Blog /

10 Takeaways from BDL Consultations

10 Takeaways from BDL Consultations

In February 2022, we launched the Canadian Chamber of Commerce Business Data Lab (BDL). After the launch, we held a series of BDL discovery sessions with stakeholders from across the country. Here are the 10 takeaways from these sessions.

In February 2022, we launched the Canadian Chamber of Commerce Business Data Lab (BDL). After the launch, we held a series of BDL discovery sessions with stakeholders from across the country. In total, we hosted six workshops with over eighty stakeholder groups, including those from:

- the Chamber Network;

- our new Federal Government Advisory Council; and

- diverse business community leaders.

For each group, we developed targeted survey questions to guide the discussions and collect structured feedback. The main objectives of these consultations were to:

- inform stakeholders about the BDL;

- understand stakeholders’ data needs and research plans; and

- identify gaps and opportunities to collaborate.

Here are my 10 takeaways from these sessions:

Takeaway 1: We’re onto something here.

There is a real demand for better business data in Canada. This was, of course, our initial hypothesis, but it’s nice to have this confirmed in our discussions. A major motivation for developing the BDL was to provide Canadian businesses with critical information to help them make better decisions and improve their performance. We foresee this happening in several ways. To give some illustrative examples, the BDL intends to:

- provide tools to help small businesses across Canada better monitor market conditions in their region;

- analyze business surveys each quarter to generate detailed insights and give leading indicators of future trends;

- assist businesses owned by under-represented groups by producing research focused on their specific needs and opportunities; and

- support understanding by the Chamber Network, policymakers, businesses, the media and the public by offering a more real-time and granular perspective of the business impacts of major economic shocks (such as supply chain disruptions, severe weather, pandemic health policies, etc.).

Takeaway 2: Help wanted.

Stakeholders want help from experts to “tame the information jungle,” by analyzing, consolidating and curating relevant business data from multiple sources. Emerging private sector data sources might be unknown to some stakeholders or are simply too expensive to obtain, analyze and sustain. By centralizing this work in the BDL, these activities can reduce duplication and save time and money for Canadian companies and the Chamber Network.

Takeaway 3: Focus on Canadian business concerns.

With a limited budget and a small team, the BDL can maximize its impact by attracting top talent and focusing its efforts on what matters most to Canadian businesses. While there are many areas of interest, stakeholders told us they want the BDL to focus on business-relevant topics, providing updates in real time and getting as granular as possible. Core topics at the top of most data “wish lists” are:

- local business conditions (such as economic activity, consumer spending, mobility, business openings/closings, obstacles and expectations, transportation and tourism); and

- local labour market information (employment, wages, job postings, market tightness, skills, immigration, demographics and housing).

Right after that is a second tier of emerging business issues that includes:

- environment, social and governance (ESG) metrics, such as greenhouse gas emissions, environmental practices for key industries and tracking “net-zero” progress;

- diversity, equity and inclusion (DEI) data on employment, business ownership and management of traditionally under-represented groups as well as intersectionality considerations; and

- the digital economy and innovation (digital adoption, online sales, business investment in technology and R&D).

Takeaway 4: Keep it simple.

Stakeholders want easy-to-use tools to analyze data quickly and generate their own insights. Participants were interested in data dashboards that bring together key metrics from different sources. Useful examples include the Alberta government’s Economic Dashboard and the Toronto Regional Board of Trade’s Recovery Tracker.

These kinds of tools allow users to navigate via point-and-click (rather than downloading data and writing their own source code), to see summary stats quickly and to develop relevant insights, including comparing regions. Stakeholders valued data simplicity, clarity of underlying data sources and methodologies, engaging visualizations, interactivity, having access to multiple layers of granularity and business relevance.

Takeaway 5: Give users options.

Stakeholders want choice and flexibility in how they engage with data. Stakeholders had a wide range of experiences and capacities in their internal ability to work with data. Therefore, to be successful, the BDL should meet users’ needs and capacities. In some cases, users want quick and easy statistics — say, to support their policy advocacy; in other cases, they want interactive, customizable tools to generate new insights and understand the broader market context in which their business operates. Users with internal expertise and the luxury of time want to download raw data to perform their own analysis. Additional distribution channels for data and insights to reach their intended audiences include social media, newsletters, reports, blogs, infographics, data visualizations, quotes, short videos, webinars and podcasts.

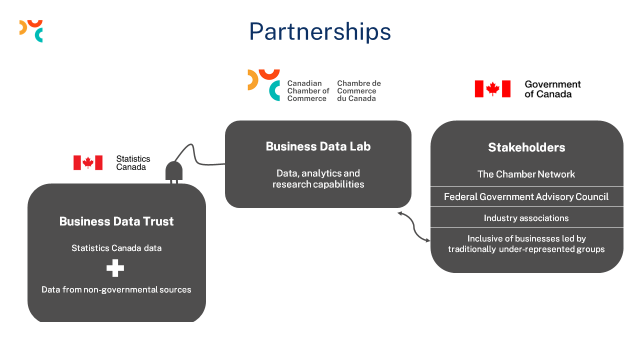

Takeaway 6: Build on Statistics Canada’s data strengths.

Our strong foundational partnership with the federal government and Statistics Canada is seen as a core strength. This provides data expertise, enhances the credibility of this initiative and allows us to collaborate on data collection (through acquisition) and, potentially, analysis. The BDL can also raise awareness and enhance the use of existing StatCan data by businesses — including the Canadian Survey on Business Conditions. Compared with StatCan, the BDL has more latitude to disseminate non-traditional, or “experimental,” data sources that can complement official statistics generated by the agency.

Takeaway 7: Collaborate across government.

Our new Federal Government Advisory Council can be a useful forum for cross-government cooperation on business data and surveys. This group consists of experts with unique perspectives on Canadian business activities, surveys and government programs for business. By bringing together representatives from10 organizations, we hope to promote collaboration, break down silos and reduce duplication of work across organizations. To highlight two examples:

- the vast majority (89%) of participants saw opportunities for better coordination of existing business surveys; “survey fatigue” — due to overlapping surveys across organizations with similar information aims — is imposing an additional response burden on business owners, which could reduce their willingness to participate in surveys;

- most respondents (80%) were interested in accessing BDL data to conduct analysis; as a result, the BDL could provide a forum to exchange research ideas, collect input on potential questions for StatCan’s quarterly business survey and help researchers across organizations to work together to build an evidence base to improve the design of government programs for businesses.

Takeaway 8: Leverage partnerships beyond government.

The BDL should leverage partnerships by working with non-governmental stakeholders with similar objectives. Partnerships can add value at all stages of production, from data sharing and analytics in the private sector, universities and think tanks, to joint reports, publications and events with the business community. As with our work with StatCan, we can achieve more by working together than we can independently.

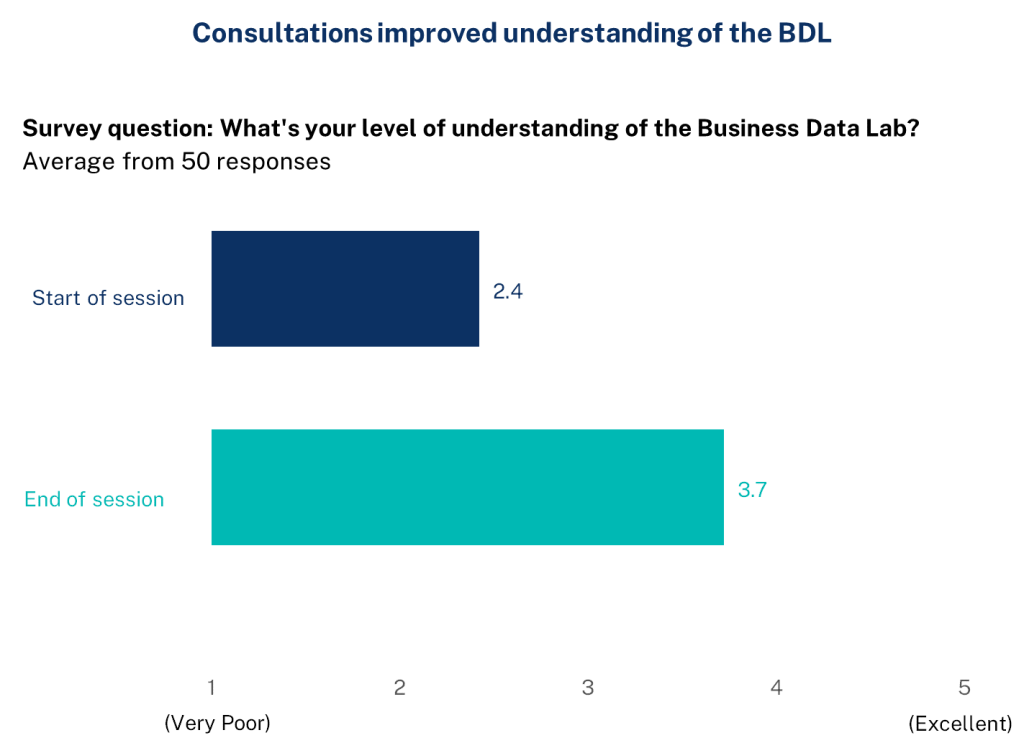

Takeaway 9: Engagement increases understanding.

Engaging stakeholders in these intensive sessions improved their understanding of the BDL. We hoped these sessions would allow us to connect with stakeholders, improve their understanding of our objectives and start a continuous feedback loop to improve our outputs to ensure we meet the needs of Canada’s business community and government stakeholders. We were pleased to see participants’ self-reported understanding of the BDL increase notably over the course of the sessions — rising from an average score of 2.4 to 3.7 (on a scale of 1 to 5, representing an increase of 54%).

Takeaway 10: Promote your work.

Ongoing promotion is needed to raise awareness of the BDL’s new outputs. The BDL intends to promote its outputs to potential users, including key influencers in niche networks on social media. We will develop great online tools and generate unique research insights, but stakeholders need to be aware of them before they can incorporate BDL outputs into their work routines.

These weren’t the only lessons we learned during these sessions.

To read more about our stakeholder discovery consultations, please see the full report here.

Other Blogs

Navigating Net Zero

Lodestar Structures: Revolutionizing Community Infrastructure