Blog /

Canadian GDP for August: It’s not all bad news

Canadian GDP for August: It’s not all bad news

Canada’s real GDP grew by 0.1% in August, led by gains in services, with the advanced estimate for September showing...

October 31, 2022

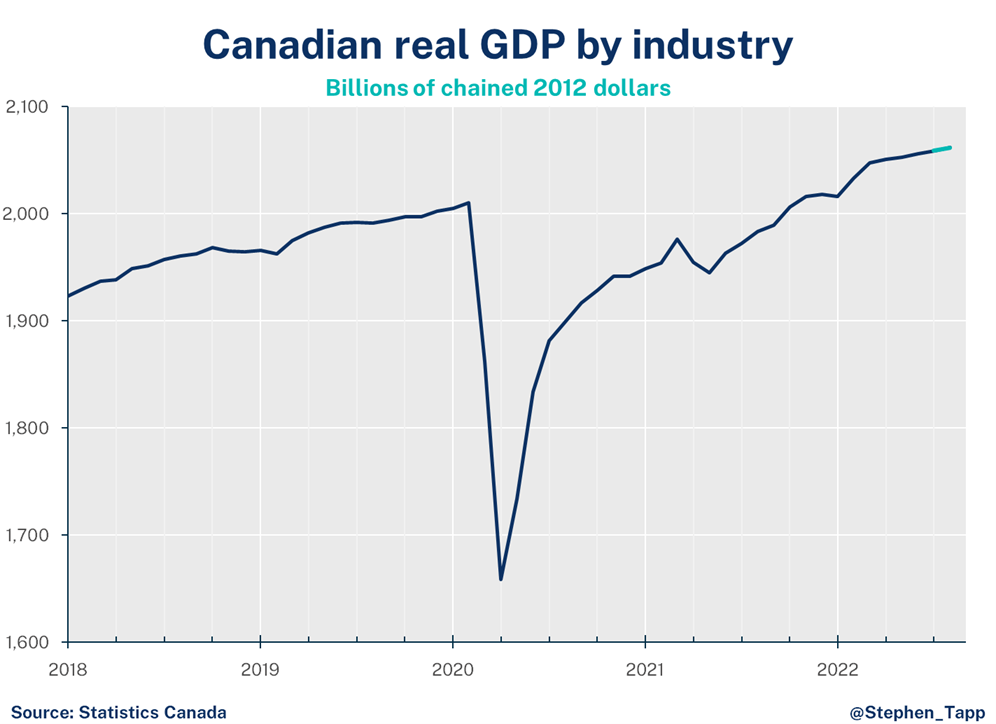

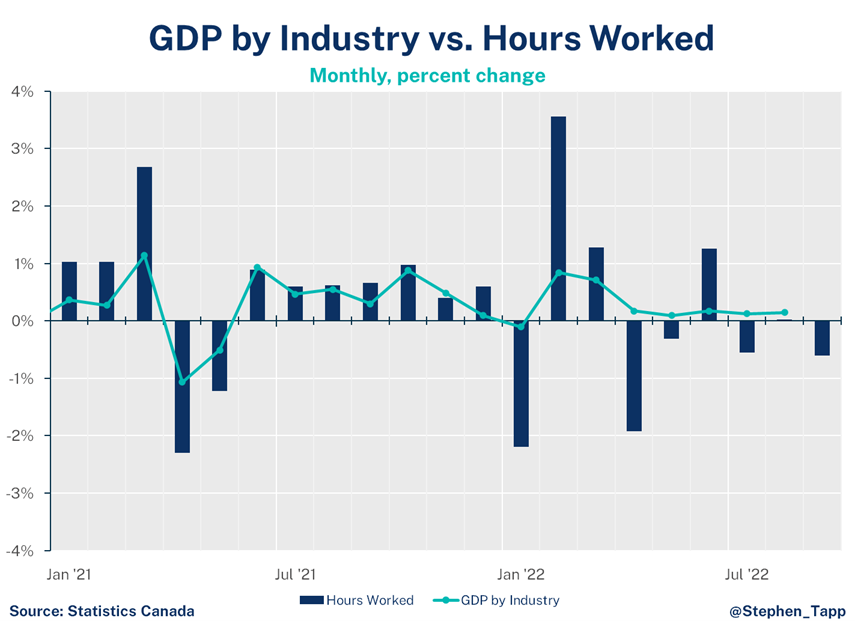

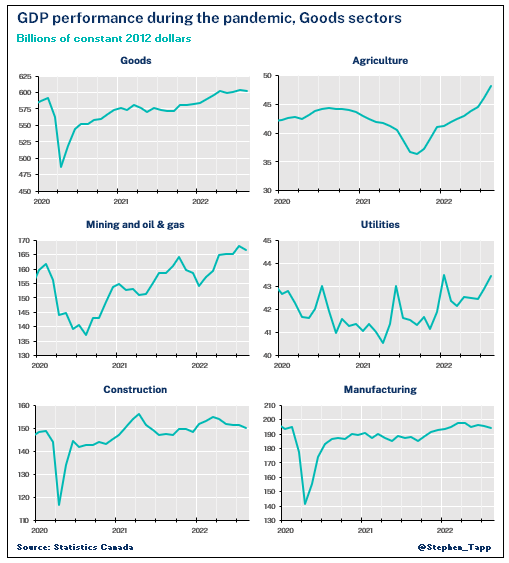

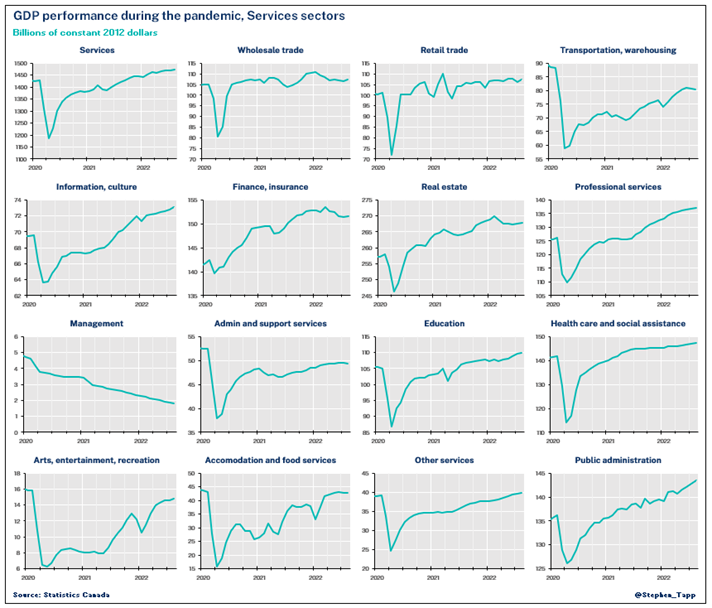

Canada’s real GDP grew by 0.1% in August, led by gains in services, with the advanced estimate for September showing yet another modest gain (0.1%). Taken together, real GDP is growing at an annualized pace of 1.6% in 2022Q3. This is roughly half the pace of the previous quarter, which shows that Canada’s economy is clearly slowing down in the second half of the year. However, despite all the recession worries, growth remains in positive territory for now, although we expect things to be even weaker in the fourth quarter.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

- Canada’s real gross domestic product (GDP) grew by 0.1% in August, led by services sectors. This result was a slight improvement on the initial advanced estimate for essentially flat growth.

- StatCan’s advanced estimate for September shows another modest increase of 0.1%. These estimates put real GDP growth on pace for an annualized 1.6% in 2022Q3. This pace is inline with the Bank of Canada’s forecast released earlier this week. These numbers show that overall economic growth in Canada is slowing in the second half of the year, and growth expected to be even slower in the fourth quarter.

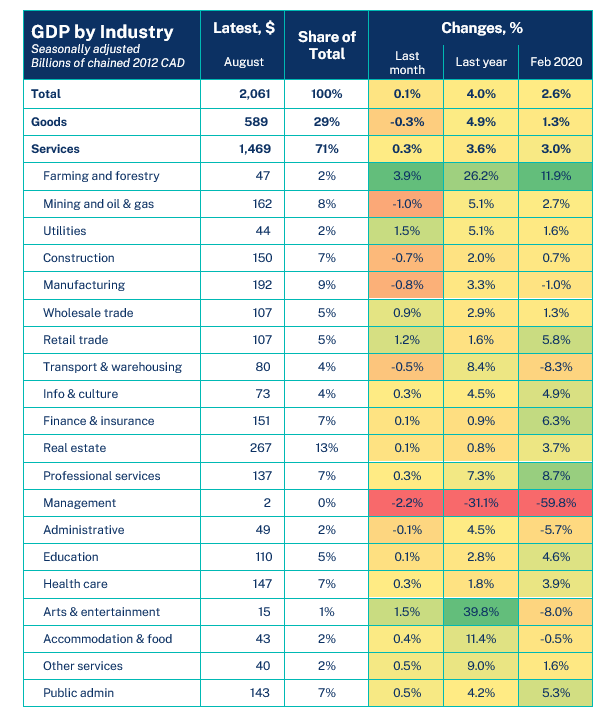

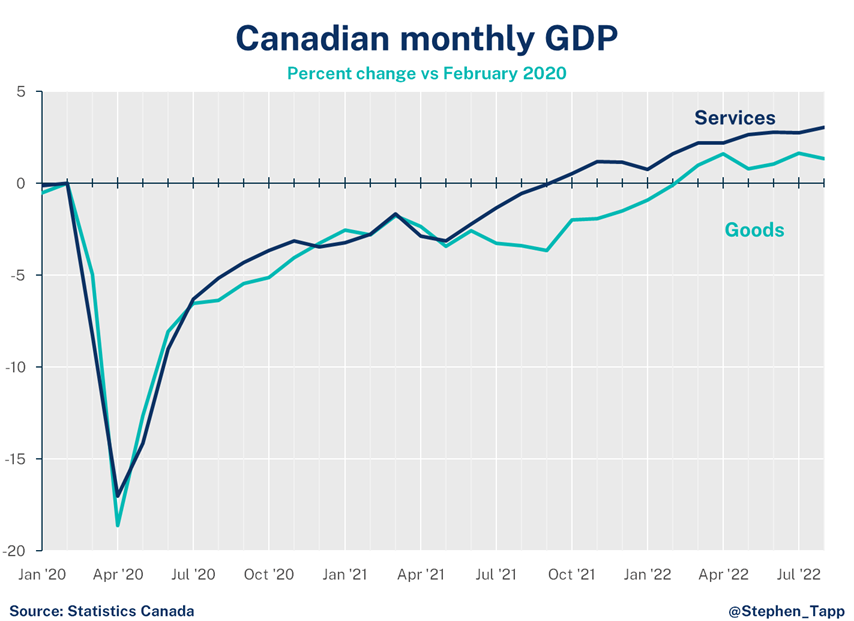

- Output rose in August in 14 of 20 sectors. Services sectorsled the wayrising by 0.3%,while goods were down 0.3% due to declines in manufacturing, oil and gas extraction, and construction.

- The biggest movers on the month were:

- Agriculture (+3.9%) was led by an increased crop production, as wheat and other grains have benefitted from improved growing conditions in Western Canada this summer.

- Utilities (1.5%) rose thanks to gains in electric power generation and natural gas distribution.

- Retail trade (+1.2%) and wholesale trade (+0.9%) both performed well.

- Construction (-0.7%) fell for the fifth month in a row. All components have weakened, from engineering to residential, non-residential, and repairs.

- Manufacturing (-0.8%) had its fourth decline in five months falling to the lowest output level since January 2022.

- Agriculture (+3.9%) was led by an increased crop production, as wheat and other grains have benefitted from improved growing conditions in Western Canada this summer.

SUMMARY TABLES

Other Blogs

Policy Matters: What Does the U.S. Have to Do with Canada’s Manufacturing Sector?

Canada’s manufacturing sector is a foundational piece of our economy.

Why Mining Companies Have Become More Sustainable and Inclusive to Stay Relevant

This blog was provided by our partners at AtkinsRéalis

Redefining AI’s Role in Industrial Work

This blog was provided by our partners at Contextere.