Blog /

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

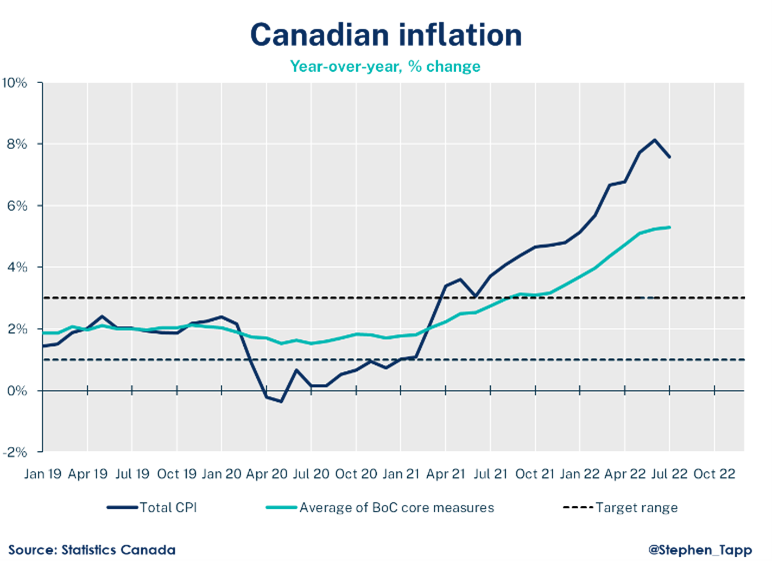

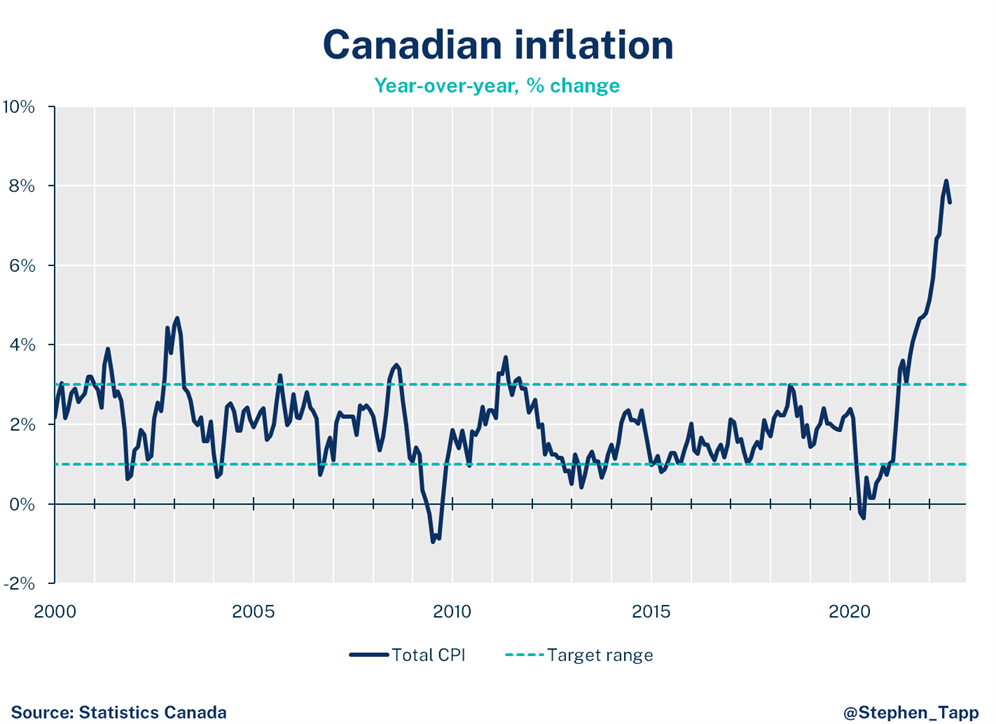

Canada’s headline inflation finally showed signs of cooling, with total CPI slowing to 7.6% year-over-year in July. Gas prices continued to be a main driver — this month on the downside — but broader-based “core” inflation measures continued to rise, which means the Bank of Canada will continue to raise interest rates.

Canada’s headline inflation finally showed signs of cooling, with total CPI slowing to 7.6% year-over-year in July. Gas prices continued to be a main driver — this month on the downside — but broader-based “core” inflation measures continued to rise, which means the Bank of Canada will continue to raise interest rates.

Stephen Tapp, Chief Economist

KEY TAKEAWAYS

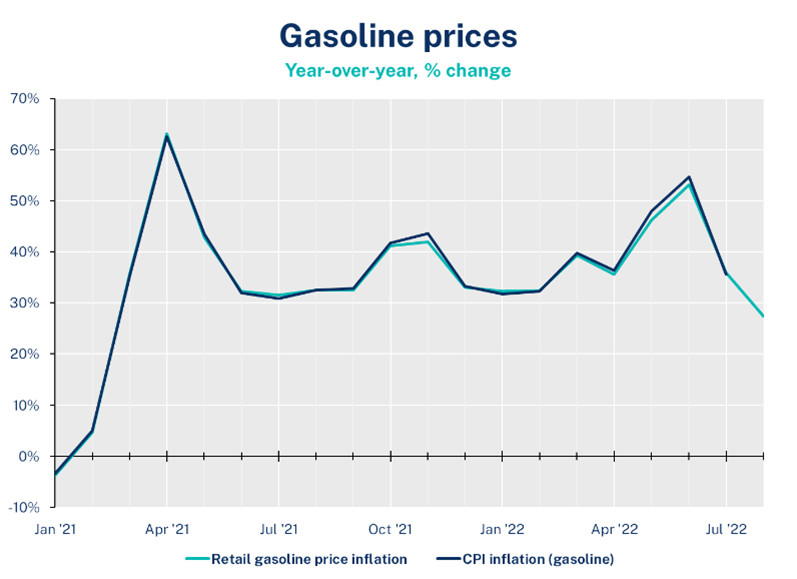

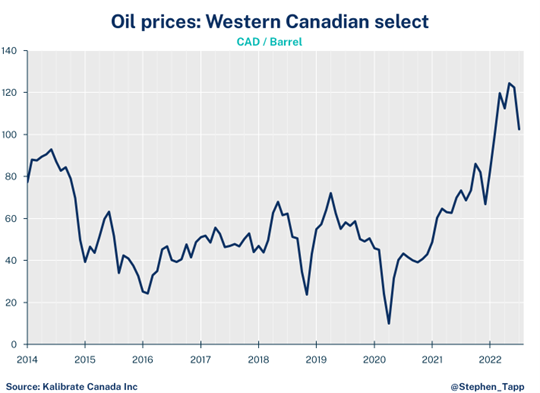

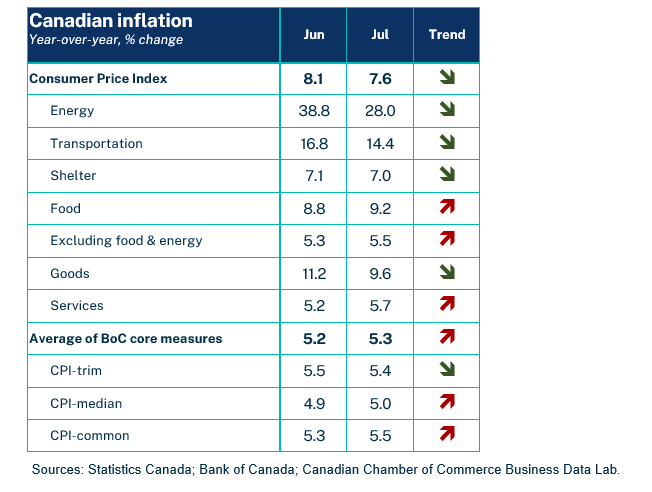

- After an uncomfortably long and painful run, growth in Canada’s headline Consumer Price Index (CPI) inflation finally began to slow in July — falling to 7.6% year-over-year, down from its peak of 8.1% one month earlier. Much like in U.S. data, the summer slowdown is largely due to falling energy prices, as consumers enjoyed some relief from lower gas prices in the last two months.

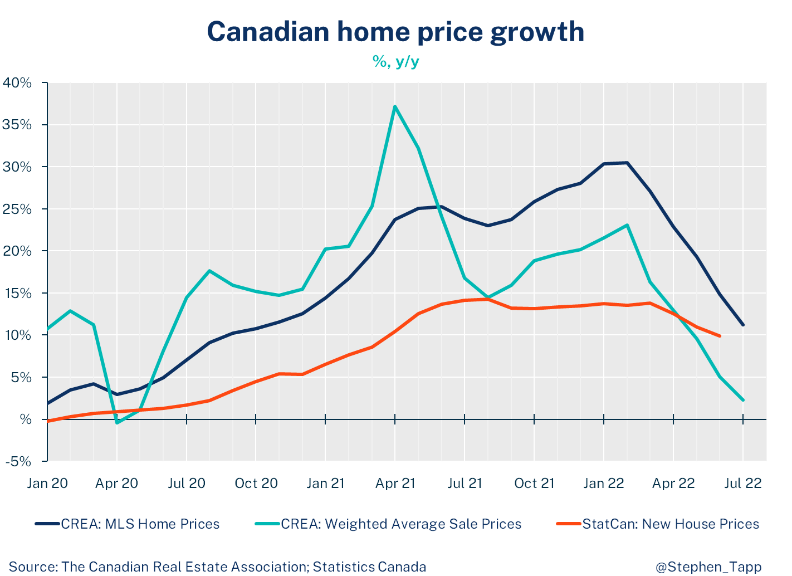

- The inflation story continues to be written by dramatic price movements in a number of industries. Energy (28%, with gas prices up 36% year-over-year, despite their drop in July); transportation (+14%, passenger vehicle prices up 8%); and food (9.2%, with groceries up 10%). Shelter costs slowed (7.0%), reflecting the cooling of Canada’s housing markets, as interest rates rise to rein in inflation.

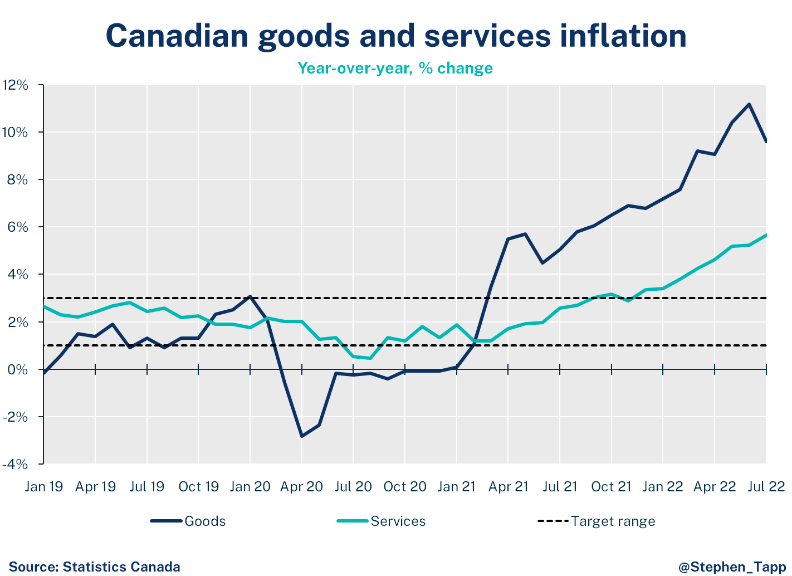

- Price increases for goods have also come down (still running at 9.6%). Services inflation accelerated to 5.7% (hotels 48%, airfares 26%). This is related to the summer travel boom to make up for lost time during the pandemic.

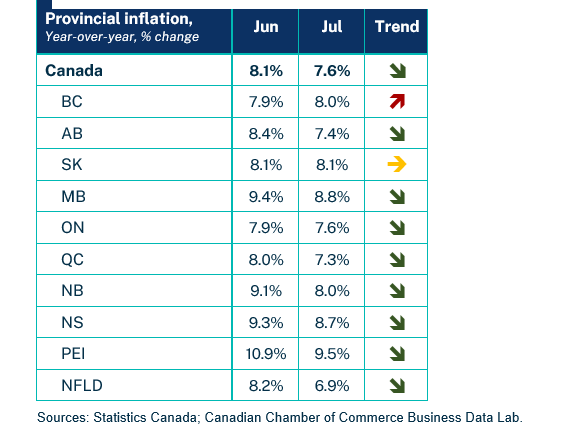

- The rate of inflation fell in eight provinces (BC and Saskatchewan being exceptions). It remains highest in PEI (9.5%) and lowest in Newfoundland and Labrador (6.9%).

- Notably, the average of the Bank of Canada’s “core inflation” measures rose to 5.3%. This will be a cause for concern for the central bank, suggesting that underlying price pressures are still strong.

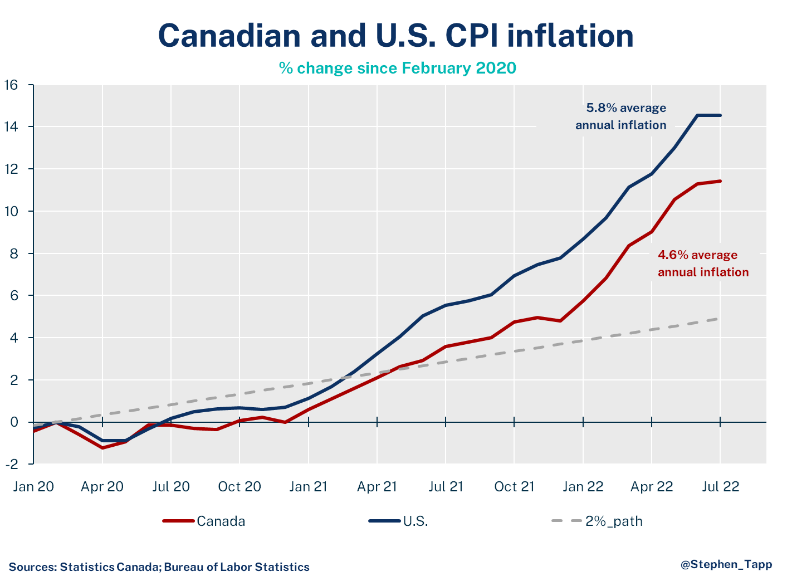

- Over the pandemic, Canadian inflation has run at an average annual rate of 4.6% — terrible to be sure, but not quite as bad as the 5.8% in the United States.

- Looking ahead, gas prices have declined steadily since mid-June (from a peak of almost $2.15 per litre nationally to $1.75. It represents a drop from 50% year-over-year price gains in June to “only” about 25% so far in August). This inflation driver should continue to drag down the overall headline figure.

- More generally, in the months ahead, momentum in inflation should decelerate further due to falling energy prices, but also slower global growth, a deflating domestic housing market and positive “base effects” (i.e., comparing 2022 inflation readings with price levels that rebounded in the Spring of 2021.)

- Looking ahead, there is still likely a long way to go before inflation returns to pre-pandemic levels of 2%. The Bank of Canada’s July Monetary Policy Report forecasts CPI inflation of 7.2% in 2022, 4.6% in 2023, and 2.3% in 2024, essentially accepting a major overshoot in prices.

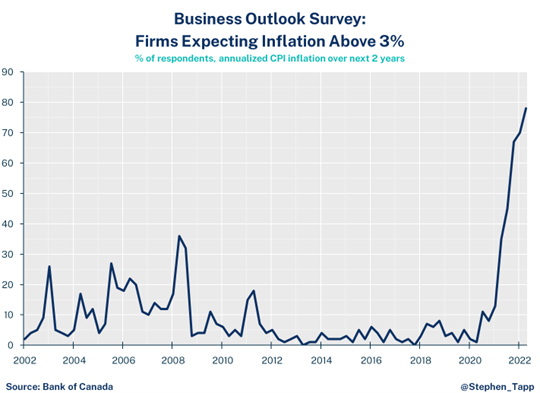

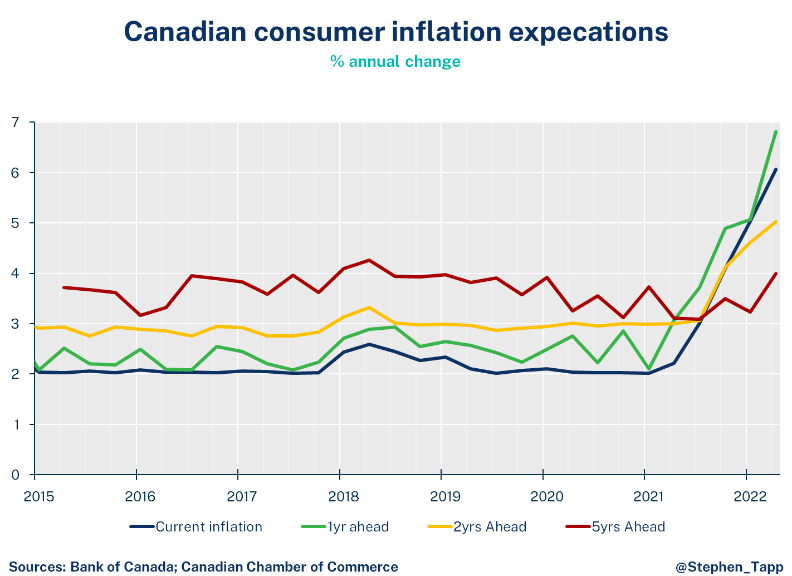

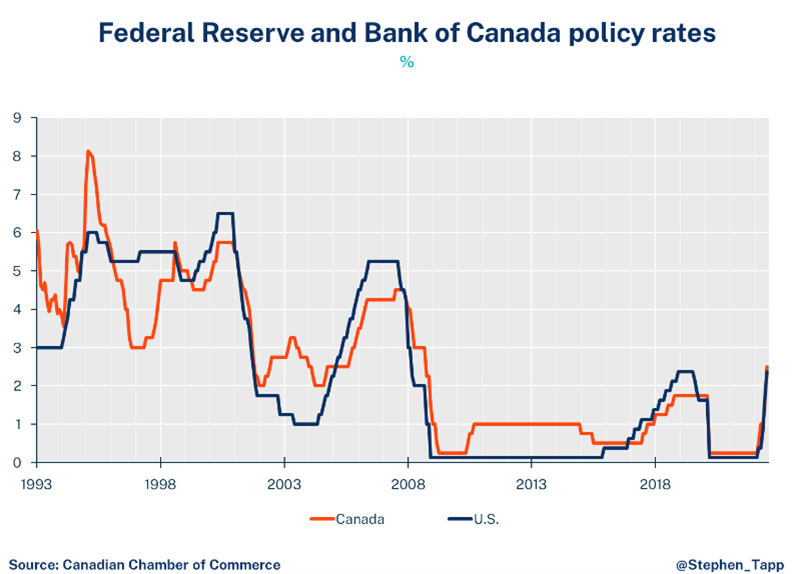

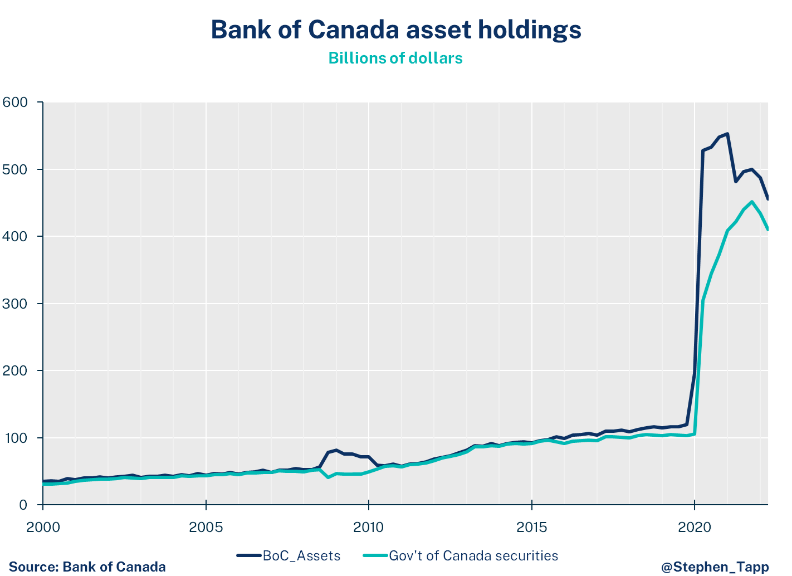

- As such, despite inflation’s belated positive turn, with core prices still rising, there is a strong case for the Bank of Canada to continue raising interest rates. The Bank’s nominal policy rate is finally back at a level which is considered “neutral” (2.5%). With inflation at 7.6%, the “real” policy rate is around -5% (still excessively stimulative). Longer-term inflation expectations are creeping up, and labour markets are as tight as at any point in recent history. To address this, the Bank’s policy rate will likely need to exceed the rate of inflation. This will come through a combination of rising interest rates and falling inflation, which entails sharply slowing demand growth, as supply continues to recover from the pandemic.

We are currently pencilling in a 50 basis point rate hike from the Bank of Canada in September. Additional hikes will continue, albeit at a slower pace, until core inflation shows continued and significant improvements, and/or the global economy materially falters.

SUMMARY TABLES

For more economic analysis and insights, visit our Business Data Lab.

Other Blogs

Disclosing Episodic Disabilities in the Workplace

A Failure of Process and Policy: Canada’s Greenwashing Amendment to the Competition Act in Bill C-59