Blog /

2022 Q3 Canadian Survey on Business Conditions: Inflation is the top issue. Labour pains intensifying, but price pressures and supply chains issues are improving

2022 Q3 Canadian Survey on Business Conditions: Inflation is the top issue. Labour pains intensifying, but price pressures and supply chains issues are improving

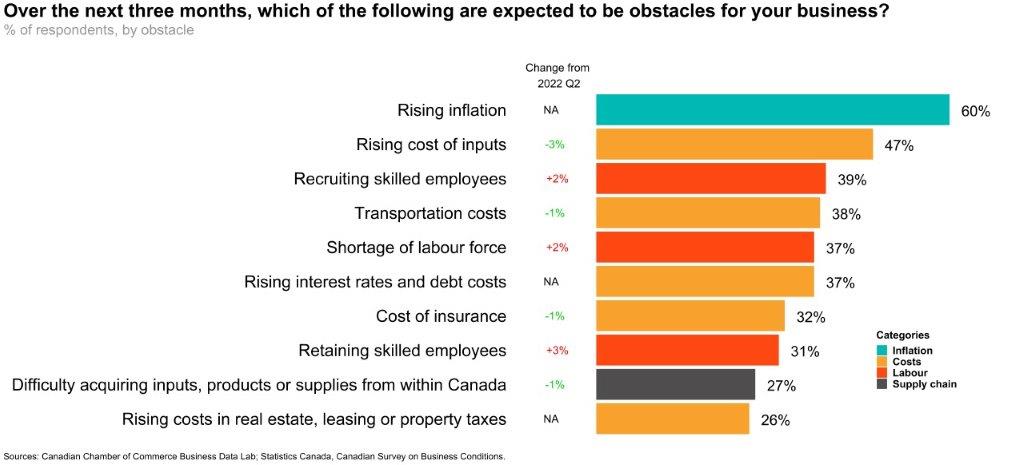

According to the latest CSBC survey, Canadian businesses continue to see inflation as their biggest near-term obstacle. A whopping 60% of firms expect inflation to be a challenge, the highest response rate in the history of the survey.

According to the latest CSBC survey, Canadian businesses continue to see inflation as their biggest near-term obstacle. A whopping 60% of firms expect inflation to be a challenge, the highest response rate in the history of the survey. This does not come as a big surprise, given how this issue has dominated news coverage and business discussions over the past year.

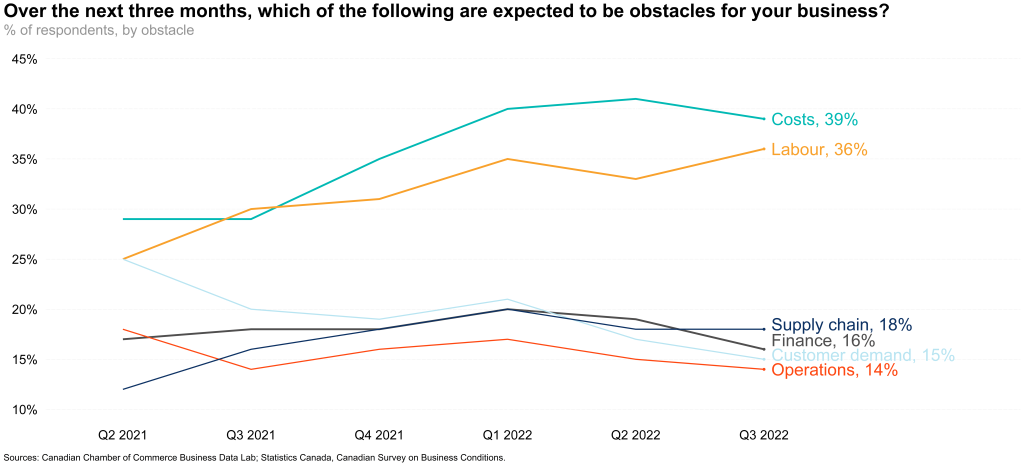

More generally, the survey shows that Canadian businesses continue to struggle with rising input costs related to the high inflation environment, hiring workers in a very tight labour market, and lingering supply chain challenges.

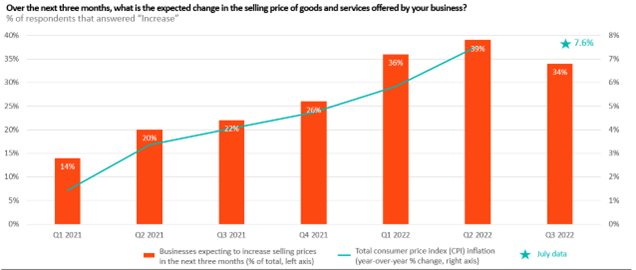

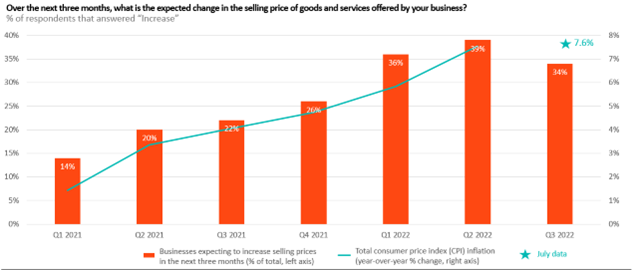

In the midst of these widespread inflation concerns, it’s encouraging to see the first signs of improvement on this front: consumer price inflation finally edged down in July (to 7.6%, down from 8.1% due to falling gas prices), and for the first time since 2021, the share of businesses that say they expect to raise prices in the coming quarter has dropped (to 34% in this survey, down from the record 39% last survey.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

- Canadian business expect rising inflation to be the top obstacle they face over the next quarter. This issue was cited by the majority (60%) of respondents, representing the highest response rate in the history of the survey.

- Similarly, the second biggest near-term obstacle is rising inputs costs, cited by almost half (47%) of businesses, down slightly from the last survey (50%). Costs pressures are highest for businesses in agriculture (72%), manufacturing (72%) and accommodation and food services (70%).

- Thankfully, there were some tentative signs of improvement on the inflation front. Over the next quarter, 34% of businesses expect to raise prices (down fromthe record39% last quarter), consistent with inflation continuing to slow from its four-decade highs.

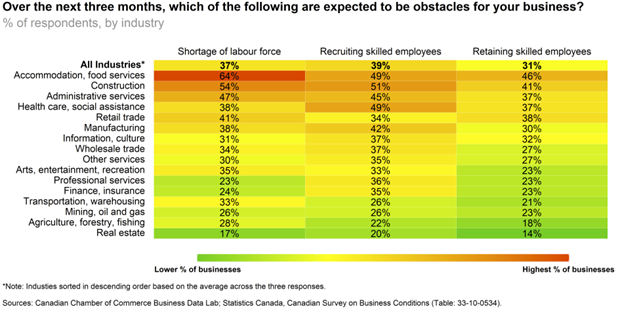

- Labour pains continue to intensify: Labour markets are extremely tight, making it hard for businesses to recruit and retain skilled employees. These concerns are relatively widespread, but most acute in accommodation and food services, construction, health care and retail. Of businesses that expect near-term labour obstacles, almost two-thirds (62%) reported that challenges related to recruiting and retaining staff have worsened from 12 months ago.

- Supply chains still a problem for firms, but showing signs of improving: A slightly smaller share of firms expect difficulties acquiring inputs and/or managing inventories. This is happeningalongside the modest improvements in global supply chains in recent months.

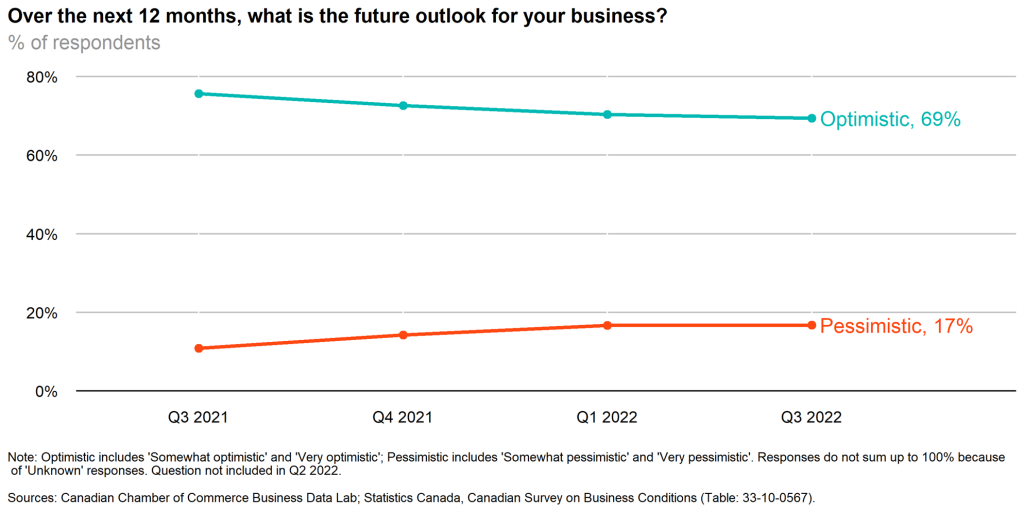

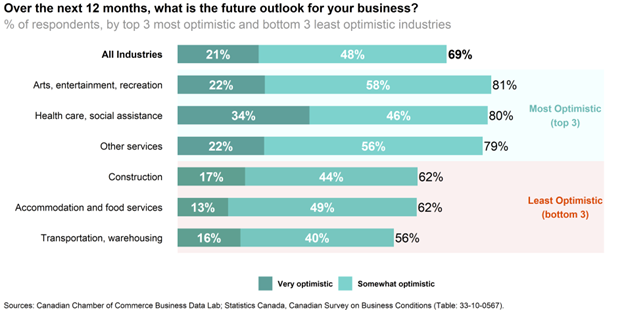

- Outlook for slowing growth: With economic growth expected to slow in the second half of the year, in the context of a weakening global economy and higherinterest rates,Canadian business optimism faded, but only slightly. The most optimistic sectors include arts, entertainment and recreation, and “other services” — both enjoying a rebound thanks to pent-up demand for hard-to-distance activities that were shut down earlier in the pandemic. The least optimistic sectors are construction, accommodation and food services, and transportation, who are dealing with an on-going housing market correction (for construction) as well as significant labour market challenges.

Rising inflation is the top business concern for 2022 Q3

Cost and labour concerns are in a league of their own

Price pressures have turned the corner

Accommodation, food services and construction most impacted by labour challenges

Canadian businesses are signaling slower growth in sales, employment and investment, shrinking profit margins in 2022 Q3

Canadian business optimism fades slightly going into 2023

Things are looking up for arts, entertainment and recreation

About the Canadian Survey on Business Conditions

Survey Objectives: The Canadian Survey on Business Conditions (CSBC) was created in Spring 2020 by Statistics Canada in partnership with the Canadian Chamber of Commerce to provide timely, relevant data on business conditions in Canada, as well as business expectations and views on emerging issues. These survey responses are used by governments, chambers of commerce, business associations and analysts to monitor evolving business conditions and devise policies to support Canadian business.

Survey Period: The 2022Q3 CSBC was collected from July 4 to August 8, 2022.

Survey Approach: The survey was conducted by Statistics Canada via electronic questionnaire using a stratified random sample of business establishments with employees. Population totals are estimated using calibration weights. The survey is based on responses from 17,013 businesses.

Business Data Lab (BDL)

Our Business Data Lab (BDL) provides future-focused, real-time data and insights for companies of all sizes, sectors and regions of the country. The BDL brings together data from a variety of sources to track evolving market conditions, providing Canadian businesses with critical information to help them make better decisions and improve their performance. Learn more.

Related News

Submission for the Pre-Budget Consultations in Advance of the Upcoming Federal Budget

The Outstanding Honourees of the Canadian Business Leader Awards

Canadian GDP for August: It’s not all bad news

Blog /

Time to put reports into action, Chamber tells House Agriculture Committee

Time to put reports into action, Chamber tells House Agriculture Committee

On February 17, 2022 the Canadian Chamber’s Senior Director, Transportation, Infrastructure & Regulatory Policy, Robin Guy, appeared at the House...

On February 17, 2022 the Canadian Chamber’s Senior Director, Transportation, Infrastructure & Regulatory Policy, Robin Guy, appeared at the House of Commons Standing Committee on Agriculture in support of the Chamber Canada’s FoodLink campaign. Guy stressed the importance acting on the numerous reports that have been completed to help Canadian agriculture grow, as well as the need to prioritize regulatory issues, supporting Canadian innovation, and supply chain corridors.

Robin Guy’s opening statement:

Check again delivery.

Chair and Honourable members, it is a pleasure to be appearing at this Committee for the first time. My name is Robin Guy, I am the Senior Director, Transportation, Infrastructure and Regulatory Policy at the Canadian Chamber of Commerce. I am also joined today by my colleague, Jarred Cohen, Policy Advisor at the Canadian Chamber.

I recognize that it may seem out of the norm for the Canadian Chamber of Commerce to appear at this Committee, but as the country’s largest industry association with members in all sectors, we have a deep stake in the success of the agriculture and agri-food industry. Our membership includes companies and associations at various points of the agriculture supply chain, including producers, processors, retailers, and ancillary businesses.

Over the last number of months, the Canadian Chamber has been running the Canada’s FoodLink campaign that has been seeking to draw visibility towards a number of priorities for the industry, such as regulatory competitiveness, trade, and innovation. As such, this committee’s study is both welcome and timely.

Before discussing a few specific points for the committee’s consideration, it is worth noting the volumes of paper littering the town talking about the sector’s potential. This includes:

- the Advisory Council on Economic Growth;

- the Economic Strategy Table on Agri-Food;

- the Industry Strategy Council and

- the Guelph Statement

Although the sector has remained resilient in the face of a disruptive two years, I mention these reports not for posterity purposes, but instead to underscore that it is important to ensure we take the voluminous work that has been produced and put it into action. I hope this committee can catalyze that action.

In the time available, allow me to focus on a few points in the areas the committee has identified as points of interest.

First is regulatory.

While often times the cost of input fluctuations are due to market forces, the regulatory burden imposes a significant cost on companies. And it is a cost that is within our control. Diverging from regulatory best practice and science-based international standards raises the cost of business. It makes Canadian companies less competitive. And it prevents small business owners from running their companies.

Too often regulators do not give sufficient considerations to economic and business impacts when making decisions. To remain competitive, this cannot be the case. We would urge the government to adopt an economic and competitive lens mandate for regulators, to ensure it does not hinder growth for Canadian business.

As Canadian business turn to recovery, I would also stress that now is simply not the right time to introduce new regulations that will hurt economic growth, and add new strains to our supply chain.

Second is transportation corridors.

Extreme weather events and aging infrastructure remain challenges to ensure we can get products to buyers and markets. We have a serious infrastructure deficit in Canada, which will require us to perform triage. It is essential that we avoid the temptation to spread whatever money is available like peanut butter across Canada. Infrastructure capacity takes time to build and we need to move now to reap benefits later. We cannot simply address existing gaps, but must look to our future needs to reach our potentials. This forward vision is essential to ensuring our transportation system can meet the future needs of our economy.

The Canadian Chamber of Commerce commends the government for its investments through the National Trade Corridors Fund. Through this program, we must continue to look at building redundancy through tools such as twinning of rail in high congestion area, increase the capacity of our bridges, and protecting industrial lands around airports and ports. I would also stress that investments must be based on clear priorities with measurable economic returns. These priorities must be clearly communicated by government so private sector can act accordingly. And these priorities must be backed by data to ensure we can see the impact projects are having to strengthen our trade corridors.

I would also like to commend the government for launching the Supply Chain Summit. Partnership and dialogue between government and the private sector are critical to work through these complexities. Establishing supply chain working groups for information sharing and moving issues forward cannot be overlooked. These are not flash in a pan issues that will be solved over night.

Third, and lastly, is supporting supply chains through innovation. The success of the Canadian agriculture sector relies on our ability to adopt to new technologies, which will support the sustainable economic growth of the agriculture and agri-food sector. The long-term viability of the industry relies also on innovation to enable tackling climate change. The government needs to work closely with industry to develop a technology-neutral net-zero transition plan, such as the 4R Nutrient Stewardship program and support for Carbon Capture, Usage Storage in the upcoming federal budget. Thank you again for the opportunity to address the Committee and I look forward to your questions.

Related News

2022 Q3 Canadian Survey on Business Conditions: Inflation is the top issue. Labour pains intensifying, but price pressures and supply chains issues are improving

Canadian Chamber to House of Commons Standing Committee on Transport, Infrastructure and Communities: We need to see long term investment in Canada’s trade infrastructure.