Blog /

May 2022 Consumer Price Index data: 7.7%, the highest rate in almost 40 years, but the worst may be yet to come!

May 2022 Consumer Price Index data: 7.7%, the highest rate in almost 40 years, but the worst may be yet to come!

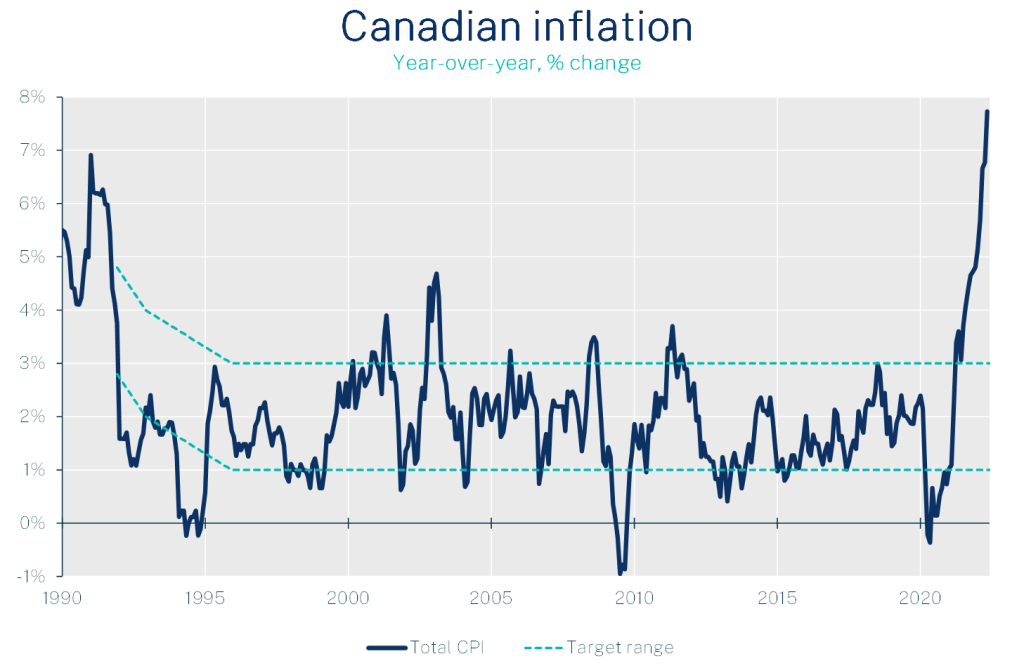

It was another incredible month for Canada’s CPI inflation, which hit 7.7% in May. This is the highest rate in nearly 40 years — and well above market expectations yet again. Price pressures continue to broaden.

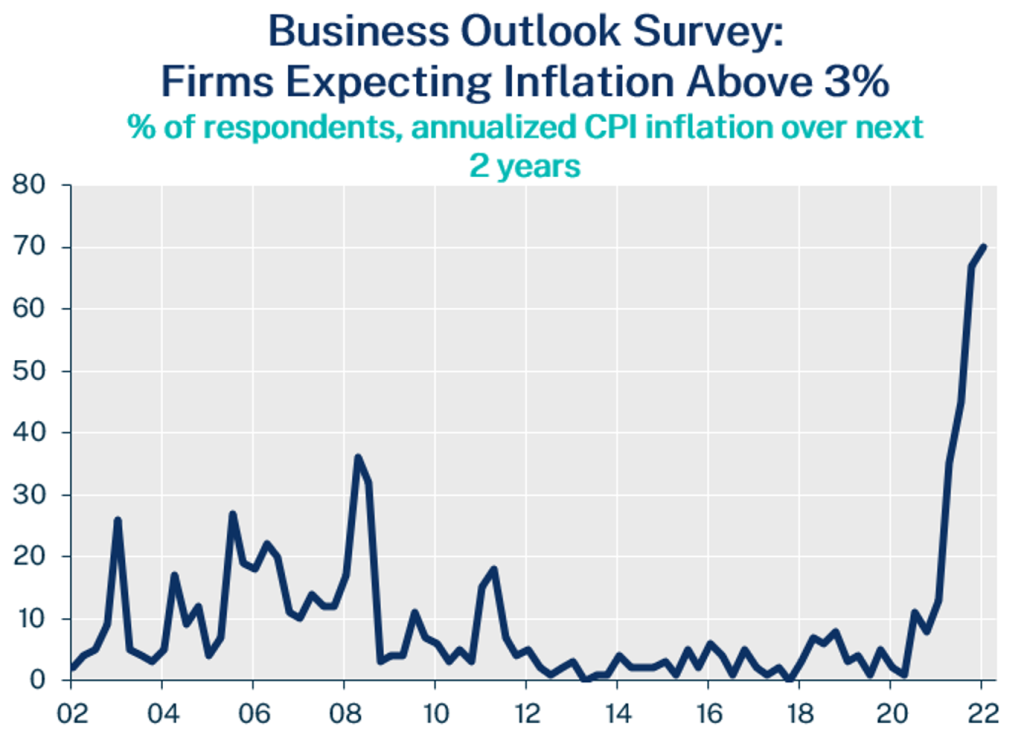

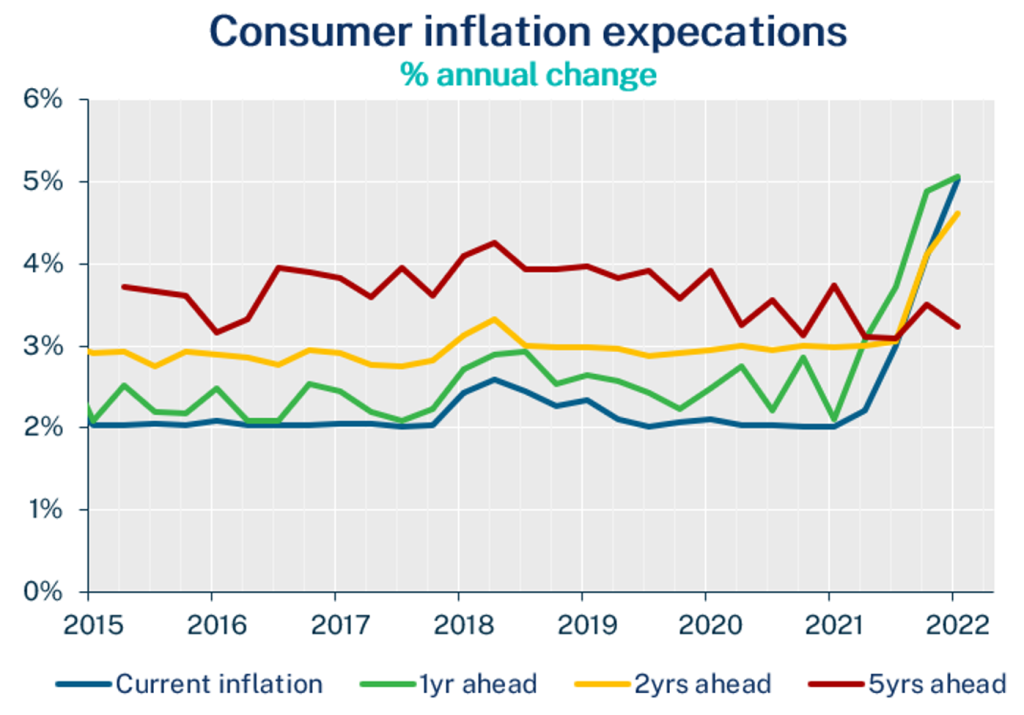

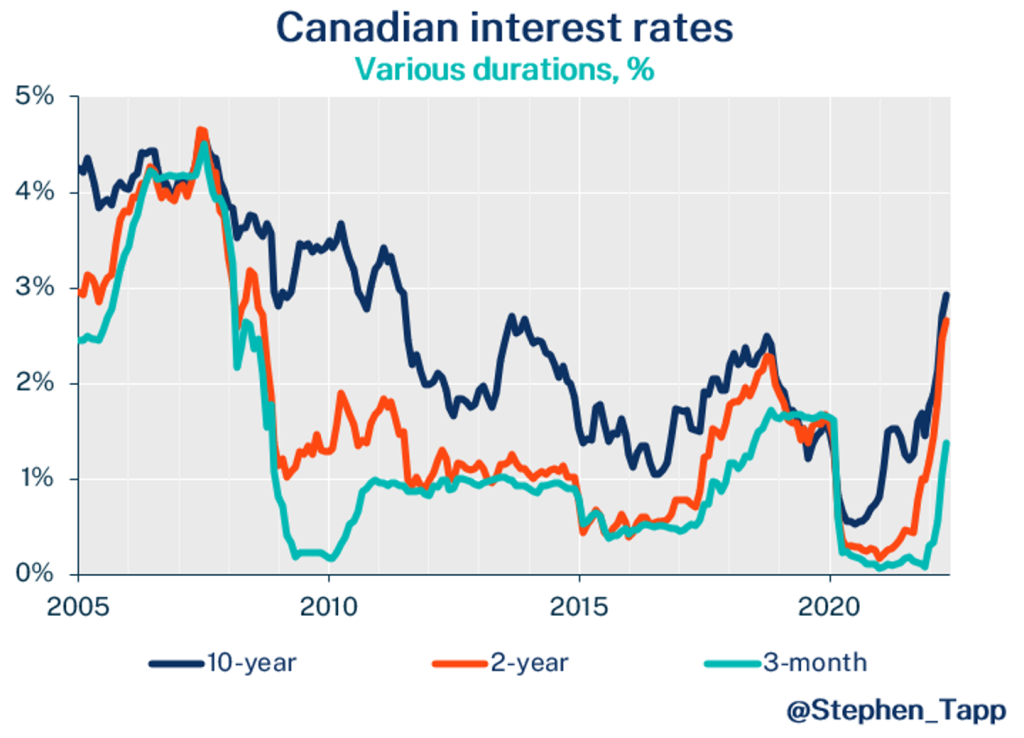

It was another incredible month for Canada’s CPI inflation, which hit 7.7% in May. This is the highest rate in nearly 40 years — and well above market expectations yet again. Price pressures continue to broaden. Sky-high gas prices could push the headline above 8% next month, while the 2022 annual could now exceed 7%! This cements the case for the Bank of Canada to follow the Fed’s 75 basis point hike at its next announcement in July.

KEY TAKEAWAYS

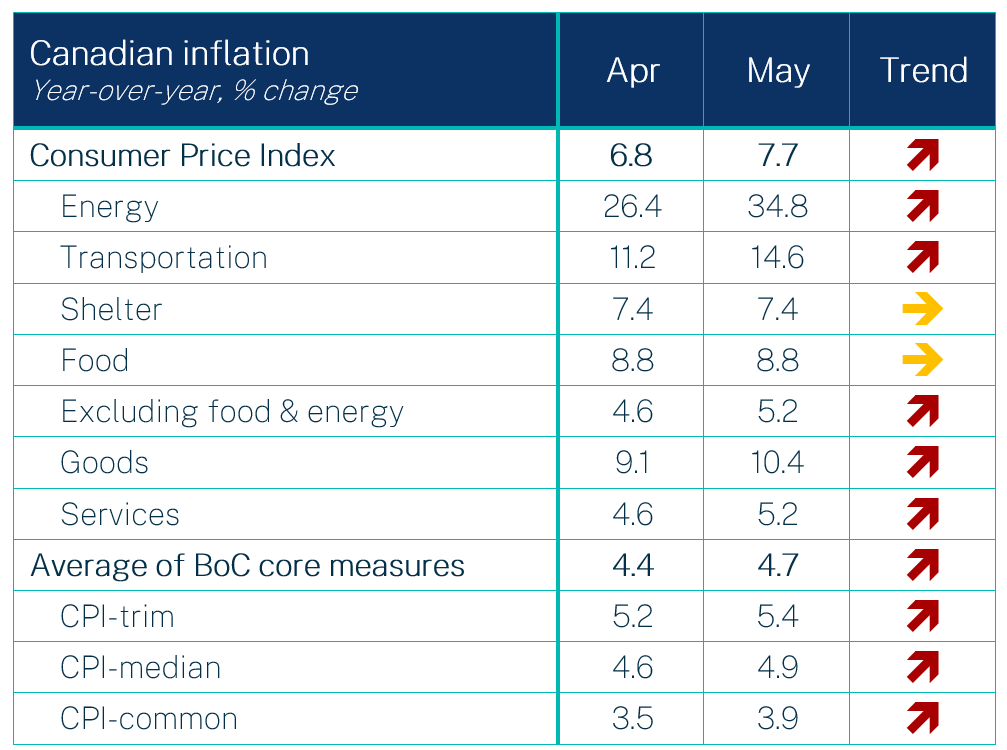

- Canada’s headline Consumer Price Index (CPI) inflation continued to rise hitting 7.7% in May, up from 6.8% in April. This is the highest rate of inflation since 1983.

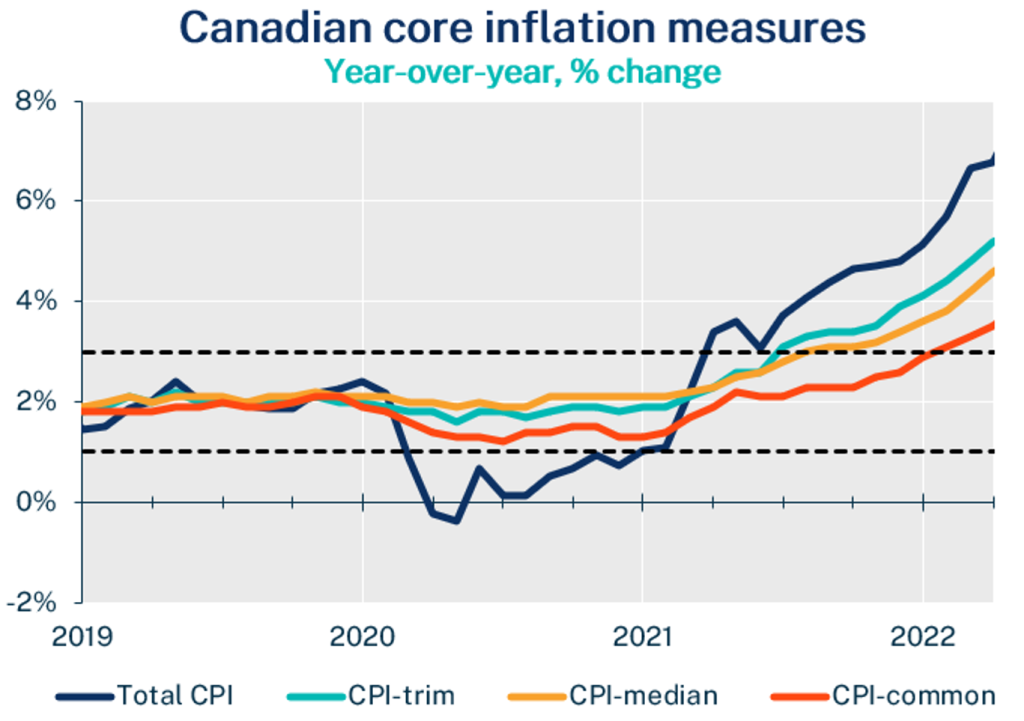

- Price pressure are broadening. Inflation excluding food and energy, rose 5.2% in May (up from 4.6% in April). The average of the Bank of Canada’s three “core measures” continued to rise, it’s now up to 4.7%.

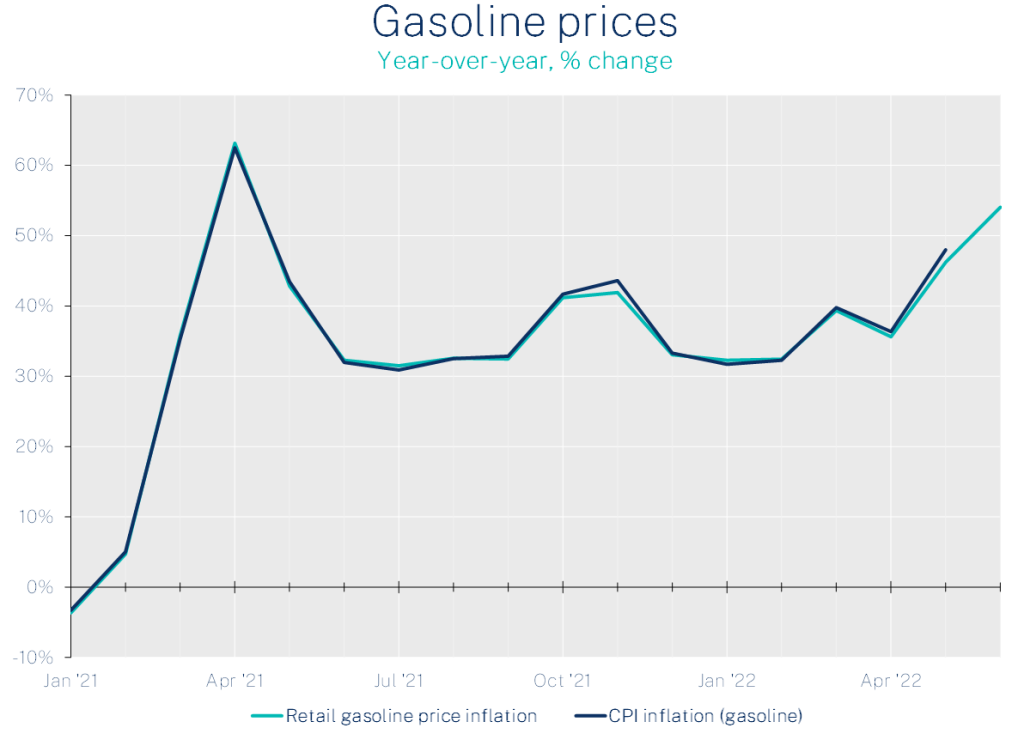

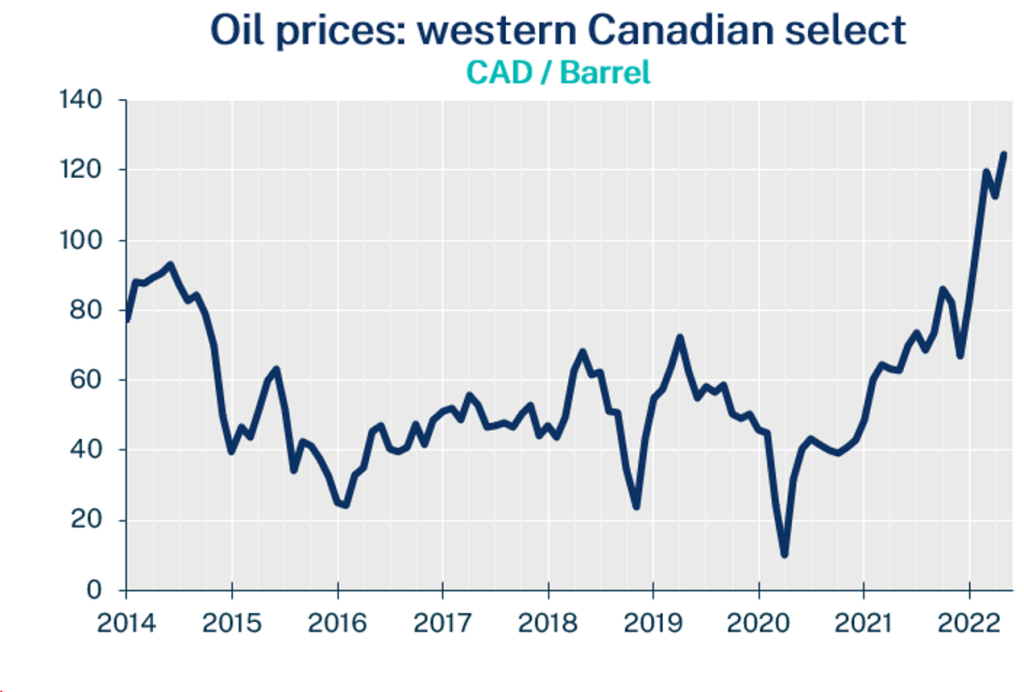

- Russia’s invasion of Ukraine continues to drive global food and energy prices. Energy prices rose 35% compared to last year. This is being driven by gas prices (48% year-over-year), and on pace to rise even further in June.

- Food prices are also a key inflation driver (8.8%). Grocery prices rose 10% year-on-year in May, equaling the gain in April.

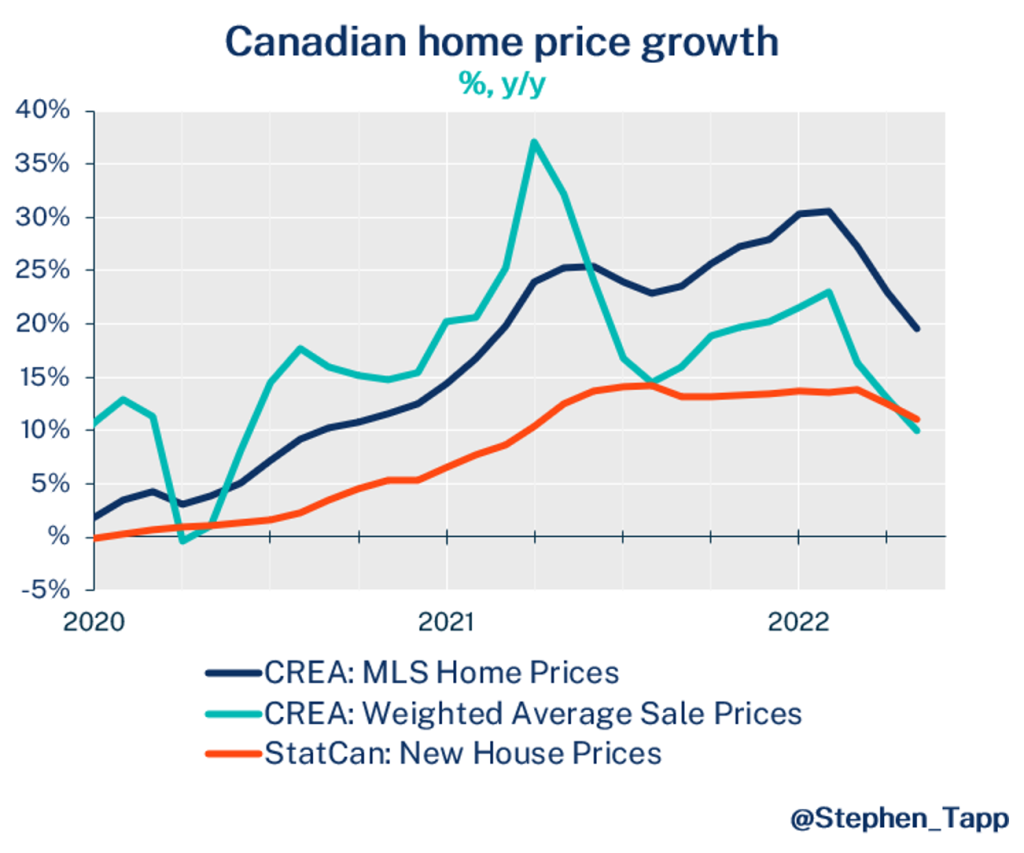

- Canadians received no relief from the prices of shelter and transportation. Shelter prices held steady at a 7.4% rate in May, while transportation prices rose 14.6%, compared to 11.2% in April.

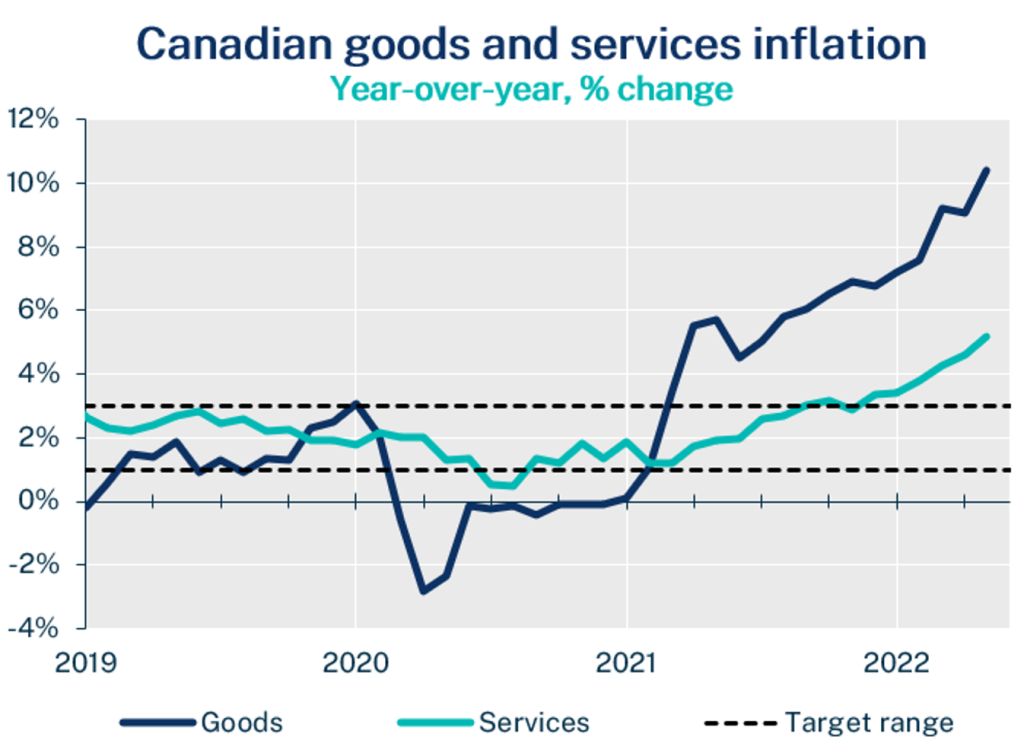

- The inflation rate for goods rose to 10.4% (up from 9.1% last month). Services prices rose to 5.2% (from 4.6%). With both aggregates continuing to worsen, it is still too early to call a peak for Canadian inflation.

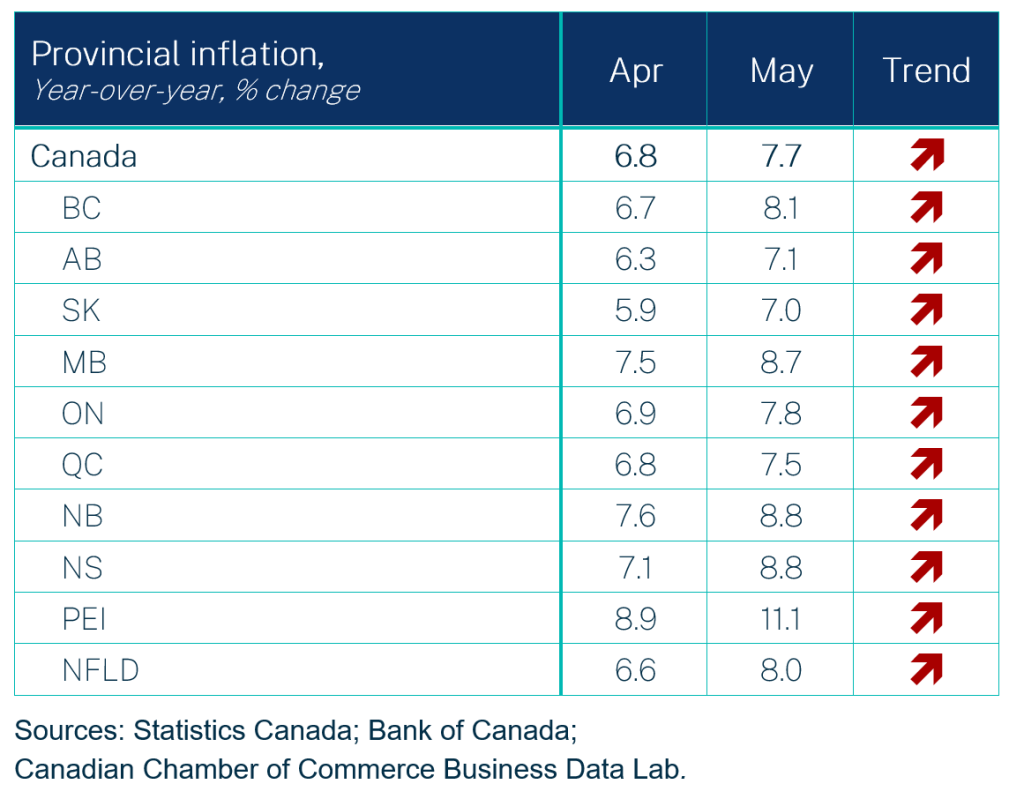

- Every province had higher inflation in May, with Prince Edward Island experiencing an 11.1% rate. Saskatchewan had the lowest inflation rate, with prices rising 7%.

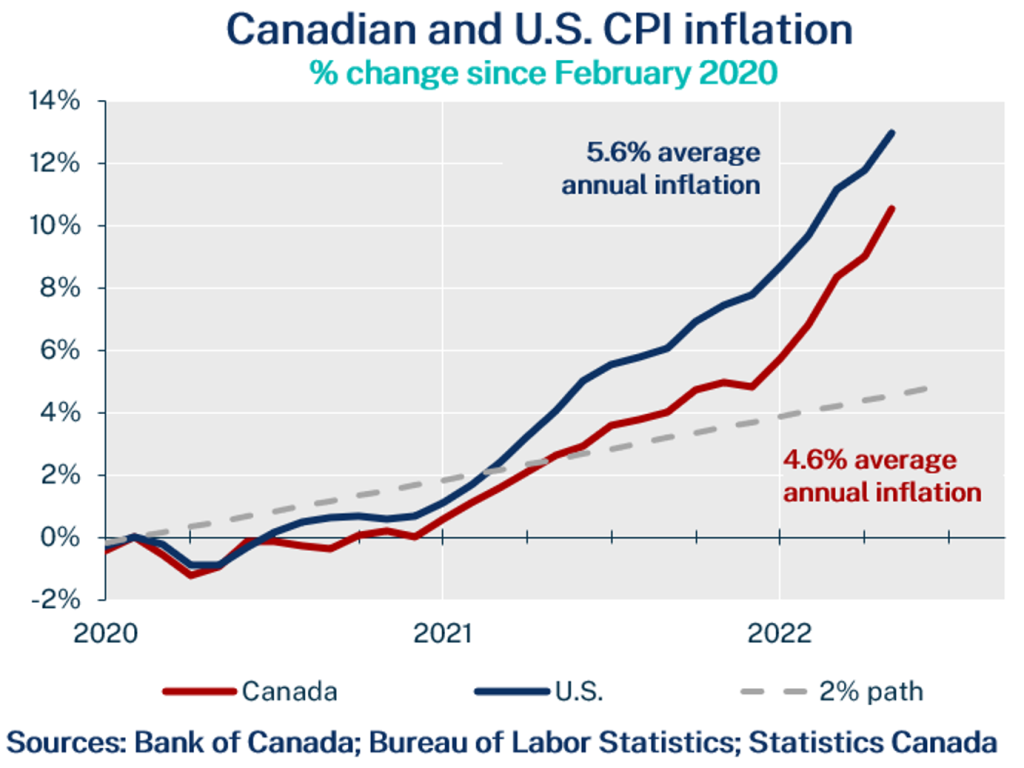

- Inflation in Canada is now running at 4.6% over the pandemic period — well above the 2% target, but below the 5.6% experienced in the United States.

SUMMARY TABLES

INFLATION CHARTS

Related News

Nice Guys Finish First: Empowering Canadian Business with Negotiation Strategies

MDR: What Is It? And Why Your Business Needs This Cyber Security Protection?