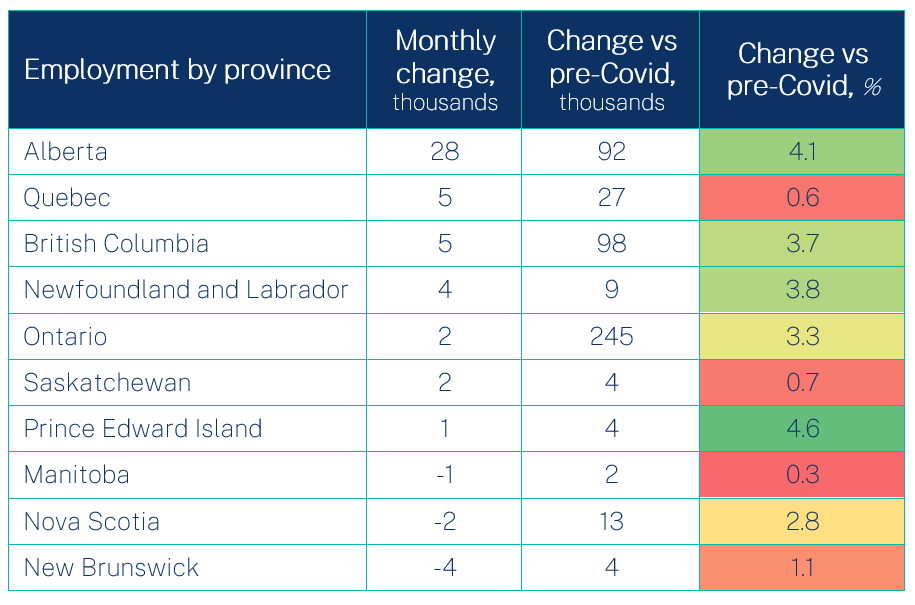

- Provincial employment recordedstatisticalincreases in Newfoundland and Labrador, Prince Edward Island, and Alberta. It declined in New Brunswick and was little changed in all other provinces.

- In May, 19% of workers did so from home.

SUMMARY TABLES

MORE LABOUR CHARTS!

Related News

What We Heard: Key Takeaways from the Natural Resources Tour “Charting the Path”

Industry leaders, policymakers and Indigenous representatives came together not only to confront the challenges facing the sector but also to highlight its tremendous potential for driving sustainable growth and fostering community resilience.

What We Heard: Delivering Connected Care for Canadians

Key leaders from across the healthcare sector gathered to discuss the importance of health data interoperability and its role in delivering connected care to Canadians.

Generative AI: Moving Beyond the Hype to Unlock Its Full Business Potential

This featured blog was provided by our partners at Vooban