Blog /

GDP by industry for April 2022: A decent month, but dark clouds on the horizon?

GDP by industry for April 2022: A decent month, but dark clouds on the horizon?

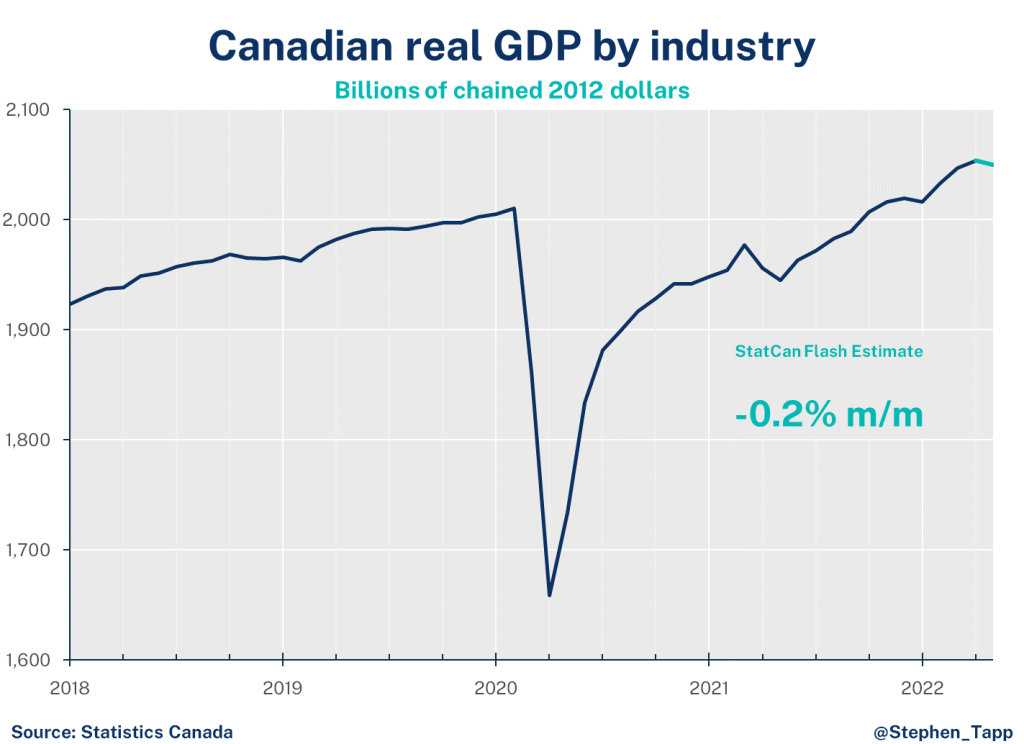

Canada’s real GDP increased 0.3% in April, led by oil and gas and client-facing sectors, which was slightly better than expected. Unfortunately, StatCan’s advanced estimate for May shows a decline of 0.2%, which puts real GDP growth on pace for an annualized 3.9% in 2022Q2.

Canada’s real GDP increased 0.3% in April, led by oil and gas and client-facing sectors, which was slightly better than expected. Unfortunately, StatCan’s advanced estimate for May shows a decline of 0.2%, which puts real GDP growth on pace for an annualized 3.9% in 2022Q2. This is good growth, but below the Bank of Canada’s most recent forecast (6.0%). On its own, this early warning sign is unlikely to deter the Bank from following through with another big interest rate increase in July.

KEY TAKEAWAYS

- Canada’s real gross domestic product (GDP) increased 0.3% in April, led by oil and gas and client-facing sectors. This result was slightly better than the earlier advanced estimate (0.2%).

- Unfortunately, StatCan’s advanced estimate shows a decline of 0.2% for May. Building in this anticipated drop in May, puts real GDP growth on pace for an annualized 3.9% in 2022Q2 — good growth, but below the Bank of Canada’s most recent forecast (6.0%). On its own, this early warning sign is unlikely to deter the Bank from following through with another big rate increase in July.

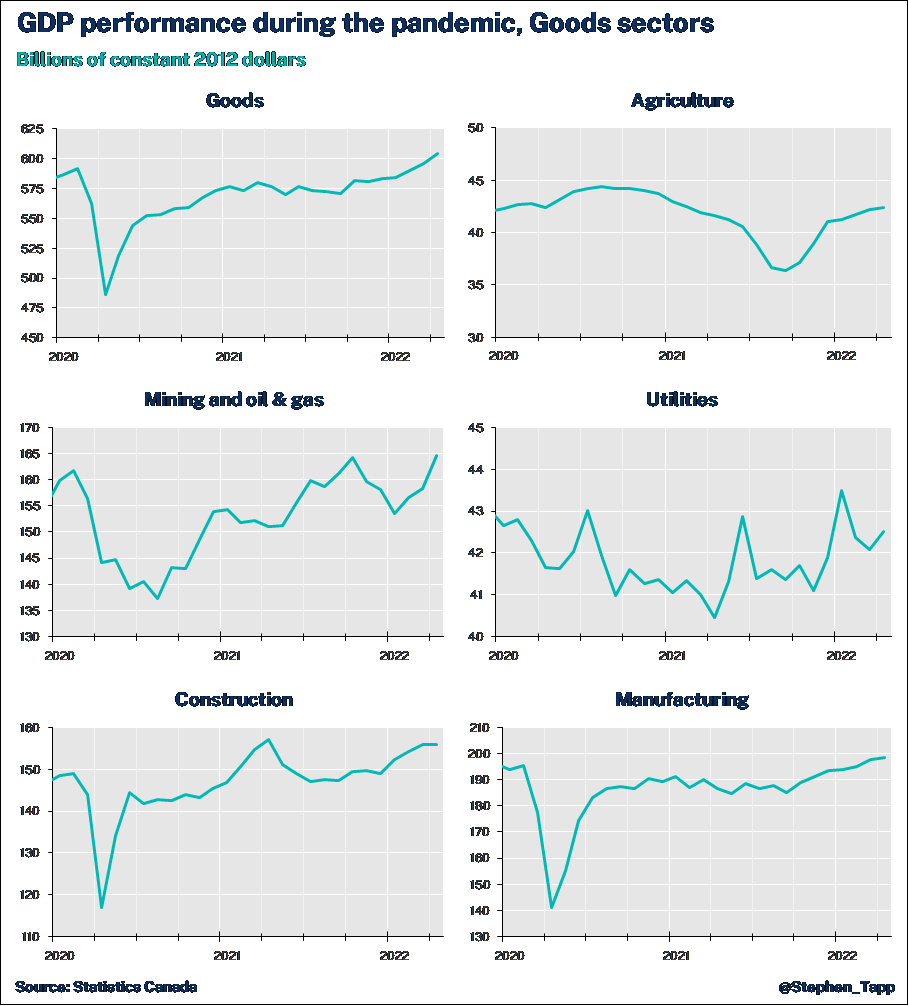

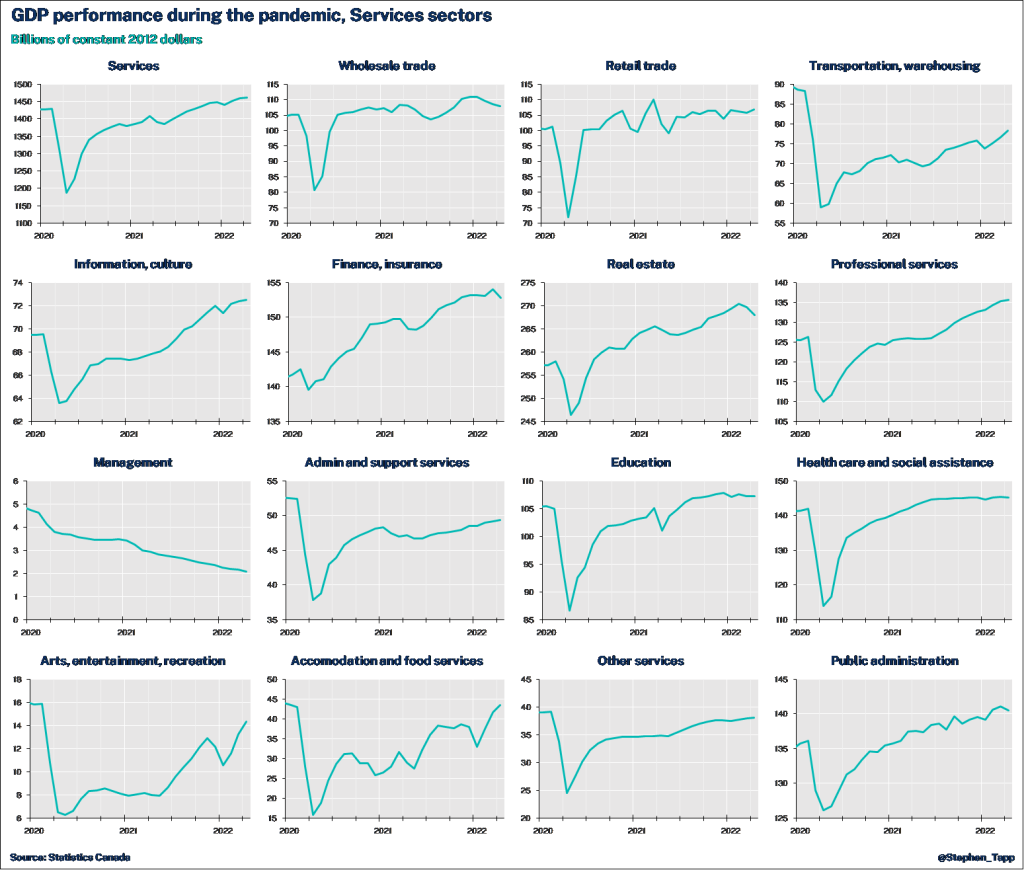

- Output gains in April were relatively broad-based with increases in 13 of 20 sectors. Goods-producing sectors led the wayrising by 0.9%,while services were up only 0.1%.

- The biggest movers of the month were:

- “Client-facing” services continue to recover, with COVID restrictions significantly eased across the country.

- Air transportation (20%) rose as travelers returned to the skies (and long lines).

- Arts, entertainment and recreation was up(7.0%, with many hockey seasons extended — aside from the Leafs).

- Accommodation and food services grew(4.6%) and has finally recovered its pre-pandemic level of activity!

- “Client-facing” services continue to recover, with COVID restrictions significantly eased across the country.

- Mining, oil and gas continued to enjoy gains (3.3%), which is unsurprising, given the recent strength of prices.

- Real estate fell (-0.8%) for the second straight month, as the housing market correction appears to be gaining steam.

- Finance and insurance pulled back (-0.7%). Financial conditions have started to tighten, as the Bank of Canada is aggressively raising interest rates to bring inflation under control.

SUMMARY TABLES

Other Blogs

Policy Matters: Revisiting the 3 Most Popular Topics of the Year

Vaccines: A Potential Key to Unlock Many of Canada’s Healthcare Challenges