Blog /

Canadian Chamber Appears Before OGGO Committee on Government Operations and Estimates

Canadian Chamber Appears Before OGGO Committee on Government Operations and Estimates

While Canada was ranked 4th in the world for ease of doing business in 2006, it has since slipped to 23rd, primarily due to the increasing burden of government regulations.

On April 10, the Canadian Chamber of Commerce’s Senior Director, Manufacturing and Value Chains, Alex Greco, appeared before the OGGO Standing Committee on Government Operations and Estimates, to highlight the pressing issue of regulatory burden on Canadian businesses.

While Canada was ranked 4th in the world for ease of doing business in 2006, it has since slipped to 23rd (as of 2020), primarily due to the increasing burden of government regulations. This stifling regulatory environment, now ranked 53rd globally, is impeding economic growth and investment.

We need a more ambitious approach from the government to accelerate modernization and streamline regulatory processes. The current complex and slow-moving regulatory environment is driving up operating costs for businesses, particularly small businesses, which lack the resources to navigate these challenges effectively.

In his remarks, Greco proposed three key recommendations to the committee:

- implementing an economic and competitiveness mandate for federal regulators,

- ensuring regulatory alignment across domestic and international jurisdictions, and

- providing regulatory certainty to businesses through evidence-based regulations.

He emphasized that these measures are crucial to create an environment where businesses can thrive and contribute to Canada’s economic success.

The video recording and full remarks can be seen below.

Mr. Chair, Honourable Members:

It is a pleasure to appear before you on behalf of 400 chambers of commerce and boards of trade and more than 200,000 businesses of all sizes from all sectors of the economy and from every part of the country.

It will come as no surprise that regulatory burden continues to be a growing concern for Canadian business. The World Bank’s “Ease of Doing Business” report ranked Canada as 23rd in 2020—but we were 4th in the world as recently as 2006. A big part of this decline is we’re now ranked 53rd for the burden of government regulation on business. Regulation is literally stifling our economy.

It goes without saying that the right policy environment can help businesses succeed and generate long-term economic growth for the country. Making Canada an attractive destination for business investment that supports economic growth requires getting the fundamentals right.

At a time when inflation is persistent, government and the private sector must look at new ways to make Canada more competitive. Governments in the past have attempted to regulate our industries into a more competitive frame, but this has had the opposite effect, as the costs of starting and growing a business have become a disincentive to investment.

The regulatory burden is troublesome in several ways, but two stand out. First, we can’t continue to move at a snail’s pace – we need the government to be more ambitious. We need the government to accelerate modernization and ensure approvals and permitting can meet our public policy ambition.

Second, the ongoing ability of companies to comply with complex regulations is increasing operating costs. It is consistently one of the biggest barriers to economic growth.

According to the SME Regulatory Compliance Cost report, the total regulatory compliance cost to small businesses was nearly $5 billion in 2011, which at the time was approximately $3,500 per business.

That number has no doubt increased over the past decade along with the regulatory burden overall.

We cannot afford for more private sector investment decisions to be sidelined because of the complex regulatory environment in Canada. Too often, we hear from our members about the investments they have on hold while they wait for direction from the government. Lack of clarity and speed on the new investment tax credits is a good example: while other jurisdictions, such as the United States move quickly to create the conditions for investment, Canada is falling behind. Investment will not wait – it will go where it is wanted.

Many members also cite increased red tape and differing certification and technical standards as major obstacles to doing business within Canada.

Complying with a complex network of overlapping regulations from all levels of government is expensive and time-consuming. When combined with inefficient and unpredictable regulatory processes, this sets businesses up for failure.

All of these issues are especially potent for small businesses, which usually lack the resources of larger companies to manage regulation and compliance.

While I commend the government for pushing a regulatory modernization agenda, we must move more boldly and urgently. We cannot just talk the talk—we need to see real action that will move the needle.

In the time remaining, I would like to focus on three recommendations for the committee.

First, the government must move to implement an economic and competitiveness mandate to federal regulators.

Too often, regulators do not fully consider economic impacts on business when making decisions.

Second is regulatory alignment across domestic and international jurisdictions.

When regulations are more consistent between jurisdictions, businesses are better able to trade within Canada and beyond. Quite simply, we should not require a “Free Trade” agreement within our own country.

Unless the government actively works to improve collaboration and alignment to ensure businesses are not at a disadvantage, we will see less innovation, fewer choices, and higher prices.

An example of this is when each province establishes its own framework for regulating pesticides or rules for the trucking of goods across jurisdictions.

Finally, the government should pledge to provide regulatory certainty to businesses.

Evidence-based regulations can both protect the public interest and promote market success.

And for companies looking to invest billions of dollars in developing new pipelines, new mines, and other large-scale infrastructure projects, this is not a “nice to have”. It is a “must-have.”

In closing, Canada needs smarter regulatory systems, better processes, and well-designed regulations to help minimize the costs to business and unlock economic growth while improving public health and safety outcomes.

Sustained collaboration with all levels of government and our international partners will make it easier for businesses to do what they do best—produce.

Thank you.

Related News

Celebrating Success: Highlights from the Canadian Business Leader Awards

The Canadian Chamber Appears Before Senate National Finance Committee on Bill C-59

Five Ways to Protect Your Business Against an Evolving Threat Landscape

Blog /

The Canadian Chamber Appears Before Senate National Finance Committee on Bill C-59

The Canadian Chamber Appears Before Senate National Finance Committee on Bill C-59

On March 20, policy experts from the Canadian Chamber appeared before the Senate National Finance Committee to address Bill C-59.

On March 20, the Canadian Chamber’s Senior Vice President of Policy and Government Relations, Matthew Holmes and Senior Director, Fiscal and Financial Services Policy, Jessica Brandon-Jepp appeared before the Senate Committee on National Finance to address Bill C-59. They emphasized the importance of Canada’s economic competitiveness and productivity — noting that Canada’s productivity has declined in 11 of the last 12 quarters — and highlighted the need for businesses to be viewed as critical partners in driving investment and growth to address these challenges.

Focusing their comments on competition policy, investment tax credits and the digital services tax proposed in Bill C-59, they expressed concerns about changes to the Competition Act and recommended specific safeguards for new “private rights of action” to prevent frivolous claims.

The full remarks and video recording can be viewed below.

*The following remarks were adjusted slightly in the final delivery.

Mr. Chair, Honourable senators:

It is a pleasure to appear before you again on behalf of 400 chambers of commerce and boards of trade, and more than 200,000 businesses of all sizes, from all sectors of the economy and from every part of the country.

The Canadian Chamber of Commerce’s primary concern this evening is that Canada’s economic competitiveness is slipping, while our productivity has declined in 11 of the last 12 quarters. This means Canadians are poorer overall, have fewer opportunities to pursue their personal goals, and have to spend more just to keep up with everyday life.

Businesses of all sizes should be viewed by government as critical partners in our collective success, which can drive investment and growth, and help turn the tide on our productivity challenges.

The committee has already received our formal submission on C-59, which included seven specific recommendations and proposed amendments: tonight we will focus our comments tonight on competition policy, investment tax credits, and the digital services tax:

First, competition policy:

As we raised during your study of C-56, we remain concerned by the ad hoc approach to changes to the Competition Act and would encourage the government to continue to consult with the business community on changes to the Act.

In particular, C-59 could overwhelm the Competition Tribunal and businesses with frivolous claims through new “private rights of action”. The Canadian Chamber’s submission recommends specific safeguards consistent with Canadian class action statutes to ensure claims are evaluated on a consistent basis, and funds are properly distributed to the consumers affected by the conduct, rather than their lawyers.

Recently there has been a lot of talk about structural presumptions in merger reviews: we saw the Competition Bureau file a brief with this committee advocating for its inclusion in C-59 pointing to the U.S. merger guidelines as inspiration. We are aware of the U.S. Chamber of Commerce’s letter to this Committee on the matter, and would encourage you to review it carefully as structural presumptions are not codified into US law, and there is no serious legislative attempt in the U.S. Congress to make structural presumptions the law. Competition agencies should continue to comprehensively examine a merger’s likely efforts on competition and consumers, including arguments that the merger would benefit consumers.

Second, Canada’s new investment tax credits:

Overall, the Canadian Chamber applauds new investment tax credits like the CCUS ITC as tools to unlock private sector investment in a low-carbon economy. In order to maximize the impact of the Clean Technology Manufacturing Tax Credit and Investment Tax Credit, we recommend they be refined to include intangible property and mine development investments.

Further, we believe the Clean Technology ITC should be expanded to include life insurers, similar to the Fall Economic Statement inclusion of Real Estate Investment Trusts. Life insurers often manage assets on behalf of pension plans. However, because pension plans are non-taxable entities, long-term investors cannot utilize the Clean Technology ITC, which will hamper long-term investment in the decarbonization of Canada’s economy.

Given the current uncertainty around the permitting environment in Canada, we also recommend extending the timeline for phasing-out the Clean Technology Manufacturing ITC and Clean Electricity ITC in order to secure large investments within the Canadian mining, manufacturing and electricity sectors. Finally, it is imperative that all of the new ITCs are implemented as soon as possible, with clarity on procedure and eligibility, so that the private sector can fuel the next wave of long-term investment in our economy.

Which brings us to new corporate taxes and the digital services tax:

The irony is that just as we’re contemplating ITCs to spur private sector investment, innovation and growth, a range of new business taxes threaten to repel investment, create uncertainty, and discourage new players from entering the Canadian marketplace.

Specifically, we call on the government to avoid imposing new taxes on the business sector, as C-59 proposes to do with a Digital Services Tax. DST is particularly concerning as it includes a retroactive tax to 2022 on online services Canadians have come to rely on, even though over 120 countries, including the U.S., have agreed to delay imposing such taxes.

First, we strongly object to the concept of tax retroactivity, which robs businesses of the certainty they need to make productive investments in innovation and growth and has a chilling effect on future investment across the economy.

Second, we oppose any measure which will increase the costs for businesses and Canadians when both are facing challenging economic headwinds. This new tax will affect far more than just large multi-national corporations: if enacted, the DST will ripple across the Canadian economy to mom-and-pop shops, small businesses, rural tourism operators, and independent makers (primarily women) who help pay the bills through “side hustle” start-ups–not to mention all of us who enjoy picking up some takeout after a long work week or booking a stay-cation close to home.

In fact, this tax will disproportionately impact businesses with low profit margins because unlike corporate income taxes, digital services taxes are levied on revenues rather than profits. As a result, there is a disproportionate tax burden being placed on companies with low profit margins, such as the online travel sector.

Finally, we must sound the alarm that successive administrations in Washington have signalled that enacting a DST could provoke damaging trade retaliation, potentially against key sectors of the Canadian economy. We are hearing directly from businesses in many sectors beyond the digital services space who are concerned that their products may be impacted by retaliatory tariffs.

At a very minimum, we call for the punitive and retroactive application of the DST to be cancelled, and the introduction of a safe-harbour for low-margin businesses similar to OECD Pillar One, Amount A in which there is a safe harbour provision.

Bill C-59 and the forthcoming Budget 2025 presents an opportunity for decisive action. We urge Ottawa to adopt pro-growth policies that will invigorate Canada’s economy. As ever, we stand ready to facilitate collaboration between policymakers and the business community to make this happen.

Thank you.

Related News

Celebrating Success: Highlights from the Canadian Business Leader Awards

Canadian GDP for July: Defying expectations, a stronger start to the third quarter than anticipated, but a slowdown remains in clear sight

Canadian Chamber to House of Commons Standing Committee on Transport, Infrastructure and Communities: We need to see long term investment in Canada’s trade infrastructure.

Blog /

Canadian Chamber Appears before Standing Committee on Public Safety and National Security

Canadian Chamber Appears before Standing Committee on Public Safety and National Security

On February 5, 2024, our Senior Director of Digital Economy, Technology and Innovation Ulrike Bahr-Gedalia, addressed the House of Commons Standing Committee on Public Safety and National Security to discuss Bill C-26, An Act respecting cyber security.

On February 5, 2024, our Senior Director of Digital Economy, Technology and Innovation Ulrike Bahr-Gedalia, addressed the House of Commons Standing Committee on Public Safety and National Security to discuss Bill C-26, An Act respecting cyber security. She emphasized the critical importance of cyber security, particularly for SMEs, and advocated for a prevention-first approach. She outlined key recommendations, including the need for clear definitions for reportable cyber security incidents and a 72-hour reporting period. While expressing support for Bill C-26, she highlighted areas for improvement, such as enabling two-way information sharing and ensuring full parliamentary oversight of Ministerial Orders, and encouraged Committee members to engage directly with telecommunication providers.

The full remarks and video recording can be found below.

Mr. Chair, Members of the Committee – good afternoon.

My name is Ulrike Bahr-Gedalia, and I am the Senior Director of Digital Economy, Technology and Innovation at the Canadian Chamber of Commerce.

I am also the Canadian Chamber’s architect and policy lead for the Digital Economy Committee, Future of Artificial Intelligence Council, and Cyber. Right. Now. Council.

As Canada’s largest and most activated business network representing over 400 chambers of commerce and boards of trade and more than 200,000 business of all sizes, from all sectors of the economy and from every part of the country, the Canadian Chamber is pleased to have this opportunity to provide feedback on Bill C-26.

Our Cyber. Right. Now. Council has been calling on government to prioritize cyber security and focus on a prevention-first approach and improved information sharing for close to three years.

Today, I’d like to share a few key recommendations and why cyber security is important to the Canadian Chamber and our members within the Canadian economy.

Over 98% of Canadian businesses are small-or medium-sized enterprises. SMEs need greater cyber security threat awareness, protection, and training to utilize the full suite of tools at their disposal to keep Canadians safe from bad actors.

Just as in other countries, Canada is facing an increasingly complex and risk-prone digital landscape. With a cyber security skills gap of some four million people globally and an ever-increasing number of connected devices (at least 67 billion devices and counting), the challenges and costs associated with securing our digitally-enabled world are increasing.

But while every organization of every size in every industry is at risk of a cyber breach, few carry the same real-world risk of crippling cyberattacks as those in the critical infrastructure sector. This threat will only grow as our critical infrastructure increasingly relies on software and connected technology to power and support its operation.

We are pleased to see Bill C-26 proceed to Committee study and support the bill overall. However, certain amendments are needed to ensure the bill reaches its full potential.

More specifically, our telecommunication members have expressed their concerns with respect to a few provisions in the Telecommunications Act, such as the lack of a due diligence defense for violations under section 15 of Part 1 resulting in monetary penalties and the extent of Ministerial Order Making Powers. I will note that this defense is present elsewhere in Bill C-26, such as in relation to cyber directions in Part 2, the CCSPA, as well as full due process for and parliamentary oversight of Ministerial Orders.

I encourage the Committee to reach out to the telecommunication providers as it is important to hear from them firsthand.

With respect to the CCSPA, our members are seeking the following improvements.

- Firstly, a clearer definition of a reportable cyber security incident. This will ensure industry is not forced to report events that do not pose a material threat to a vital system. Failure to clearly define the parameters for a reportable incident will undermine the purpose of C-26 and overwhelm government authorities, who will have to process and assess each cyber incident reported.

- Secondly, allowing for a 72-hour reporting period for cyber security incidents as opposed to immediate reporting. Allowing for reporting “within 72 hours” provides organizations the time to investigate, and will harmonize with existing regimes, such as in the United States, one of our key trading partners.

- Finally, two-way information sharing is crucial. As currently drafted, the CCSPA only contemplates one-way information sharing from designated operators to the government. We believe this is a missed opportunity and potential weakness and underscores my earlier noted prevention-first approach: the more information we have, the more we can work together and the better we can help prevent incidents.

Thank you for listening and for the opportunity to participate in the study of Bill C-26.

Related News

Five Ways to Protect Your Business Against an Evolving Threat Landscape

Canadian GDP for July: Defying expectations, a stronger start to the third quarter than anticipated, but a slowdown remains in clear sight

Top Hiring and Training Government Funding Programs

Blog /

Canadian Chamber Appears Before House of Commons Standing Committee on International Trade

Canadian Chamber Appears Before House of Commons Standing Committee on International Trade

Canadians are frustrated by the affordability crisis: they want to see products move and prices remain stable. This requires business and government sharing the common goal of a functional supply chain and a growing economy.

On February 1, Matthew Holmes, Senior Vice President, Government Relations and Policy, and Robin Guy, Vice President and Deputy Leader, Government Relations at the Canadian Chamber of Commerce, appeared before the House of Commons Standing Committee on International Trade (CIIT) for their study on “Canadian Business in Supply Chains and Global Markets.”

In their remarks, they emphasized the need for long-term investments in trade infrastructure, highlighting the critical role supply chains play in maintaining Canada’s economic health and its reputation as a reliable trading partner. They also advocated for government to lead the development of a vision for Canada’s trade corridors and called for regulatory modernization and alignment to ensure Canada’s competitive success.

The full remarks are available below.

Opening Remarks

[Check against delivery]

Good afternoon, Madame Chair and honourable members,

Thank you for the opportunity to appear before you today.

The question before this Committee is a significant one: when the value of two-thirds of Canada’s GDP is based on trade activity, how we manufacture and move good across the country, how we prioritize and protect our critical trade infrastructure, and the markets we choose to focus on, whether next door in the U.S. or as far as the Indo-Pacific, have outsized impacts on the health of our economy, opportunities for our businesses, and the quality of life of everyone in the country.

While our supply chains have largely recovered from the worst of the pandemic’s disruptions, many of our members continue to face disruption, inconsistent supply, and persistent inflationary pressures. According to the most recent Statistics Canada Canadian Survey on Business Conditions, a quarter of businesses still identify supply chain challenges as a key concern, and one that over 60% of them expect to persist.

The evolving role of transportation and logistics is critical to Canada’s competitive success, but our supply chains remain only as strong as their weakest link. The challenges and costs presented by climate shocks, such as frequent floods and wildfires, have demonstrated how fragile many of our supply chain systems and structures are. And, in the context of a highly restive labour environment, key points in our trade corridors have experienced repeated or prolonged strikes, putting further strain on a precarious system and compromising our reputation as a reliable place to do business.

Canadians are frustrated by the affordability crisis: they want to see products move and prices remain stable. This requires business and government sharing the common goal of a functional supply chain and a growing economy.

To do this, we need to see long term investment in Canada’s trade infrastructure. Businesses need to be able to get their goods to market reliably. We can’t just simply look to address the needs of today, but the challenges and opportunities that we see 20 and 30 years from now.

[Robin Guy, Vice President and Deputy Leader, Government Relations]

While government isn’t solely responsible for infrastructure investment, a federal commitment to major, strategic, long-term investments is key to building Canada’s trade infrastructure.

The Government’s National Trade Corridors Fund is a positive step forward. While it is supporting worthwhile projects, the government must work to increase the speed at which projects receive funding. It must work with business on ensuring transparency for projects and by continuing to demonstrate how funding is helping to address supply chain challenges of both today and tomorrow.

We need government to lead the development of a vision for Canada’s trade corridors. This Committee’s 2019 report on the topic included a number of important recommendations, including protecting industrial lands along trade corridors, the need for regulatory harmonization across jurisdictions, and the imperative to ensure environmental assessment timelines do not hamstring our ability to move goods across the country.

A 2021 European Court of Auditors comparison of frameworks for large transportation projects in Canada, Australia, the United States, Switzerland, France, Norway and the European Union, noted all but Canada had an overarching transport infrastructure strategy framework.

In addition to vision, we need government to protect our critical supply chains from predictable and preventable threats.

While government can’t solve all of our supply chain issues, it must put in place policies that will enable trade and strengthen supply chains.

The introduction of Bill C-58, which aims to prohibit the use of replacement workers during strikes suggests that the government actually wants to move away from preserving stability. It is in fact, doubling down on Canada being seen as an unreliable and unstable trading partner.

Lastly, we need government commitment to accelerate its regulatory modernization agenda.

Regulatory modernization continues to be a growing concern. Business who trade interprovincially cite increased red tape and differing certification and technical standards as major obstacles to doing business within Canada. Unfortunately, Canada has a complex network of overlapping regulations from all levels of government that diminish competition, discourage open trade, and make everything more expensive.

Regulatory effectiveness is integral to a competitive environment and requires smarter regulation to attract new economic opportunities to Canada.

We believe that it is imperative that regulators and businesses work together to share perspectives to develop optimal regulatory approaches. An economic lens mandate for regulators would add a new tool that will encourage stable, manageable regulations that supports economic growth.

Thank you for your time. We look forward to answering your questions.

Related News

Top Hiring and Training Government Funding Programs

Canadian Chamber Appears before Standing Committee on Public Safety and National Security

What We Heard at The State of Small Businesses in Canada Virtual Event

Blog /

What We Heard at The State of Small Businesses in Canada Virtual Event

What We Heard at The State of Small Businesses in Canada Virtual Event

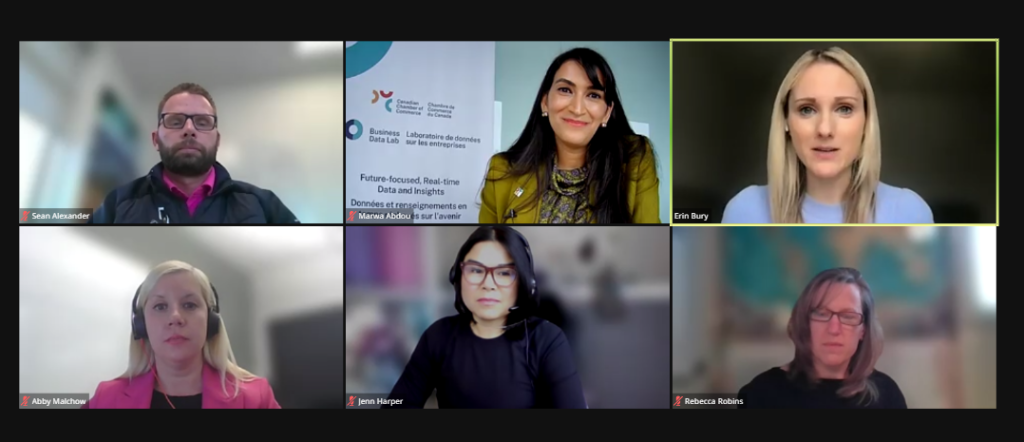

On January 29, attendees from across Canada joined us for a very special virtual event.

On January 29, attendees from across Canada joined us for a very special virtual event, The State of Small Businesses in Canada: Navigating Click-and-Mortar Opportunities. Hosted in partnership with Amazon Canada, the event corresponded with the launch of the new report from the Business Data Lab, A Portrait of Small Business in Canada: Adaption, Agility, All at Once.

We were honoured to have Minister of Small Business Rechie Valdez join us to discuss the importance of timely data for small business owners and the federal programs available to help small businesses succeed. Following Minister Valdez’s address, Marwa Abdou, report author and Senior Research Director, Business Data Lab, broke down the report’s key findings, after which attendees heard from a panel of small business owners about their experiences navigating the complex economic and digital landscape.

Panellists:

- Sean Alexander, President and Founder of KAILANI

- Erin Bury, Founder and CEO, Willful

- Jenn Harper, Founder and CEO of Cheekbone Beauty Cosmetics, Inc.

- Abby Malchow, Manager of Small Business Partnerships, Amazon

- Rebecca Robins, RSSW, Owner, Whole Home Beauty Drywall and Painting

The Tools Are Out There

Small businesses don’t have to tackle today’s challenges on their own. Whether looking for information, financing or mentorship, Minister Valdez provided many examples of available tools designed to help entrepreneurs reach their goals and transition to a “click-and-mortar” reality.

- Canada Digital Adoption Program

- Business Benefits Finder

- The Business Data Lab’s Business Conditions Terminal

- Canada Small Business Finance Program

- Business Development Bank of Canada

Opportunity Amidst Uncertainty

With 98% of all businesses in Canada falling under the small business category and 57% of those under the micro business (1-4 employees) category, unpacking the realities of small business is vital for greater understanding and evidence-driven policy updates.

Five key highlights from the report:

- Small business is big business in Canada.

- Canadian businesses are smaller, more diverse and more resilient than we thought.

- Having an omnichannel presence is no longer a luxury but a necessity.

- While there are several bright spots in the data, more work is needed to help small businesses.

- Targeted policy should be data-driven and underpinned by diversity, equity and inclusion.

For a full breakdown of the report’s highlights, read our summary blog.

The Power of Data

The importance of timely, relevant and regional data for small businesses cannot be understated. Up-to-date insights gives Canadian small businesses the information they need to make informed decisions and improve their performance. However, it can take some work to get good at understanding data or to recruit the people who can.

Omnichannel Presence is Essential

With consumer shopping habits changing — 83% of retail shoppers conduct online research before they visit a store, and 8% shop online from a retailer with a physical location nearby — small businesses need to have omnichannel presence and an online payment solution. Our panellists’ advice to attendees is to start with a high-quality website and to research the best tools and channels for getting in front of the desired audience, whether that’s social media, Amazon or physical retailers. Small businesses looking to expand should consider increasing their capacity through cloud technology, like Amazon Web Services.

Value-Based Shopping

Value-based shopping is becoming more and more pervasive, especially among Gen Z, and that includes shopping from small businesses. According to Abby Malchow, 60% of Amazon sales are from independent sellers that are small- and medium-sized enterprises. To help users find small businesses, Amazon provides a small business search filter and badge.

Go Where Your Customers Are

Advertising has changed but some things remain the same — and that’s going where your customers are. Do some research into the available channels, traditional or digital, to figure out where you want your product to go and where your customers are. Not everyone uses the same social media platforms, and TV ads, shopping channels and traditional partnerships with relevant stakeholders can all be beneficial strategies.

Interested in attending an event like this one? Check out all upcoming hybrid, virtual or in-person events on our website.

Related News

Canadian Chamber appears before Standing Senate Committee on National Finance.

Canadian GDP for July: Defying expectations, a stronger start to the third quarter than anticipated, but a slowdown remains in clear sight

Bridging Opportunities for Women Entrepreneurs

Blog /

What We Heard: “Economic Reconciliation and Indigenous Entrepreneurship” Inclusive Growth Dialogue

What We Heard: “Economic Reconciliation and Indigenous Entrepreneurship” Inclusive Growth Dialogue

In May 2023, we hosted an Inclusive Growth Dialogue on the topic of “economic reconciliation and Indigenous entrepreneurship.”

In May 2023, in partnership with the Leduc, Nisku and Wetaskiwin Regional Chamber of Commerce, we hosted an Inclusive Growth Dialogue on the topic of “economic reconciliation and Indigenous entrepreneurship” in Nisku, Alberta. The Inclusive Growth Dialogue opened with a lively panel discussion, featuring:

- Danielle Baptiste, Owner, Sage Beauty

- Darryl Addison, General Manager, SATO Canada

- Justin Bourque, President, Athabasca Indigenous Investments

- Reg Potts, Director, Partnerships and Indigenous Development, Backwoods Energy Services

- Wayne Di Lallo, Co-owner, DFW Career Services

After the panel, attendees heard from keynote speaker, Derek M. Bruno, Founder, SevGen Consulting, before breaking intro roundtable discussion groups to further explore what they had heard.

Here are some of the highlights from this important dialogue:

Economic Reconciliation

In the process of economic reconciliation, it is important to recognize the long-term effects of intergenerational trauma (such as the trauma endured in residential schools) on Indigenous communities and acknowledge its significance.

Economic reconciliation requires:

- Acknowledging existing challenges faced by Indigenous communities.

- Including Indigenous communities in economic activities.

- Recognizing treaty and aboriginal rights.

- Reframing economic systems to align with Indigenous cultural frameworks.

- Building partnerships between organizations and Indigenous communities for long-term benefits.

- Supporting Indigenous communities in terms of training and employment opportunities.

- Educating the public about Indigenous cultures, histories, and issues.

- Developing the northern regions of Canada.

- Investing in teachers, elder care programs, critical infrastructure, and community development.

Barriers Experienced by Indigenous Individuals and Entrepreneurs

Current laws, programs and policies fail to adequately address the specific barriers faced by Indigenous populations and even create additional obstacles that impede the building of sustainable economies and the accumulation of wealth.

A significant barrier faced by Indigenous people is the racism and discrimination that hinders their access to opportunities for advancement in various aspects of life, including education, employment, mentorship and financial services.

- Indigenous individuals often find themselves confined to minimum wage jobs, with limited chance of advancement or recognition of their potential.

- Indigenous entrepreneurs struggle to access capital as well as find mentors, quality education and training opportunities.

- Indigenous businesses regularly encounter difficulties in securing loans or financial assistance from banks and other institutions.

Employer Responsibility in Promoting Reconciliation

Employers can promote reconciliation by establishing culturally safe workplaces that recognize and accommodate the diverse and unique needs and backgrounds of Indigenous employees from various nations, reserves and communities. A culturally safe workplace must include employers actively addressing and eliminating abusive, discriminatory, and stereotyping behaviours. Employers can also help Indigenous employees get recognition, training and professional growth by creating opportunities for mentorship, modifying training programs to facilitate the hiring and inclusion of Indigenous individuals, and encouraging the development of ideas and initiatives that promote workplace collaboration.

The Role of Chambers of Commerce in Economic Reconciliation

There are many positive actions chambers of commerce can take in forwarding economic reconciliation and fostering long-term relationships with Indigenous businesses and communities, including:

- Participating in community events and promoting Indigenous-based events that reverse stereotypes.

- Hosting training, education and coaching opportunities and workshops.

- Highlighting the success stories of Indigenous communities’ leaders and sharing.

- Advocating for reducing barriers in accessing grants and funding for Indigenous entrepreneurs and businesses.

- Establishing partnerships with Friendship Centres and collaborating with Indigenous communities to create mastermind groups, share information, and build bridges of support.

It is critical that chambers adopt the reconciliation practices they promote by hiring Indigenous employees, increasing the representation of Indigenous groups on boards of directors and providing training and coaching for and about Indigenous communities and representation.

The Canadian Chamber of Commerce’s Commitment to Reconciliation

In the spirit of reconciliation, the Canadian Chamber of Commerce is committed to building respectful relationships that support Indigenous rights and improve business opportunities for Indigenous peoples. For a number of years, we have had the Canadian Chamber’s Indigenous Affairs Policy Committee, mandated to examine practices that reinforce relationships between Indigenous and non-Indigenous businesses and communities. The Committee advocates for legislation, regulation, and policy which support opportunities that grow Canada’s economy, respect the rights of Indigenous people, advance economic reconciliation and align with the United Nations Declaration on the Rights of Indigenous People.

About the Inclusive Growth Dialogues

In collaboration with the Canadian Chamber Network, we co-hosted five Inclusive Growth Dialogues in 2023. These dialogues provide an opportunity to identify challenges and opportunities relating to the role chambers can play in advancing economic reconciliation and fostering a more inclusive business community.

The What We Heard blogs for Halifax’s Inclusive Growth Dialogue on celebrating Nova Scotia’s Black economy, and Guelph and Coquitlam’s Inclusive Growth Dialogues on employment inclusion of people with visible and invisible disabilities are ready to read!

Related News

Connecting, Networking and Celebrating with the Canadian Chamber Network

#PatientsAreWaiting For a Canadian Health Data Ecosystem

3 Ways Inflation Is Blocking Your Path to Business Success

Blog /

Canadian Chamber appears before Standing Senate Committee on National Finance.

Canadian Chamber appears before Standing Senate Committee on National Finance.

On December 13, 2023, our Senior Vice President of Policy and Government Relations Matthew Holmes appeared before the Standing Senate Committee on National Finance to discuss C-56 "the Affordable Housing and Groceries Act."

On December 13, 2023, our Senior Vice President of Policy and Government Relations Matthew Holmes appeared before the Standing Senate Committee on National Finance to discuss C-56 “the Affordable Housing and Groceries Act.”

He welcomed amendments to the Excise Tax Act for housing supply but suggested adjustments for more support. Expressing concern, he urged careful consideration of the proposed amendments to the Competition Act in C-56, emphasizing the lack of transparency and potential risks. He questioned the urgency and effectiveness of C-56, advocating for robust consultation on consequential changes to the Competition Act.

The full remarks are available below.

The Canadian Chamber of Commerce is the country’s largest and most activated business network — representing over 400 chambers of commerce and boards of trade and more than 200,000 businesses of all sizes, from all sectors of the economy, in every part of the country.

We welcome amendments to the Excise Tax Act that should assist in the creation of much needed housing supply. That said, we have thoughts on simple adjustments to C-56 which would allow Canada to support the development of even more housing with the goal of restoring affordability for Canadian families.

We also commend the government’s efforts to ensure Canada’s competition laws are strong in order to promote competition and foster a thriving economy. While we support the need to enhance competition in Canada, we are very concerned by the manner in which changes have been repeatedly introduced as parts of omnibus implementation acts, ways and means motions, or peppered throughout other legislation such as C-56, without real consultation with the business community or academic experts in what is a very particular area of the law.

Therefore, we urge the Senate to approach the proposed amendments to the Competition Act in C-56 with careful consideration and prudence, and we ask the honourable members of this committee to consider what the urgency behind this bill is? Will these proposed changes to the Competition Act change prices in grocery stores in time for New Years celebrations? Perhaps they will by 2030, perhaps not.

In fact, they could have the opposite effect, even diminish competition, especially given some of the new litigious elements being considered under C-59. The reality is, we don’t know. And quite frankly, it’s almost absurd for me to be speaking to you today about a handful of changes in C-56, when other changes are being proposed in C-59, currently before the House. Intentionally or not, this approach lacks transparency and obfuscates what the actual plan for the future of Competition law in Canada is. And that approach ultimately makes it harder and riskier to do business in Canada.

I recognize the government is under considerable pressure to address the affordability crisis that Canadians face today. It needs to show action, and it needs to convince Canadians it has a plan. Unfortunately, in my view, C-56 does not actually do anything about the real problems being faced by Canadians: at best it is a vehicle for administrative changes. At worst, it broadens the mandate of the Competition Bureau to become something of a price regulator, which would be inappropriate and concerning. By rushing it through with a false sense of urgency, we risk making decisions that could have outsized impacts on businesses of all kinds, as well as consumers and the broader economy.

We maintain that changes to the Competition Act, which are consequential and lasting, should benefit from robust consultation with stakeholders. This has not been our experience with C-56, the changes that preceded it following Budget 2022, nor, to date, with the changes proposed in C-59.

Related News

Canadian Chamber Appears before Standing Committee on Public Safety and National Security

What We Heard: “Economic Reconciliation and Indigenous Entrepreneurship” Inclusive Growth Dialogue

MDR: What Is It? And Why Your Business Needs This Cyber Security Protection?

Blog /

Top Hiring and Training Government Funding Programs

Top Hiring and Training Government Funding Programs

This blog was provided by Mentor Works, a Ryan Company.

This blog was provided by Mentor Works, a Ryan Company.

An organization’s strength lies in its team. It is highly important that small businesses in Canada are aware that there are government grants available that can be used to offset the costs of onboarding new employees and/or providing training to both existing and new employees. In addition to increasing and enhancing an organization’s talent pool, these grants may also connect applicants with meaningful employment opportunities.

The purpose of this blog is to provide you with information on hiring and training grants that are currently available across Canada to assist Small-Medium-Enterprise (SME) sized businesses in obtaining and supporting employees.

Listed below are government funding programs to assist organizations in hiring or retraining staff, improving their effectiveness and upskilling their staff in new areas such as advanced technologies. Depending on when you read this article, some of the funding programs listed below may or may not be open at the time. Find out what programs are currently available for intake by visiting our Hiring & Training Page.

Canadian Small Business Grants for Hiring and Training

1. Yves Landry Foundation Funding for Training Via the Government of Canada

The Yves Landry Foundation Funding for Training Via the Government of Canada assists organizations in adapting to new technologies, processes, or procedures, as well as any changes within the company. By supporting innovation and retooling, new lines of production can be developed for increased productivity. Through this program, training must directly contribute to improving domestic supply chains or enhancing competitiveness, such as expanding domestic markets.

- Funding Amount: Successful applicants may access up to 25–50% of costs to a maximum of $100,000 per application.

- Applicant Eligibility: Ontario manufacturers with 10–1000 employees may be eligible. Read more about eligibility in our recent blog post.

2. Mitacs Accelerate Program

The Mitacs Accelerate program pairs small businesses with talented candidates who have earned a Master’s, PhD or postdoctoral fellowship (PDF) in order to overcome innovation challenges. To support the challenges facing small businesses, interns must conduct research and develop tools, models, technologies or solutions.

- Funding Amount: Up to $15,000 is provided for every four- to six-month internship, with a contribution of $7,500 from the partnering organization. If the business leverages 6+ internship periods from 3+ interns, additional funding support is available through the cluster stream. Funding includes intern stipend and research costs.

- Applicant Eligibility: The program is open to Canadian corporations, for-profit businesses, and selected non-profit organizations. There is support for all industries and sectors, however innovation research and development projects are given priority.

3. IRAP Youth Employment Program (YEP)

The IRAP Youth Employment Program (YEP) program is designed to assist employers in hiring and training young Canadian post-secondary graduates. A graduate may be selected for funding in a variety of areas, such as business development, technical advancement, customer service or administration. For assistance in getting started, businesses are encouraged to contact the Industrial Research Assistance Program (IRAP) of the National Research Council (NRC).

- Funding Amount: Up to $30,000 per graduate (up to two graduates) for a period of 6-12 months.

- Applicant Eligibility: The applicant must be an incorporated, financially stable, Canadian business with 1–500 employees. It is the applicant’s responsibility to recruit graduates before applying. A candidate must be between the ages of 15 and 30.

4. Canada Job Grant (CJG)

The Canada Job Grant (CJG) program reduces the cost of third-party skills training for new and existing employees through government funding. Launched in 2014, the Canada Job Grant provides upwards of $194M each year to help new and existing employees learn new skills and become more valuable to their employers. Each province and territory except Québec has a separate Canada Job Grant (CJG) stream, with varying funding amounts, eligibility criteria, and deadlines. Some streams are open all year, like the Canada-Ontario Job Grant (COJG), while others are open only periodically.

- Funding Amount: Grants are provided to eligible businesses for employee training projects up to 50-100%, depending on the province.

- Applicant Eligibility: The eligibility criteria for applicants vary by province; there are streams for Ontario, Alberta, British Columbia, Manitoba, Newfoundland, Saskatchewan, New Brunswick, Nova Scotia and Prince Edward Island. Details about streams can be found on the main page.

Learn More About Government Funding Opportunities

Listed in this blog are Canadian government funding programs for hiring and training small and medium-sized businesses. Our free Canadian Startup Business Resources are available if your business does not meet the requirements of any particular program.

If your business is looking to get started on accessing grants for hiring and training, contact the Mentor Works, a Ryan Company team to learn which grant program may be suitable for your business and subscribe to our Weekly Funding Newsletter to keep up with the latest government funding news.

For more information on the programs listed in this blog, please register for our upcoming webinars, where our team discusses high level details regarding government funding opportunities.

Related News

Canadian Chamber of Commerce Testifies on Port Strike Impact and Supply Chain Stability

What We Heard at The State of Small Businesses in Canada Virtual Event

Canadian Chamber to House of Commons Standing Committee on Transport, Infrastructure and Communities: We need to see long term investment in Canada’s trade infrastructure.

Blog /

Nice Guys Finish First: Empowering Canadian Business with Negotiation Strategies

Nice Guys Finish First: Empowering Canadian Business with Negotiation Strategies

This blog was provided by Shapiro Negotiations Institute (SNI).

This blog was provided by Shapiro Negotiations Institute (SNI).

Canadians are known for their niceness, a trait that has become a hallmark of their national identity. This characteristic provides a unique perspective on negotiation, influence and interpersonal relations. It aligns well with the ‘power of nice’ ethos of the Shapiro Negotiations Institute (SNI), the premier global leader in enabling organizations to empower their sales and procurement teams with strategic negotiation and influencing skills.

Though the name of the game in negotiating is to obtain desired results, how you get them is just as important. While many dealmakers play hardball by assuming a winner-take-all, scorched earth attitude, they do so at the risk of alienating the other party and losing out on future opportunities. SNI instead believes in the ‘power of nice’ and this is at the heart of SNI’s process and success.

While based in Baltimore in the United States, SNI is committed to the success of Canadian businesses both at home and on the global stage. It strives to empower Canadian companies, from start-ups, small businesses to multinational organizations, by improving their negotiating abilities. This bridges a gap in a market where world-class training is often unavailable due to Canada’s smaller size. To support this endeavor, SNI partners with various organizations to raise awareness and access to such training for Canadian professionals. These organizations include the Canadian Chamber of Commerce, the Forum for International Trade Training, the Association of Canadian Advertisers, TradeReady.ca and more.

SNI’s focus on Canadian firms is diverse, ranging from enterprises headquartered in Canada such as TD, MNP and the Toronto Blue Jays to various international organizations aiming to expand their operations into Canada.

Andres Lares, a proud Canadian, leads SNI. He is passionate about supporting entrepreneurs and businesses from his country. Lares has contributed to and been featured in publications such as Harvard Business Review, Forbes, Yahoo, NBC, CNBC and more. In a recent article on tradeready.ca, he imparts invaluable insights for Canadians aiming to launch or expand their work internationally. The article emphasizes that negotiation is a crucial skill in business, especially for establishing partnerships and acquiring clients. Mastering this skill is vital for effective business conduct. However, international negotiation demands a higher level of these skills, as minor cultural misunderstandings can jeopardize entire deals. The piece offers advice on avoiding such mistakes and preparing effectively for international negotiations to ensure successful business transactions.

Andres Lares is the Managing Partner at SNI, where he is responsible for the strategy and operations of the sales, negotiation, and influence training firm. He has led the development of SNI’s award-winning interactive online negotiation training, mobile applications, and VR applications, and has multiple patents pending.

Related News

2022 Q3 Canadian Survey on Business Conditions: Inflation is the top issue. Labour pains intensifying, but price pressures and supply chains issues are improving

The Canadian Chamber Appears Before Senate National Finance Committee on Bill C-59

Canadian GDP for August: It’s not all bad news

Blog /

Five Ways to Protect Your Business Against an Evolving Threat Landscape

Five Ways to Protect Your Business Against an Evolving Threat Landscape

This blog was provided by Max Shier, Vice President, Chief Information Security Officer, Optiv. Securing your business against rapidly advancing...

This blog was provided by Max Shier, Vice President, Chief Information Security Officer, Optiv.

Securing your business against rapidly advancing cyber threats is more important than ever – and it starts with reinforcing basic cyber hygiene. Most data breaches are still due to insider threats, caused by individuals with the best of intentions who still inadvertently fall for phishing and social engineering tactics, costing their organizations substantial fees and losses.

Let’s get back to basics and continue to reinforce behaviors that will help protect your business from the inside.

Use Strong Passwords and Password Managers

It may seem glaringly obvious, however, strong passwords are fundamental to securing online activity. Update passwords regularly and use a strong, unique password for every professional and personal account. For larger organizations, consider holding a training workshop on password development with features to implement and avoid.

Here are some password best practices:

- Use complex passwords with a minimum of 12 characters that require lowercase and uppercase characters, numbers and special symbols

- Incorporate password blacklisting and audits

- Implement password vaulting for privileged accounts

- Consider using password managers for personal accounts

Enable Multi-Factor Authentication

Build on your strong password with multi-factor authentication (MFA) for enhanced security. MFA requires users to present at least two pieces of evidence to prove their identity, making it much harder for cybercriminals to gain unauthorized access to accounts even if they have compromised a password.

Popular MFA methods include one-time SMS passcodes, hard tokens, security questions and push-to-accept notifications with number matching or other user inputs.

Update Software

Threat actors will always go the route of least resistance, and it does not get much easier than vulnerabilities in software and applications. Turn on automatic updates when possible or update software and security patches as soon as they are available. As technology evolves, so do hacking techniques, making outdated software more susceptible to exploitation.

Additionally, compliance with industry standards and regulations often mandates up-to-date software, safeguarding not only sensitive data but also your company’s reputation.

Recognize and Report Phishing

Phishing scams continue to be a worldwide threat to organizations. More than a third of surveyed respondents took at least one action in 2022 that put themselves or their organization at risk.

Companies can empower their employees to recognize and report phishing scams by providing comprehensive cybersecurity training, similar to the password workshop mentioned earlier. Encouraging a culture of skepticism can be beneficial, prompting employees to verify unexpected emails or links before taking any action. Thus, it is also important to establish a clear and user-friendly reporting system that encourages teams to promptly report any suspicious emails or activities they encounter.

Limit Your Digital Footprint

Anywhere you go online, you leave a digital footprint. Cybercriminals can use this footprint to create more effective social engineering schemes. Employees should be encouraged to regularly review and adjust their privacy settings on social platforms, like LinkedIn, to control visibility of any personal details.

When traveling for work or working remotely in a public setting, urge the use of an enterprise Virtual Private Network (VPN) solution to protect any sensitive information on the device/devices.

These five tactics are all part of a greater strategy that can foster a security-first culture. By investing in a comprehensive cybersecurity plan, organizations not only protect their sensitive data and operations, but also fortify their reputation and resilience.

Related News

Nice Guys Finish First: Empowering Canadian Business with Negotiation Strategies

Top Hiring and Training Government Funding Programs