Blog /

Canadian Chamber recommends responses to US Inflation Reduction Act before House Trade Committee

Canadian Chamber recommends responses to US Inflation Reduction Act before House Trade Committee

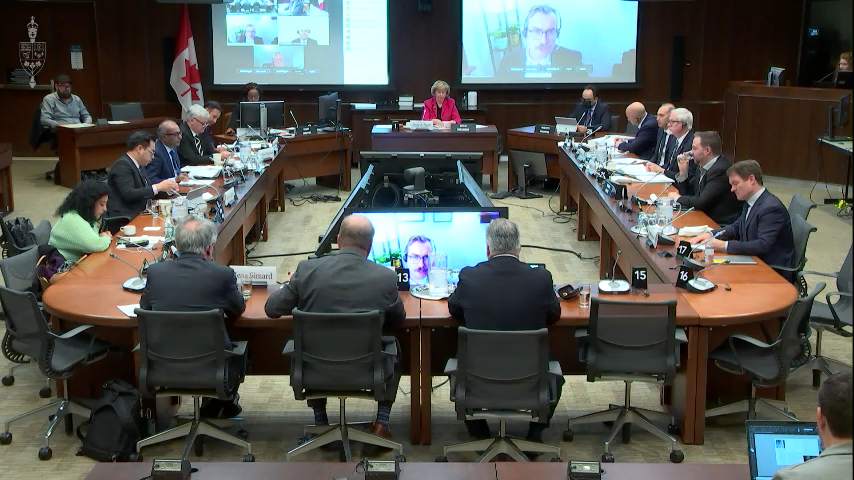

On November 15, 2022 David Billedeau, the Canadian Chamber’s Senior Director Natural Resources, Environment, and Sustainability appeared before the House...

On November 15, 2022 David Billedeau, the Canadian Chamber’s Senior Director Natural Resources, Environment, and Sustainability appeared before the House Standing Committee on International Trade to address the potential trade impacts of the United States Inflation Reduction Act.

In his remarks, Billedeau highlighted the potential opportunities as well as the risks for several Canadian sectors, including automotive manufacturing, critical minerals, clean technology, and labour. He also made several important recommendations, including working to enable Canada to attract more venture capital, expedite approvals to reduce project lead times, and for Canada to create a green jobs strategy.

David Billedeau’s opening remarks

Check against delivery.

Madam Chair and Honourable Members, thank you for the opportunity to attend today’s discussion on behalf of the Canadian Chamber of Commerce.

While the Inflation Reduction Act of 2022 presents opportunities for Canadian businesses, we must also recognize significant challenges facing Canada’s private sector. To that end, I will tailor my remarks to focus on automotive manufacturing, critical minerals, clean technologies, and labour considerations.

With respect to automotive manufacturing, the Act introduces and extends EV tax credits—notably, eligibility for these credits ultimately requires EV batteries to be 100% made in North America by 2029. This creates considerable opportunities for Canada’s natural resources and manufacturing sectors.

However, given the protracted timelines to build upstream and midstream mining infrastructure, as well as the lead times to modify automotive supply chains, it will be difficult for automotive manufacturing firms operating in Canada to meet credit eligibility requirements in the near-term.

This brings us to critical minerals. Global demand for certain minerals is expected to increase by up to 600% by 2040. This presents a rare opportunity for Canada, and the Chamber believes that Canada can serve North American and global market demand for minerals required for electric vehicles and clean technologies.

To match domestic mineral production and processing with increasing demand, it is important to focus attention on facilitating resource development within Canada—where it takes an average of 15 years to move mining projects from discovery to first production. These lead times will impact Canada’s decarbonization efforts while limiting opportunities to develop new and existing mining and manufacturing facilities across Canada.

On the topic of clean technologies, the Inflation Reduction Act contains supports for domestically produced alternative fuels such as hydrogen and biogas—as well as for clean technologies like CCUS. Further, the Act contains credit multipliers for products meeting domestic content and local human resources thresholds. Such incentives will make it difficult for Canadian clean technology firms to compete in the US market.

While Canada’s recent Fall Economic Statement has provided investment tax credits for clean technologies, Canada must take further measures to secure a level playing field and opportunities for Canadian workers.

Lastly, a few comments on labour availability. A study conducted by the BlueGreen Alliance indicates that the Act will create over 9 million “climate-tech” jobs in the US by 2032—largely in STEM fields.

The skyrocketing demand for labour in the United States will place pressure on Canada’s ability to attract and retain skilled workers to drive its own green economy. This is concerning as the competition for talent is already a major pain point in Canada, with around one-third of Canadian businesses experiencing labour difficulties.

With these factors in mind, I would like to table the following recommendations for your consideration.

First, to further develop our mining, clean technologies, and advanced manufacturing sectors, Canada must be able to compete for major capital investments. This requires securing venture capital for early-stage projects, accelerating the implementation period of the Strategic Innovation Fund, expanding fund allocation for critical minerals, and ensuring that incentives within the Inflation Reduction Act do not serve as non-tariff barriers to Canadian businesses.

Second, to reduce mining project lead times, the Government of Canada must work with a spectrum of stakeholders to responsibly expedite development and permitting timelines.

Third, Canada needs a green jobs strategy that brings together all levels of government—as well as secondary and post-secondary institutions across the country—to develop the domestic capacity of skilled workers needed to drive our economy and build the projects that will get us to net zero.

In close, the Canadian Chamber encourages the Committee to carefully examine the regional economic implications of the Inflation Reduction Act while also looking towards the boundless potential for Canada to drive global transitions to net zero. Thank you again for your time and consideration. I look forward to your questions.

Other Blogs

Policy Matters: Revisiting the 3 Most Popular Topics of the Year

Vaccines: A Potential Key to Unlock Many of Canada’s Healthcare Challenges