Blog /

Canadian GDP for July: Defying expectations, a stronger start to the third quarter than anticipated, but a slowdown remains in clear sight

Canadian GDP for July: Defying expectations, a stronger start to the third quarter than anticipated, but a slowdown remains in clear sight

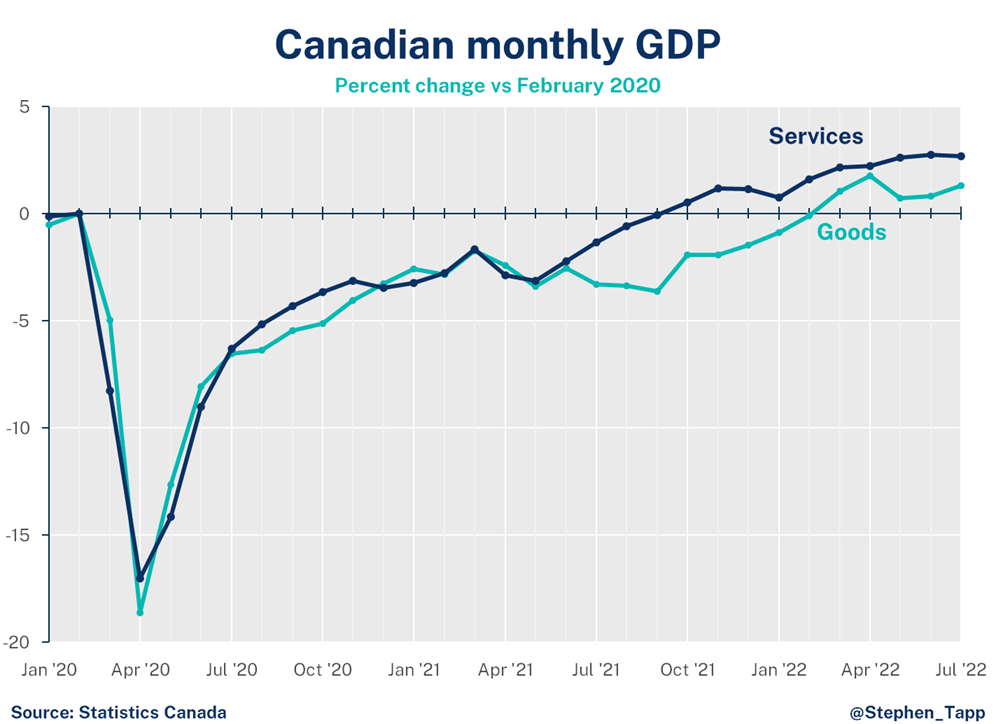

The writing has been on the wall for Canada’s real GDP as slowdown has been underway in the third quarter with falling housing prices and three consecutive months of job losses. July’s data gave Canadians slight reprieve with a surprising real GDP edging growth of 0.1%.

The writing has been on the wall for Canada’s real GDP as slowdown has been underway in the third quarter with falling housing prices and three consecutive months of job losses. July’s data gave Canadians slight reprieve with a surprising real GDP edging growth of 0.1%. Still, with consumption for in-person services moderating after months of pent-up demand, inflation is placing consumers and producers in the line of fire. Canadians all around should brace for impact in the coming half –interest rate hikes are likely to continue in tandem with sustained slowdown from here on out for a while.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

KEY TAKEAWAYS

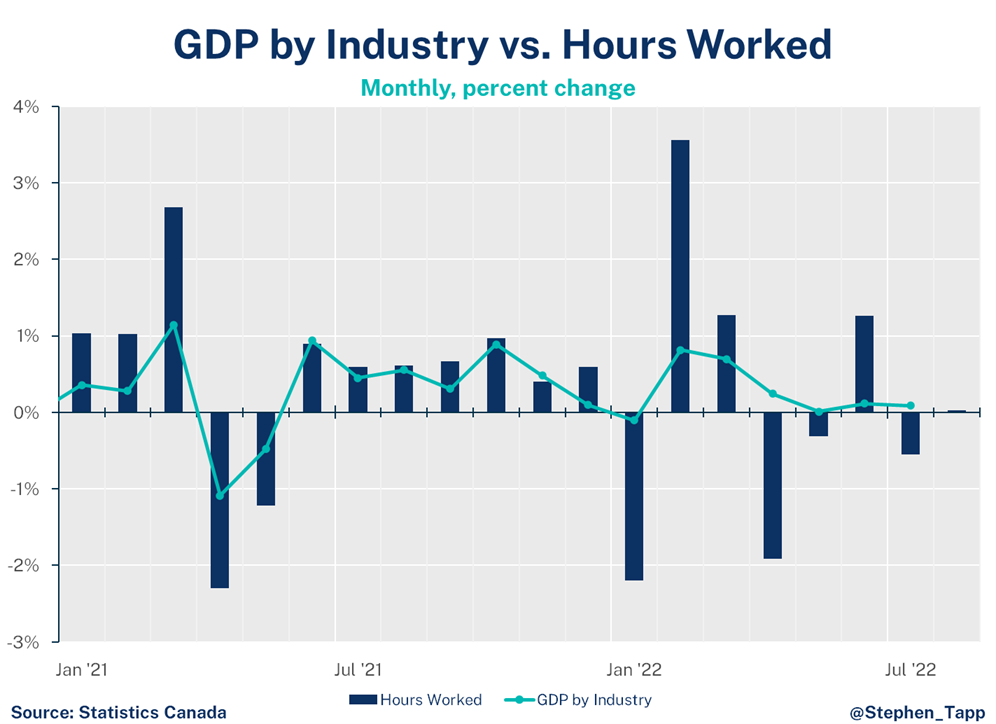

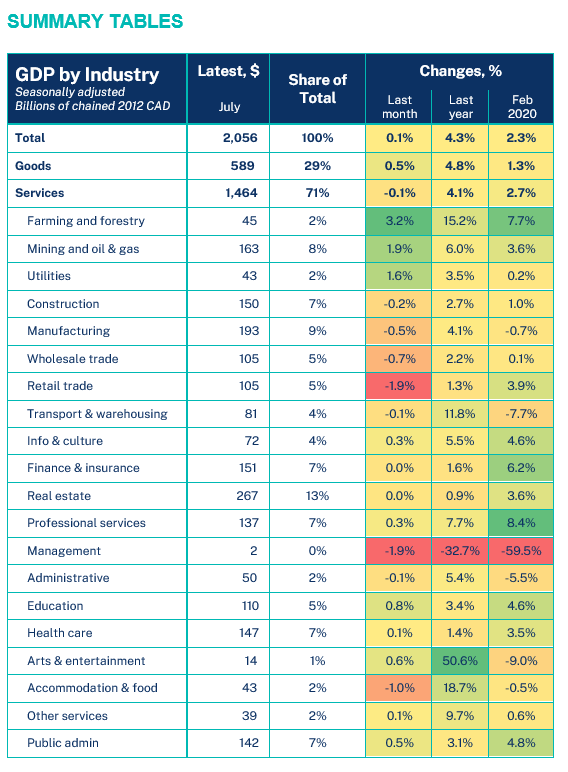

- Canada’s real gross domestic product (GDP) increased 0.1% in July, powered by growth in natural resources (agriculture and oil and gas) and the public sector. This headline result outperformed the previous advanced estimate of -0.1%.

- StatsCan’s advanced estimate for August shows essentially no change. Assuming no change for the rest of the quarter, puts real GDP growth on pace for an annualized 0.7% in 2022Q3 — much slower than in the first half of the year, and weaker the Bank of Canada’s most recent forecast (2.0%).

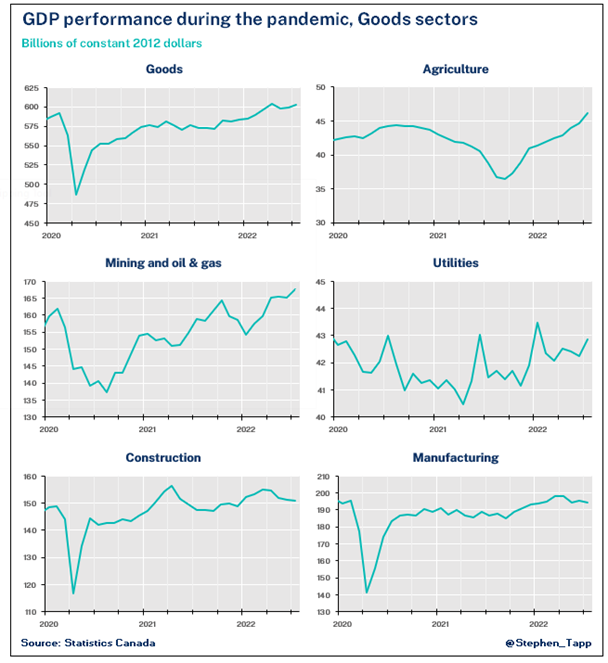

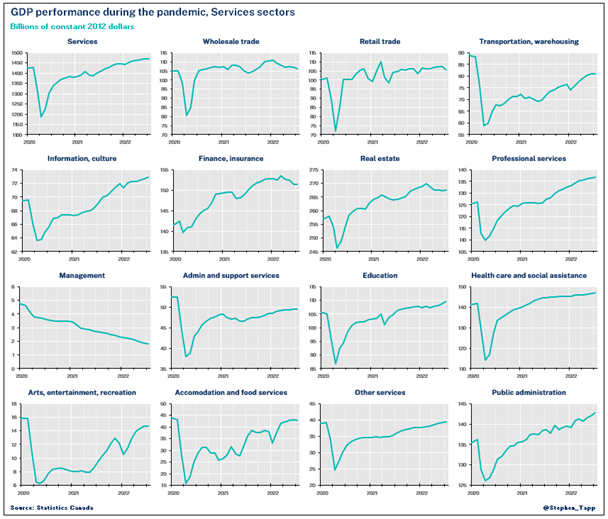

- Output increased in 11 of 20 sectors. Goods-producing sectors led the way,rising by 0.5%. Consumption for in-person services is moderating after months of pent-up demand, and services fell by 0.1% on the month.

- The biggest movers in July were:

- Agriculture, farming, and forestry had the highest sector growth(3.2%) driven by crop production. This rebound, particularly, in wheat and grain production comes from an improved harvest, thanks to improved weather conditions and strengthening demand.

- Mining, quarrying oil and gas alsoenjoyed gains (1.9%), following two months of declines last quarter. This was partly related to oil sands facilities maintenance that had constrained production, amid strong demand.

- Retail Trade declined(-1.9%) as food and beverage (-1.8%) as well as gas continued to fall prey to soaring prices and ‘normalized’ demand.

- Accommodation and food services declined for the first time in two quarters (-1.0%).

- Manufacturing also contracted (-0.5%) — its third decline in four months — alongside Wholesale trade’s (-0.7%) fifth decline since the start of the year.

For more economic analysis and insights, visit our Business Data Lab.

Other Blogs

Protecting Mid-Market Businesses: Cybersecurity for Growing Enterprises

Policy Matters: Why It’s Time to Go All-In on Canada’s Economic Sovereignty