Blog /

Policy Matters: Investing in the Next Generation of Skills and Technology for the Future of Mining

Policy Matters: Investing in the Next Generation of Skills and Technology for the Future of Mining

Now is the time to invest in Canada’s research ecosystem to support the talent and technology needs of all Canada’s emerging sectors, especially critical minerals.

Critical minerals are a group of 31 minerals identified by the government of Canada as playing an essential role in priority supply chains and essential economic green growth. These critical minerals represent significant economic potential in the billions of dollars, greater energy independence for Canada, and opportunities for reconciliation with Indigenous communities upon whose land many of these projects will take place.

But if Canada is to realize its vast potential and become a global leader in critical minerals, we have to start investing in our future now. While the Government of Canada has outlined an ambitious Critical Minerals Strategy, they have not laid out a focused plan to develop the top tier research talent we need to be successful. Now is the time to invest in Canada’s research ecosystem to support the talent and technology needs of all Canada’s emerging sectors, especially critical minerals.

Why Research and Development Matters

Investing in research and development is integral to equipping, attracting, and retaining talent and driving the innovation that allows Canada to stay competitive in a global market. Without sufficient investment in research and development, companies and countries face economic decline.

Unfortunately, this is what’s happening in Canada. In Q3 of 2023, GDP fell by 1.1% annualized. Instead of the expected post-pandemic productivity increase, our productivity has dropped to 2016 levels. And out of our fellow G7 countries — five of which outrank us in productivity — we are last in terms of percentage of GDP spent on research and development.

If Canada is to remain economically prosperous — and there’s no reason we shouldn’t given our natural wealth that extends beyond critical minerals — we need a research and development ecosystem that supports the talent and technology that can respond to urgent and emerging issues and areas of opportunity for economic growth.

The Feedback Loop Between Talent and Technology

As Canada is experiencing a labour shortage across all sectors, the competition for highly skilled talent is fierce.

In the mining industry, Canada’s leading companies are trying — and struggling — to recruit for jobs that require advanced skillsets (like chemists, engineers, and geologists) at the same time as industries like aerospace and automotive. This makes the need for sustained research investment even more essential as there is no surplus of highly qualified talent sitting around waiting.

But if we want Canadians to fill these critical roles, we need to build our domestic research capacity by recruiting the top faculty from around the world to train the next generation in our universities — which is exactly what our competitors are doing.

Canada’s wellbeing, prosperity, and global competitiveness will hinge ever more on how well we can nurture and empower our talented minds.

Report of the Advisory Panel on the Federal Research Support System

To prevent falling any further behind, Canada needs to fund robust opportunities for graduate and post-doctoral researchers through scientific grants and scholarships. Even if future industry professionals only have an undergraduate degree, it is still attained by training with faculty whose research is funded by grants.

By increasing support for research talent through grants and scholarships, the government can make it a more attractive proposition to get a master’s degree or doctorate in an area that will ultimately support the mining sector. Additionally, government should provide investment for graduate students to connect and network within the mining industry to better plan their studies around their workforce goals.

University-Led Innovation

Canada is a leader in mining technology, but to maintain that lead, we need university-driven innovation — like what’s happening at McMaster University.

McMaster is pioneering research that has the potential to make mining more sustainable and productive while also providing benefit to local communities. The University is a leader in vehicle electrification as well as vehicle and equipment automatization, the combination of which will lend itself to mining companies, allowing them to take lucrative risks underground without putting miners in harm’s way. This important work is made possible through research and development grants.

McMaster has also partnered with a supplier to develop a private 5G network, which has potential to connect remote mines to the outside world and give them the ability to distribute large amounts of data quickly, increasing the safety of people and the environment. The added benefit of this kind of high-speed connectivity is that it’s not limited to the mine but can be extended to local communities.

But new technology will require the people who have the skills to deploy, fix and manage it effectively. As it is the graduate and postdoctoral researchers who will design and deploy the technology that will drive innovation in the largely fragmented mining industry, Canada can spark the sector’s green transition and open up careers that rival competing sectors by creating more opportunities for advanced research.

The Current State of Canada’s Research and Development Ecosystem

In late 2022, the Government convened an Advisory Panel on the Federal Research Support System to provide recommendations on how to modernize the government’s support for academic research, with a stated goal of better supporting the full spectrum of talent Canada needs.

The panel’s report, released in 2023, found that “A coordinated and agile federal support system that is equipped to respond to the needs of the modern research enterprise as well as emerging government priorities would provide great benefits to all Canadians. That said, success in science, research and innovation that is competitive on the global stage hinges first and foremost on being able to effectively support and retain Canada’s top research talent and build a research enterprise that fosters discovery of new knowledge through investigator-initiated research.”

The report also concluded that the current research and development ecosystem lacks sufficient coordination making it difficult for our science and research community to work toward common strategic objectives and for us to stay on par with our competitors, who are investing heavily in their own research and development.

Looking Ahead

Canada is at cross-roads. It’s apparent that we can’t reach our full potential without new technology and a skilled and highly educated labour force, both of which depend on a robust and specialized research and development strategy. Investing in and strengthening the federal research support system matters immensely for Canada’s critical minerals sector.

To transform our critical minerals and larger mining industry into a global powerhouse, one that adds value to our economy, we have to respond to the investments and innovation happening in other countries. If we don’t get moving, we’re going to be left behind.

This Policy Matters was written in collaboration with McMaster University and Universities Canada, members of the Canadian Chamber’s Critical Minerals Council.

Related News

A Better Life for All: Read the 2023 Annual Report

Ensuring Equitable Access to Adult Vaccines across Canada

Level Up Your Organization’s Cloud Security with These Five Actions

Blog /

What We Heard: “Employment Inclusion of People with Visible and Invisible Disabilities” Inclusive Growth Dialogue

What We Heard: “Employment Inclusion of People with Visible and Invisible Disabilities” Inclusive Growth Dialogue

With diversity, equity and inclusion (DEI) efforts often focusing on race, gender, and ethnicity, it's critical to expand these discussions to also include accessibility and people with visible and invisible disabilities, including neurodivergence.

In October (Disability Employment Awareness Month), we hosted two Inclusive Growth Dialogues on the topic of “employment inclusion of people with visible and invisible disabilities”.

With diversity, equity and inclusion (DEI) efforts often focusing on race, gender, and ethnicity, it’s critical to expand these discussions to also include accessibility and people with visible and invisible disabilities, like neurodivergence.

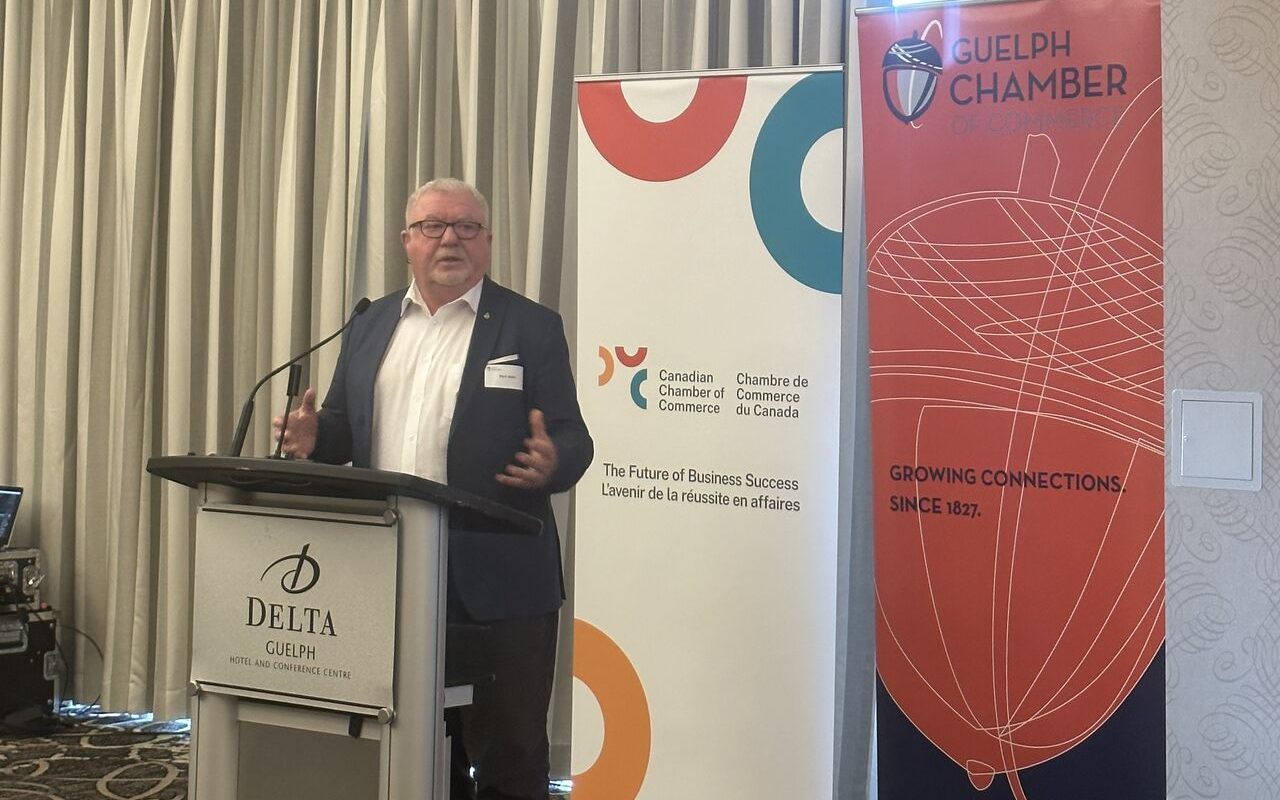

The first dialogue was held on October 4, in Guelph, Ont., in partnership with the Guelph Chamber of Commerce, and the second on October 5, in Coquitlam, B.C., in partnership with the Tri-Cities Chamber of Commerce.

Guelph Inclusive Growth Dialogue:

Keynote speaker: Mark Wafer, former President and CEO of Abilities Canada and disability inclusion advocate

Panellists:

- Nikki Gore, Director, Marketing and Business Development at Auticon

- Mike Greer, Senior Specialist, Engagement and Accounts, Accessibility Certification at the Rick Hansen Foundation

- Cathy Katrib-Reyes, Senior Manager with the Equity and Inclusion Department at the Canadian Broadcasting Corporation (CBC)

Coquitlam Inclusive Growth Dialogue:

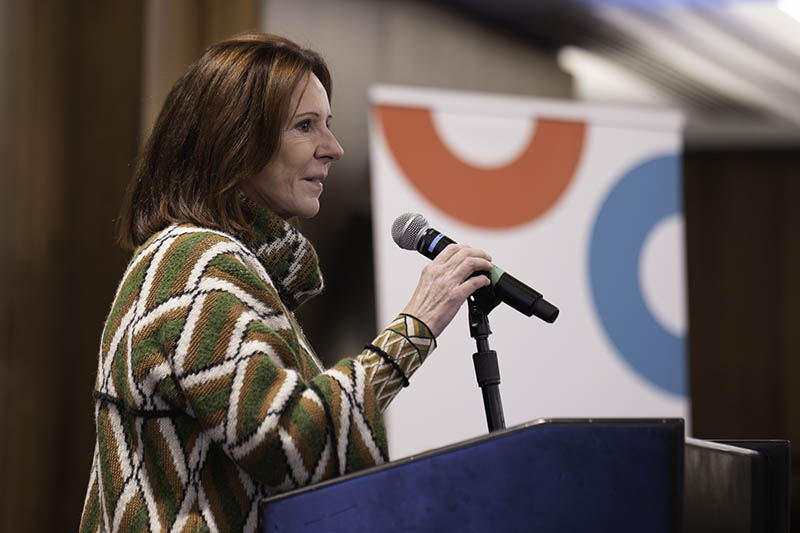

Opening remarks: Stephanie Cadieux, Chief Accessibility Officer, Government of Canada

Keynote speaker: Marco Pasqua, award-winning entrepreneur, and accessibility consultant

Panellists:

- Lisa Beecroft, Co-Owner of Gabi & Jules

- Yat Li, Senior Accessibility Consultant of the President’s Group

- Brad Liski, CEO and Co-Founder of Tru Earth

- Carol Simpson, President and CEO of Focus Professional Services

- Nate Toevs, Employer Outreach Developer at the Neil Squire Society

Here are some of the highlights from these important dialogues:

Building Trust

As trust significantly affects whether individuals disclose their disabilities in professional settings, it is critical that employers cultivate a workplace culture of understanding and mutual support. This can look like encouraging ongoing DEI and accessibility learning, complying with accessibility legislation and regulation, normalizing conversations around disabilities (including neurodivergence) and hiring dedicated staff who support the organization’s accessibility and inclusion initiatives.

Shifting the Workplace Mindset

Though a lot has been done to counter the false narrative that people with disabilities do not contribute to the economy, more is needed. Organizations must take a definitive stand on inclusion and accessibility — and they don’t need to develop a flawless plan before they begin. A mindset shift in the workplace starts from the top down, with executives following the guidance of the disabilities community and demonstrating a commitment to accessibility and DEI through conversation, education and accommodation.

Local chambers can encourage businesses to reframe their perspectives on individuals with disabilities by providing educational resources and training programs that address and correct misconceptions that form barriers to employment.

Recruitment and Hiring

Businesses should work towards normalizing the presence of people with visible and invisible disabilities in the workplace, which will likely involve updating hiring practices to prioritize equity and inclusion. For instance, being upfront about their willingness to provide accommodations rather than waiting for the applicant to disclose their need first. Organizations do not need to wait until their environment is accessible to hire people with disabilities but can recruit first and then provide accommodations based on the new hire’s needs. Local chambers of commerce can encourage inclusive hiring practices by applauding businesses that demonstrate effort and commitment to inclusion through awards and public recognition.

Accommodations in the Workplace

Accessible workplaces have a higher employee retention rate, yet many people wrongly assume that the cost of accommodations is too high. However, simple changes like desk heights or lighting can go a long way. Other examples of accommodations include:

- Using tools like transcription services during meetings to ensure that everyone has equal access to information.

- Reevaluating workplace documents and forms to ensure they are straightforward.

- Adopting flexible workplace policies around work hours, work environment and job duties to accommodate different needs.

- Encouraging clear and inclusive communication by considering the pace of speech and avoiding idioms that might be confusing.

Understanding that everyone can be held to the same expectations, but may need different accommodations to meet those expectations, is fundamental to the development of more accessible and neuroinclusive workplaces that see accommodations as the norm rather than an exception.

The Role of Chambers of Commerce

The role of chambers of commerce as connectors and in promoting the inclusion of people with disabilities in the economy is pivotal. Chambers can facilitate conversations, implement training programs for employees and employers on working with individuals with disabilities, encourage big businesses to reflect on current practices and engage in education, initiate regular networking events and spaces that create opportunities for diverse voices to be part of key decision-making processes, and amplify the services available to both individuals with disabilities and organizations seeking to hire them. Chambers can also set tangible accessibility and inclusion goals and hold entities accountable for meeting them. But most importantly, chambers themselves must embody the same practices they encourage businesses to adopt.

About the Inclusive Growth Dialogues

At the Canadian Chamber of Commerce, we believe that diversity, equity and inclusion (DEI) are essential to fairness of opportunity, competitiveness of business, and our nation’s economic growth and prosperity. Our Inclusive Growth initiative advocates for a business environment that works for everyone, paying particular attention to groups of the population that historically and presently face barriers, preventing them from fully participating and thriving in our economy.

Through our Inclusive Growth initiative, we aim to mobilize the knowledge and resources of the Canadian Chamber Network to be a strong agent for change. In collaboration with the Canadian Chamber Network, we co-hosted five Inclusive Growth Dialogues in 2023. These dialogues provide an opportunity to identify challenges and opportunities relating to the role chambers can play in advancing economic reconciliation and fostering a more inclusive business community.

A What We Heard blog will be produced for all five Inclusive Growth Dialogues, so be sure to come back for those insights. The Halifax Inclusive Growth Dialogue’s What We Heard blog is available now.

Related News

Protect Your Business From Cybercrime

Guarding Against Business Email Compromise (BEC): Protecting Your Business in an Evolving Threat Landscape

What We Heard at our #BHM2024 Elevate & Celebrate Black Excellence Event

Blog /

Guarding Against Business Email Compromise (BEC): Protecting Your Business in an Evolving Threat Landscape

Guarding Against Business Email Compromise (BEC): Protecting Your Business in an Evolving Threat Landscape

This blog was provided by John Hewie, National Security Officer, Microsoft Canada.

This blog was provided by John Hewie, National Security Officer, Microsoft Canada.

Have you ever received a suspicious email from your colleague asking for urgent help – but something about the tone or language is not quite right? Or clicked on an invoice from a repair company that seems unfamiliar and claims to be overdue? If so, you’re likely one of the hundreds of thousands of people and organizations targeted daily by Business Email Compromise (BEC) attacks.

While ransomware often gets the most of the attention in the news, Business Email Compromise contributes up to 100 times more in financial losses vs ransomware payments according to the FBI 2022 Internet Crime Report. Individuals and companies of any size using email for communication could be at risk for BEC. If a business email compromise attack is successful, your business could lose hundreds of thousands of dollars, face widespread identity theft or accidentally leak confidential data like intellectual property or personal information. In 2020, the Canadian Anti-Fraud Centre (CAFC) recorded a total of nearly $30 million in reported losses due to BEC scams, while the first six months of 2021 alone saw over $26 million in reported losses.

Find out how this growing threat is impacting Canadian businesses and what you can do to protect your assets.

Understanding Business Email Compromise

Business email compromise (BEC) is a type of cybercrime where the scammer uses email to trick someone into sending money or divulging confidential company information. The culprit poses as a trusted figure, like a boss or vendor, then asks for a fake bill to be paid or for sensitive data they can use in another scam.

With the increase of hybrid work environments in recent years, communicating and collaborating primarily by email has become the norm, leaving more organizations vulnerable to BEC attacks. In the past year, the frequency of BEC attacks has skyrocketed globally. Between April 2022 and April 2023, 35 million business email compromise attempts were detected and investigated by Microsoft Threat Intelligence, for an average of 156,000 daily attempts.

As new technologies and innovations are introduced, threat actors work quickly to adapt their techniques and evolve their use of technology to carry out more sophisticated and costly BEC attacks. The success of these attacks is largely due to the growing targeting of organizations of all sizes, including small businesses, the exploitation of trusted business relationships and development of more specialized skills by the threat actors.

Common Business Email Compromise Attacks

Here are the most common types of compromised email.

Data theft: Sometimes cybercriminals start by targeting the HR department and stealing company information, like a schedule or personal phone number. Then it’s easier to carry out one of the other BEC scams and make it seem more believable.

False invoice scheme: Posing as a legitimate vendor your company works with, the scammer emails a fake bill—often closely resembling a real one. The account number might only be one digit off. Or they may ask you to pay a different bank, claiming your bank is being audited.

CEO fraud: Scammers either spoof or hack into a CEO’s email account, then email employees instructions to make a purchase or send money via wire transfer. They might even ask an employee to purchase gift cards, then request photos of serial numbers. Gift cards don’t offer the same protections as other payment methods, like credit or debit cards – once the scammer has used up the funds, there is no getting it back. Pausing to verify urgent requests from a boss by reaching out with a trusted email address or phone number is a simple way to foil these scams.

Account compromise: Scammers use phishing or malware to get access to a finance employee’s email account, such as an accounts receivable manager. Then the scammer emails the company’s suppliers fake invoices that request payment to a fraudulent bank account.

Tips to Prevent Business Email Compromise

Follow these five best practices to stop business email compromise:

Use a secure email solution: Email apps like Office 365 automatically flag and delete suspicious emails or alert you that the sender isn’t verified. Then you can block certain senders and report emails as spam. Defender for Office 365 adds even more BEC prevention features like advanced phishing protection and suspicious forwarding detection.

Set up multifactor authentication (MFA): Make your email harder to compromise by turning on multifactor authentication, which requires a code, PIN, or fingerprint to log in as well as your password.

Teach employees to spot warning signs: Make sure everyone knows how to spot phishing links, a domain and email address mismatch, and other red flags. Simulate a BEC scam so people recognize one when it happens.

Set security defaults: Administrators can tighten security requirements across the entire organization by requiring everyone to use MFA, challenging new or risky access with authentication and forcing password resets if info is leaked.

Use email authentication tools: Make your email harder to spoof by authenticating senders using Sender Policy Framework (SPF), DomainKeys Identified Mail (DKIM), and Domain-based Message Authentication, Reporting, and Conformance (DMARC).

Reduce your attack surface: Ensure email forwarding and use of legacy protocols like POP/IMAP is disabled at the organization level.

Adopt a secure payment platform: Consider switching from emailed invoices to a system specifically designed to authenticate payments.

If you’re organization has fallen victim to BEC, you’re not alone. Contact your local police as soon as possible. The Royal Canadian Mounted Police guidance on BEC and reporting is here.

The ever-evolving cyber threat landscape presents growing challenges to all businesses. By understanding the evolving nature of BEC and taking proactive measures, you can protect your business from these sophisticated threats. Joining forces in the fight against cybercrime is essential – it’s a collective responsibility to improve cyber resilience and ensure the safety of your business and its data. To boost your cybersecurity knowledge visit Microsoft Security 101 for free training resources.

Related News

Driving Net-Zero Success: Highlights from the Ready to Compete Report

Highlights from our Executive Summit Series 2022

Critical Minerals Can Create Transformative Economic Opportunities for Indigenous Communities — If We Do It Right

Blog /

Canadian Chamber of Commerce Testifies on Bill S-244

Canadian Chamber of Commerce Testifies on Bill S-244

An Act to amend the Department of Employment and Social Development Act and the Employment Insurance Act to establish the Employment Insurance Council.

On Thursday, November 30, our Senior Director, Future of Work, Diana Palmerin-Velasco testified in front of a Standing Senate Committee on Bill S-244, an Act to amend the Department of Employment and Social Development Act and the Employment Insurance Act to establish the Employment Insurance Council. We support the establishment of the Employment Insurance Council to strengthen the work that the Employment Insurance Commission has done to facilitate business and labour input into employment policy in Canada.

WATCH THE TESTIMONY AND READ THE FULL REMARKS BY DIANA PALMERIN-VALESCO BELOW.

Good morning Madam Chair, Deputy Chair and committee members, and thank you for the opportunity to appear today as part of your examination of Bill S-244, an Act to amend the Department of Employment and Social Development Act and the Employment Insurance Act to establish the Employment Insurance Council.

I’m Diana Palmerin Velasco, Senior Director, Future of Work at the Canadian Chamber of Commerce. The Canadian Chamber of Commerce represents some 200,000 Canadian businesses, through more than 450 local, provincial and territorial chambers, plus 100 association members.

The Canadian Chamber has played a leading role in the discussions resulting in this Bill and has officially endorsed it. Our President and CEO, The Honourable Perrin Beatty, has stated that:

“With the creation of an employment insurance advisory council, Senator Bellemare’s Bill S-244 will enshrine a true and meaningful tripartite approach between business, labour and government. This will ensure that the Employment Insurance program is sustainable, responsive, non-partisan, inclusive and relevant for the current and future generation of Canadian employers and employees”.

The Canadian economy faces multiple challenges, and the world of work is rapidly changing. In the context of the post-pandemic recovery, an aging population, skills shortages and transition to the digital and green economy, we need to create conditions for business, labour and government to work together as true partners. To achieve this, productive dialogue and exchange of ideas and information among partners must continuously take place through an ongoing process of engagement designed to build mutual understanding.

One of the main purposes of Bill S-244 is to enhance social dialogue within the Canada Employment Insurance Commission. Since 1990, employers and workers fund the EI system in its entirety. As a matter of principle, it’s only fair that business and labour have access to a tripartite institutionalized structure through the establishment of the Employment Insurance Council. This Council would allow business and labour to provide advice and agree on mutually acceptable and beneficial recommendations regarding labour market policies. Particularly, as they relate to employment insurance and skills development.

The International Labour Organization (ILO) defines social dialogue as “a tripartite process where all types of negotiation, consultation, or simply exchange of information between, or among, representatives of governments, employers and workers, on issues of common interest relating to economic and social policy take place”.

Unlike consultation, social dialogue is not a short lived, unilateral process. It is a proven governance tool that has worked well in several countries and across several international organizations. Successful social dialogue structures and processes have proven potential to resolve important economic and social issues.

The Canadian Chamber of Commerce supports the establishment of the Employment Insurance Council to strengthen the work that for almost 20 years, the Employment Insurance Commission has done to facilitate business and labour input into employment policy in Canada. Employers are invested in the viability of the EI program and as such we want to be true partners in finding and implementing solutions to ensure a well-functioning system that meets the needs and expectations of Canadians.

Thank you for providing me with this opportunity to appear, and I would be pleased to take any questions you might have.

Related News

Accelerating Progress on Gender Equality

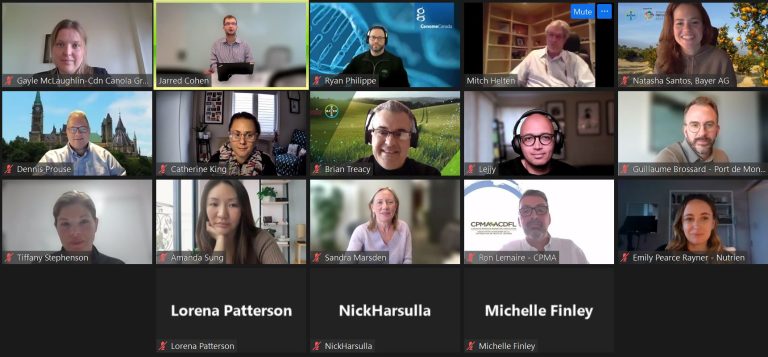

Canadian Chamber’s Food Supply Council meets with Business@OECD Food and Agriculture Committee Vice-Chair Natasha Santos

Policy Matters: Canadian Business Is an Integral Part of the Economic Solution

Blog /

Protecting the Decision-Makers

Protecting the Decision-Makers

The role of directors’ and officers’ insurance in the legalized cannabis industry

This blog was provided by David Kerr, National Practice Leader, Life Sciences at Gallagher.

Directors and key managers are responsibility for making key decisions that shape the trajectory of the organization they serve. In light of this profound responsibility, safeguarding decision-makers from a legal perspective is crucial. This emphasis on legal safeguards parallels the comprehensive protection afforded to the entire business entity.

Few industries are as fast moving as the cannabis sector. Companies seek to balance product development and innovation with the need to operate in a challenging regulatory landscape. In a complex risk environment, cannabis companies and their senior executives must be aware of their potential liabilities.

Decisions made by directors and senior officers can help drive innovation and growth within the sector, as well as recognition for the company and its work. Senior executives are judged by their decisions and could be held personally responsible for the consequences. As a result, many companies are now ensuring that they have the most appropriate insurance for their needs, including directors’ and officers’ insurance.

What is Directors’ and Officers’ Insurance?

Directors’ and officers’ (D&O) liability insurance indemnifies management and the board of directors for claims, which may arise from the decisions and actions taken within the scope of their duties. Common claims include:

- Breach of trust

- Breach of duty

- Misleading statements

- Error

- Wrongful trading

- Neglect

Claims can be made by employees, shareholders, investors, competitors, regulators or third parties. Directors’ and officers’ insurance can cover expenses associated with defending such proceedings, including compensation costs. This insurance coverage not only serves to safeguard individuals but also plays a crucial role in protecting the company itself.

What Protection Does D&O Insurance Afford?

Protection of directors and officers

D&O insurance covers individuals—current, future and past directors, as well as nonexecutive directors, subsidiaries and officers of a company. It is designed to protect their personal assets in the event of a claim against them relating to their decisions and actions taken within the scope of their duties. It can also protect spouses who may be brought into a lawsuit because of shared property interests or transferred property.

Directors and officers can personally face significant fines and disqualification periods, and without cover in place, would be responsible for the financial implications. Without D&O insurance, directors are subject to investigation, even years after leaving the company.

Protection and benefits for the company

As well as covering the personal liability of company directors and officers, D&O policies can also provide company reimbursement in the event that the company has paid a claim on behalf of its directors and officers. This can prove to be vital in protecting the balance sheet of the company.

In addition, having a solid directors and officers liability insurance policy can be instrumental in attracting potential board members to a company. Because of the increased risk to their personal assets, directors and officers are increasingly looking to evaluate their company’s D&O insurance, seeking assurances that their coverage is as broad as possible with limits sufficient to protect them.

D&O Risk Exposures in the Cannabis Industry

Navigating the complex risks of this sector can be challenging for companies and their directors. Key areas for concern that could lead to D&O claims include:

- Company insolvency

- Regulatory investigations

- Shareholder/investor action

- Accusations of bribery/corruption

- Defamation

- Harassment/discrimination

- Intellectual property

- Mergers and acquisitions

Benefits of Leveraging the Assistance of an Insurance Broker

Utilizing the expertise of a seasoned and well-informed insurance broker is essential when negotiating and securing directors’ and officers’ coverage, especially in the intricate cannabis industry. Engaging the support of an experienced broker in this field will increase the likelihood of obtaining fitting coverage. Brokers will adeptly negotiate, on your behalf, suitable coverage terms and pricing, taking into account the nuances of the current D&O market dynamics. Serving as advocates for their clients, brokers can also assist in navigating through the claims process.

About the Author

David Kerr, BComm, CIP, CRM

National Practice Leader, Life Sciences

https://www.ajg.com/ca/industries/healthcare-and-life-sciences-insurance/

Related News

Canadian Chamber’s Western Executive Council Meets with Prime Minister Justin Trudeau

Canadian Chamber urges Parliamentarians to avoid unintended consequences of Bill C-228 at House Finance Committee

Canadian Chamber of Commerce Testifies on Bill C-27

Blog /

What We Heard: “Celebrating Nova Scotia’s Black Economy” Inclusive Growth Dialogue

What We Heard: “Celebrating Nova Scotia’s Black Economy” Inclusive Growth Dialogue

Through our Inclusive Growth initiative, we aim to mobilize the knowledge and resources of the Canadian Chamber Network to be a strong agent for change. In collaboration with the Canadian Chamber Network, we co-hosted five Inclusive Growth Dialogues in 2023.

At the Canadian Chamber of Commerce, we believe that diversity, equity and inclusion (DEI) are essential to fairness of opportunity, competitiveness of business, and our nation’s economic growth and prosperity. Our Inclusive Growth initiative advocates for a business environment that works for everyone, paying particular attention to groups of the population that historically and presently face barriers, preventing them from fully participating and thriving in our economy.

Through our Inclusive Growth initiative, we aim to mobilize the knowledge and resources of the Canadian Chamber Network to be a strong agent for change. In collaboration with the Canadian Chamber Network, we co-hosted five Inclusive Growth Dialogues in 2023. These dialogues provide an opportunity to identify challenges and opportunities relating to the role chambers can play in advancing economic reconciliation and fostering a more inclusive business community.

On September 28, in partnership with the Halifax Chamber of Commerce, we held the “Celebrating Nova Scotia’s Black Economy” Inclusive Growth Dialogue at the Atlantica Hotel. The Dialogue kicked off with a panel discussion featuring Tiffani Young, CEO & Founder of Natural Butter Bar, Nevell Provo, CEO & Founder of Smooth Meal Prep, and Temi Ologbenla, Founder of Temi Bakes. Panellists shared on their entrepreneurial journeys and discussed the challenges facing Black entrepreneurs, including limited access to capital and financing, lack of professional networks, and few role models and mentors. Afterward, attendees heard from Alfred Burgesson, CEO of Tribe Network.

Here are some of the highlights from this important Dialogue.

Addressing Barriers to Success

Within the existing ecosystem, minority-owned businesses, including Black and 2SLGBTQI+ businesses, often lack the support necessary to succeed and to scale. Providing tailored education, training and resources designed for growth and expansion, addressing systemic barriers to accessing capital, and providing opportunities for networking and mentorship are all critical for long-term success.

Building Bridges with Black-Led Businesses

There are many opportunities for chambers to come alongside Black entrepreneurs and businesses, beginning with establishing a clear DEI plan that outlines their commitment to inclusivity — but it is essential that support extends beyond seasonal activations, such as Black History Month. Consistency is key.

Chambers can build bridges with Black-led businesses by:

- Actively participating in events organized by Black-led businesses and creating opportunities for Black and other racialized business owners to participate in events.

- Ensuring that opportunities for collaboration and support are well advertised using a variety of channels, including social media, newsletters, and community networks.

- Being intentional about expanding their networks to include Black-led businesses and encouraging others to do the same.

Increasing Access to Mentorship and Coaching

Chambers can help increase access to coaching for Black entrepreneurs by engaging with government and advocating for policies that support the implementation of mentoring programs and by providing financial resources, like funds and grants, to help expand the reach and accessibility of these programs. Mentoring programs should have a simplified, user-friendly application process and be promoted on various channels to better reach underrepresented communities.

Additionally, chambers should help establish spaces where experienced Black entrepreneurs are encouraged to be role models and can share their knowledge with up-and-coming entrepreneurs.

Getting Communities Involved

Local communities can help level the playing field and better support Black entrepreneurs by giving them a seat at the table where decisions are made and ensuring their voices are heard. Local communities can help dismantle barriers that hinder the progress of Black entrepreneurs by addressing education disparities through accessible and affordable workshops and training programs that go beyond startup basics, advocating for initiatives that provide increased access to capital for underrepresented entrepreneurs, initiating conversations about race and inclusion, actively seeking out and supporting Black entrepreneurs, and amplifying the voices and groups that already do so.

Using Data to Address Disparities

It’s essential to address implicit biases that may exist in the entrepreneurial ecosystem. Data can reveal disparities and inequalities in access to resources, funding and opportunities for Black entrepreneurs. Decision-makers can use this information to prioritize efforts to address these disparities and promote equitable access to capital.

A What We Heard blog will be produced for the rest of the five Inclusive Growth Dialogues, so be sure to come back for those insights!

Related News

Policy Matters: Canada’s Productivity Problem

Canadian Chamber’s Food Supply Council meets with Business@OECD Food and Agriculture Committee Vice-Chair Natasha Santos

Responding to a Cyberattack: What Businesses Should Know

Blog /

Balancing the Risks and Benefits: Insights from our Artificial Intelligence Executive Summit

Balancing the Risks and Benefits: Insights from our Artificial Intelligence Executive Summit

On November 22, 2023, the Canadian Chamber of Commerce hosted the Artificial Intelligence Executive Summit at The Rideau Club to tackle this critical topic. The Summit provided an opportunity for business leaders and stakeholders to engage on the transformative potential of AI while also taking a closer look at the ethical and responsible adoption and development of the technology.

It will be incumbent on policymakers to champion the ethical and responsible uses of AI grounded in Canadian values of fairness, equity and social responsibility. Values that move us beyond safeguards for technical compliance to a deeper commitment of responsibility, trustworthiness, and ethical AI practices.

Deputy Minister Simon Kennedy

On November 22, 2023, the Canadian Chamber of Commerce hosted the Artificial Intelligence Executive Summit at The Rideau Club to tackle this critical topic. The Summit provided an opportunity for business leaders and stakeholders to engage on the transformative potential of AI while also taking a closer look at the ethical and responsible adoption and development of the technology.

After a welcome from The Future of AI Council Lead, Ulrike Bahr-Gedalia, Senior Director, Digital Economy, Technology & Innovation, Canadian Chamber of Commerce, and introduction by Nicole Foster, Director of AWS Global AI/ML and Canada Public Policy, Amazon, the summit kicked off with a keynote address and fireside chat with Deputy Minister Simon Kennedy of Innovation, Science, and Economic Development Canada, moderated by Catherine Fortin LeFaivre, Vice President, Strategic Policy & Global Partnerships, Canadian Chamber of Commerce. Topics explored by Deputy Minister Kennedy, including responsibly regulating AI while still encouraging broader adoption, spilled into the panel discussion (moderated by Yana Lukasheh, VP, Government Affairs and Business Development, SAP Canada, and Future of AI Council Co-Chair) featuring Gabriel Batstone, Co-founder and CEO, Contextere; Jennifer Boger, Chief Scientific Officer, ESGai Technologies; Christine Guyot, Director, Corporate Affairs, Microsoft; and Anna Hannem, VP, Data and AI Risk, Scotiabank. After the keynote and panel, in-person guests were invited to network.

Key Themes and Insights

Keeping Our Edge by Translating AI into the Economy

Canada will only maintain its lead and leadership in the AI space if we match research with more action. Canada is a significant AI researcher, but we need to translate AI into the economy and that can only happen through adoption. Unfortunately, Canada invests in technology at a lower rate than some of our global competitors and G7 peers. Our slow rate of digital adoption has been worrying for many years, but the addition of AI takes it to a new level.

Increasing Adoption Rates through Trust and Literacy

As AI has become more pervasive in the economy, Canadians have become more conscious of the potential impacts on their lives — positive and negative — but consciousness does not necessarily equate understanding as to how AI is being used. The lack of broader AI adoption is partially due to a literacy issue — once people understand the technology, what it is and what it is not, and how important it is, adoption rates will increase. Universities, trade schools and polytechnics will all play a crucial role in AI literacy and education. But adoption also depends on Canadians trusting that the technology will be used for good. Fostering public trust requires transparency, accountability and the development of common standards. Of note is that Indigenous communities seem to adopt AI at a much higher rate than the “average Canadian population”.

Striking the Right Balance between Risks and benefits

Leveraging the significant power of AI in our economy and society is a complex challenge. We want to address the risks without losing the benefits of AI. Creating a balanced framework will help build public trust and encourage ethical use of AI, while also being as unintrusive as possible. But part of striking the right balance also means agreeing on or clarifying definitions: what exactly defines high-impact or a high-impact system? Artificial intelligence is not something to be afraid of — it’s important to get the regulations right and have a discussion around the risks, but we can’t forget to bring awareness to the many benefits and opportunities AI will create.

Responsibly Regulating AI

Regulations around AI require precision but being too prescriptive for a general-purpose technology means that by the time the regulations are passed, they’re out of date because of the rate at which the technology and world change.

Overregulation of AI can stifle innovation and discourage information sharing, but the absence of appropriate safeguards can lead to significant unintended consequences. As Deputy Minister Kennedy said, “Any set of rules where there are no consequences at all are not credible.” But in the regulatory world, the emphasis is on compliance rather than consequence when working with good-faith actors.

Leveling the Playing Field for SMEs

Impact of regulations on small businesses is different than big organizations. Integrating AI into your business, especially as an SME, can be intimidating. The more regulation, the more time and resources it takes. Being unable to allocate the resources to AI becomes a barrier to entry. AI regulations need to make sense for the size of business and the type of context they’re operating in. Just because an organization uses AI doesn’t make it a high-risk company. The role of government is to incentivize the kind of ecosystem and environment needed for SMEs to have their voices heard and to leverage training, as well as for larger tier companies to mentor and collaborate with SMEs.

Addressing the Fear of AI

Transformative tech is always disruptive, but it will have a net positive good in the end. Applying technology like AI to jobs will lead to greater productivity which leads to higher growth and thus more jobs. Also, every time there is a new innovation or transformative technology, jobs that didn’t previously exist are created. Anecdotal evidence has found that AI positively affects employee satisfaction as it allows people to focus more on what they like doing. It can also empower people to work in jobs that may have once been out of reach due to lack of traditional education. In this context, the interconnectedness of Augmented Intelligence and Artificial Intelligence is worth noting. Augmented Intelligence is a term used to describe the combination of people and AI working together to enhance human intelligence and decision making and improve the way people do work — not replace it.

The Future of AI Council

On November 6, 2023, the Canadian Chamber of Commerce launched the Future of AI Council, a 30-member forum representing a diverse cross-section of organizations from across the country. The Council will play a leading role in advocating for government policies that establish AI as a positive economic force through the responsible development, deployment and ethical use of AI in business.

We would like to acknowledge that this Summit took place on the traditional territory of the Anishinabe Algonquin Nation. The Canadian Chamber of Commerce recognizes and appreciates their historic connection to this place. We also value the contributions that Inuit, Métis, and other Indigenous Peoples have made, both in shaping and strengthening this community, province and country.

Thank You to Our Event Partners

Thank You to Our Excellence Level Partners

Related News

Improving Cross-border Travel at Toronto Pearson

Life Sciences Summit: Accelerating Canada’s Health Data Ecosystem

The West Coast Advantage for Energy Exports

Blog /

Policy Matters: The Importance of Building Rare Earth Elements (REE) Supply Chain Resilience in Canada

Policy Matters: The Importance of Building Rare Earth Elements (REE) Supply Chain Resilience in Canada

If we don’t act now to build a resilient, domestic REE supply chain, we’ll lose out on a once in a generation opportunity and remain dependent on the inputs of other countries that are less sustainable and responsible than us.

Rare earth elements (REE) are one of the 31 critical minerals identified by the government as being essential to our green growth and economic security. REE are also part of an even more exclusive group of six critical minerals initially prioritized by the Canada Critical Minerals Strategy for “their distinct potential to spur Canadian economic growth and their necessity as inputs for priority supply chains.”

Before Canada can take advantage of our vast REE deposits, we have some significant challenges to overcome — and fast! If we don’t act now to build a resilient, domestic REE supply chain, we’ll lose out on a once-in-a-generation opportunity and remain dependent on the inputs of other countries that are less sustainable and responsible than us.

The Importance of a Domestic REE Supply Chain

Canada has some of the largest known reserves and resources of REE in the world, estimated at 15.1 million tonnes in 2022.

Even so, a new REE mine hasn’t been opened in decades and we have no domestic separation and refining facilities, a key step in turning rare earth elements into usable forms. Due to our lack of a REE supply chain, we import the majority of our REE and REE-enabled inputs from China, the world’s largest producer of rare earth elements.

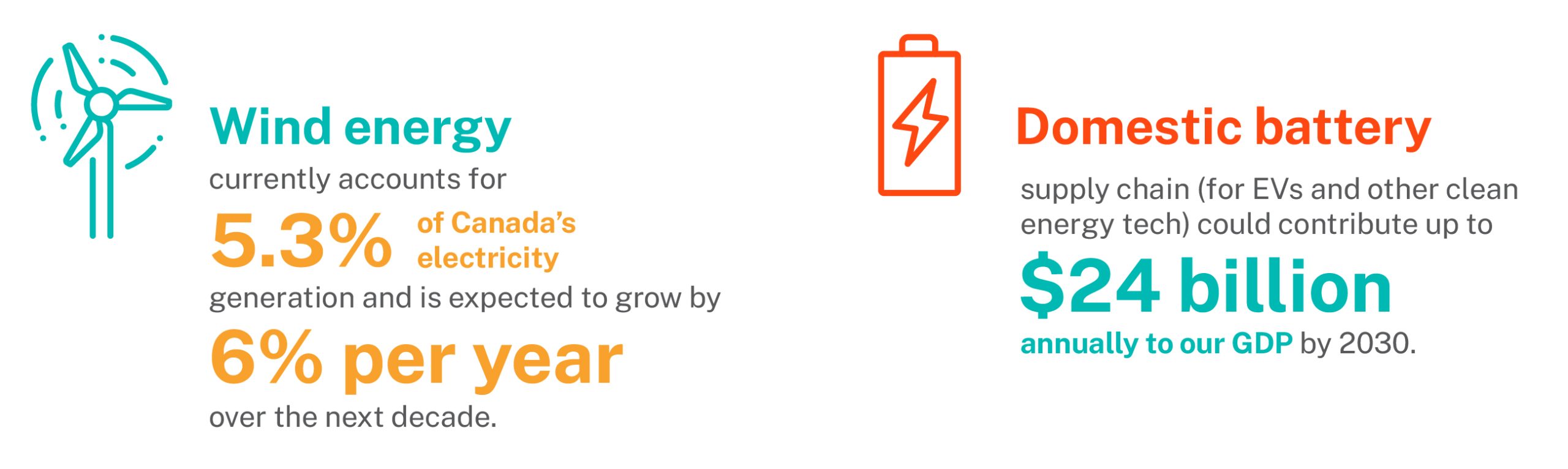

REE are key components in many electronics, clean energy, aerospace, automotive and defence technologies. But the greatest global demand for REE is permanent magnets, which are found in wind turbines and electric vehicles — two technologies poised to play a significant role in Canada’s green growth and energy security.

However, permanent magnets require a heavy REE called dysprosium (REE are categorized as either light or heavy based on their atomic number). China is currently the only commercial producer of heavy REE, allowing it to dominate the permanent magnet market.

Developing a resilient REE supply chain will reduce Canada’s dependence on REE imports and increase our energy independence and security, while also significantly adding to our economic prosperity.

The Challenges

Now, you might be asking the question, “If rare earth elements are so important to our future and we have the largest known reserves and resources in the world, why don’t we already have a REE supply chain?”

To answer that question, let’s take a quick look at some of the challenges we mentioned earlier.

REE Projects in the Works

Despite the challenges, there are REE projects underway, working to reengage the supply chain back in Canada.

Ucore (a Canadian Chamber of Commerce Critical Minerals Council member) has a commercial demonstration plant in Kingston, Ontario, separating heavy REE from light REE and then further refining to highly pure individual REE oxides. The next phase of the project is to take the demo plant and plug it into a full-size commercial plant in Alexandria, Louisiana, and eventually a second plant in Canada.

The Role of Government in REE Supply Chain Development

Government will play an important role in jumpstarting the REE supply chain through strategic programs and policies, like:

- Incorporating critical mineral pre-production costs into the new Critical Mineral Exploration Tax Credit, which would spur production by lowering financing costs to get new mines up and running.

- Offering tax incentives to encourage more critical minerals processing in Canada and secure the important midstream refining and processing part of the supply chain.

- Accelerating the regulatory cycle will help new mines get up and running quicker and ensure necessary mine life extensions.

- Doing due diligence on the mine proposals so that the mining opportunities with the best chance of bringing a critical mineral to market and staying economically viable are prioritized.

- Investing in expanding the reach and resilience of transportation and energy infrastructure to remote regions to allow for REE exploration, mining and delivery.

While government investment and support are vital, it’s the private sector that will ultimately lead this sector. We have an opportunity to get ahead of our competitors by tapping into our legacy of innovation and entrepreneurship and asking questions about current processes and standards that will spur new ideas.

Related News

Thank a Truck Driver This Holiday Season

Become [More] Cybersecure Today

Are You Unsinkable?

Blog /

Critical Minerals in North America: Recap of the Critical Minerals Mission to Washington D.C.

Critical Minerals in North America: Recap of the Critical Minerals Mission to Washington D.C.

At the heart of this mission was the Canada-U.S. Joint Action Plan on Critical Minerals Collaboration, a pivotal blueprint that charts a course toward mutual success in securing essential resources.

By Bryan Detchou, Senior Director, Natural Resources, Environment & Sustainability Canadian Chamber of Commerce.

As the curtains draw on the Canadian Chamber of Commerce’s Critical Minerals Mission to Washington D.C., it is evident that the collaborative efforts between Canada and the United States have laid a robust foundation for shared economic prosperity and security. The mission, organized in partnership with the U.S. Chamber of Commerce, was a testament to the commitment of both nations in addressing the global challenges associated with ensuring access to critical minerals.

At the heart of this mission was the Canada-U.S. Joint Action Plan on Critical Minerals Collaboration, a pivotal blueprint guiding mutual success in securing essential resources. The mission brought together industry leaders, policymakers and experts, creating a platform for recognizing past achievements and discussing future strategies for sustainable economic growth.

One of the key achievements of this mission was fostering recognition for our joint goals. By uniting representatives from both countries, the event highlighted the importance of a collaborative approach to addressing the challenges posed by the critical minerals sector. It underscored the shared commitment to securing these vital resources and ensuring the resilience of our supply chains.

Discussions were not merely focused on the present but aimed at shaping a sustainable and secure future, exchanging insights on best practices and exploring innovative solutions. The mission facilitated a deeper understanding of the opportunities and challenges that lie ahead in the critical minerals sector.

The success of the mission extends beyond the discussions that took place within the conference rooms, to the relationships forged and strengthened outside of them. Connections made between industry leaders, policymakers and experts will undoubtedly contribute to the ongoing collaborative efforts between Canada and the United States.

Looking forward, the Critical Minerals Mission has set the stage for a future marked by security and prosperity. The insights gained will serve as a guiding light for both nations as they navigate the complex landscape of critical minerals, ensuring that our economies remain resilient and our shared goals are met.

The Canadian Chamber of Commerce’s Critical Minerals Mission to Washington D.C. stands as a shining example of international collaboration for a common cause. It is a reminder that by working together, nations can overcome challenges, secure essential resources, and pave the way for a future characterized by economic prosperity and security.

Luncheon at the Canadian Embassy

We had the opportunity to engage with the Canada-U.S. community in Critical Minerals and network with political staffers, industry professionals, and policy leaders in the field.

Panel 1: Canada-US Collaboration on Critical Minerals

Moderated by John Barnwell, Natural Resources Officer at the Canadian Embassy, the panel explored strategies to improve critical mineral security and ensure the future competitiveness of Canadian and U.S. minerals industries. The panel featured speakers Geoffrey R. Pyatt, Assistant Secretary of State for Energy Resources at the U.S. Department of State; Christopher Sands, Director, Canada Institute, Wilson Center; Veronika Shime, Vice President of International Policy and Sustainability, National Mining Association; and Robbie Diamond, President & CEO, Securing America’s Future Energy (SAFE).

Panel 2: A Net-Zero Outlook for Mobility

This panel focused on the opportunities to meet the growing demand for low or zero-emission vehicles and strategies to align with ambitious domestic GHG emissions reduction goals. Christopher Guith, Senior Vice President, Global Energy Institute, U.S. Chamber of Commerce, moderated the panel with speakers Abigail Seadler Wulf, Head of the American Battery Materials Initiative, U.S. Department of Energy (DOE); David C. Adams, President & CEO, Global Automakers Canada; Flavio Volpe, President & CEO, Automotive Parts Manufacturers’ Association (APMA); and Ben Steinberg, Executive Vice President and Critical Infrastructure Group Co-Chair, Venn Strategies & Spokesperson for the Battery Materials & Technology Coalition (BMTC).

Panel 3: Unearthing Tomorrow: Exploring the Future of Mining in North America

Moderated by Bryan N. Detchou, Senior Director, Natural Resources, Environment and Sustainability at the Canadian Chamber of Commerce, this panel delved into the evolving landscape of mining in North America. It explored opportunities, challenges and innovations that will shape its future, highlighting the critical roles of women in mining and indigenous participation. The panel featured speakers Photinie Koutsavlis, Vice President, Economic Affairs and Climate Change, Mining Association of Canada (MAC); Katie Sweeney, Executive Vice President and Chief Operating Officer, National Mining Association; and Steve Feldgus, Deputy Assistant Secretary for Land and Minerals Management.

Rooftop Networking & Cocktail Reception at the U.S. Chamber of Commerce

Panel 4: Opportunities and Incentives

This panel focused on measures to promote foreign investment and trade, including fiscal incentives, financial incentives, and other incentives. Moderated by Johnna Muinonen, President of Dumont Nickel, Magneto Investments LP, the panel included Zacheriah Boykin, Critical Materials Portfolio Lead, Supporting the Office of the Assistant Secretary of Defense for Industrial Base Policy (OASD(IBP)); Abigail Seadler Wulf, Head of the American Battery Materials Initiative, U.S. Department of Energy (DOE); and Alejandro Jacquez, Special Assistant to the President for Economic Development and Industrial Strategy, The White House.

Panel 5: De-Risking Mining & the Role of Government

This discussion explored the value of de-risking resource exploration and development projects and ensuring governments seize the generational opportunity of Critical minerals. Guided by moderator Julian Ovens, Partner, Crestview Strategy, the panelists included Mark Selby, Chairman and CEO of Canada Nickel Company; David Anonychuk, Global Vice President, Metallurgy and Consulting, SGS; Adam Frost, Senior Vice President, Export-Import Bank of the United States; and Alexander Hergott, President and CEO, The Permitting Institute.

Panel 6: The Role of Provincial Offices in Washington D.C. in Securing a North American Supply Chain of Critical Minerals

Moderated by Daniel Caramori, Vice President, Member Relations and Services, Canadian Chamber of Commerce, this group discussed the role of Provincial Offices in Washington D.C. in securing a North American supply chain of critical minerals. Panelists included Bob Maurice, Commercial Affairs Attaché, Québec Government Office in Washington; Justin Meyers, Senior Policy Advisor, Nelson Mullin Saskatchewan Representative in Washington D.C.; and Robert Capecchi, Policy Officer – State Engagement, Office of Ontario in Washington, DC

In summary, the message from America was clear, we need to get more Canadian critical Minerals out from the ground and into the North American ecosystem to accelerate the energy transition and ensure the continent’s energy security.

The conversations in D.C. were also a strong reminder of the power of the Canada-U.S. partnership, and the dedication of many individuals, companies and organizations present that will drive us towards a future where critical minerals are not just a source of economic growth but a symbol of our unwavering commitment to a more secure and prosperous world.

The Canada-U.S. relationship is like a two-country buddy cop movie. We might have our differences, but we always solve the case together in the end. That’s why I am confident that together, we can solve the critical minerals case and find new and innovative solutions that will provide the energy security that Canada, the United States, or our democratic friends and allies need for our collective clean energy future.

The Canadian Chamber of Commerce would also like extend our sincere appreciation to our sponsors— E3 Lithium, Frontier Lithium, and Vale Canada Ltd.—for their invaluable support in making this event a success, and our partners at the U.S. Chamber of Commerce and the Canadian Embassy in Washington, D.C.

Related News

Policy Matters: Women & the Economy In Canada

A Roadmap to Fortifying the Digital Future of Small Business in Canada

Policy Matters: The Canadian Chamber of Commerce’s Blueprint for a Stronger Economy

Blog /

Navigating the Green Transition: Insights from our Green and Transition Finance Executive Summit

Navigating the Green Transition: Insights from our Green and Transition Finance Executive Summit

This critical summit examined the evolving landscape of sustainable finance, addressing the imperative for a credible taxonomy and aligning climate disclosures with international standards.

On November 9, 2023, the Canadian Chamber of Commerce brought together industry leaders, experts, and stakeholders at the Vogue Hotel Montreal Downtown, for the Green and Transition Finance Executive Summit.

This critical summit examined the evolving landscape of sustainable finance, addressing the imperative for a credible taxonomy and aligning climate disclosures with international standards. The summit aimed not only to dissect challenges but also to explore opportunities for small and medium-sized businesses amid transformative reforms.

Keynote Fireside Chat and Panellists

The summit commenced with a fireside chat with Guy Cormier, President and CEO of Desjardins Group, who shared insights into the economic outlook during an engaging conversation moderated by Milla Craig, President and CEO of Millani. This dynamic exchange set the stage for a distinguished panel discussion that included Fate Saghir (Mackenzie Investments), Bruno Caron (Miller Thomson LLP), Eoin Ó hÓgáin (Power Sustainable), Matthew Seddon (Sun Life Financial), and Florian Roulle (Finance Montréal). Together, they explored the challenges and opportunities surrounding the green transition in Canada.

Key Themes and Insights

Economic Landscape and SMEs

The consensus among experts indicated an anticipated mild global recession within the next 8-12 months, with the exception of the U.S. Small and medium-sized enterprises (SMEs) were counselled to shift their focus toward analyzing their financial performance and fundamentals instead of emphasizing growth strategies. The discussion also offered insights into the changing landscape of interest rates, emphasizing that the historic low rates of the past ~25 years are unlikely to resurface. Factors such as the aging baby boomer generation, shifts in global trade dynamics (especially with Asia), and the impact of regional conflicts contribute to a complex economic landscape.

Green Transition and SMEs

The crucial need for SMEs to adjust to the demands of sustainability emerged as a central theme, presenting both challenges and opportunities. While regulatory pressures and sustainability targets can present significant challenges, embracing the green transition also offers financial incentives and an opportunity for SMEs to distinguish themselves.

Balanced Approach to Transition

The discussions underscored the inevitability of the green transition, propelled by regulatory pressures and the advocacy of younger generations. Striking a balance between accelerating the transition and being sensitive to resource industries that support Canadians emerged as a complex but necessary objective.

Navigating “Greenwashing” and Opportunities in Transition

The absence of clear, universal standards and taxonomy has raised concerns about “greenwashing” within the business community. Differing methodologies employed by auditing firms often lead to divergent sustainability assessments. This discrepancy creates a climate of apprehension among businesses, discouraging them from openly discussing their sustainability endeavors for fear of being labeled as engaging in “greenwashing.” Conversely, embracing robust ESG practices has emerged as a crucial avenue for businesses to access new sources of capital. The shift towards sustainability not only aligns with global best practices but also stimulate the development of innovative, sustainable technologies.

ESG Disclosures, Taxonomy, and Capital Mobilization

The panel discussion examined critical areas demanding attention. The absence of standardized ESG disclosures emerged as a pressing concern, signaling the necessity for a unified framework to assess the sustainability records of businesses. The call for a transition taxonomy – a classification system defining criteria for business activities aligned with green transition objectives – was also underscored. Presently, Canada is experiencing an investment shortfall related to the transition compared to other jurisdictions like the U.S. and the EU. The discussion highlighted the urgency for coordinated efforts between the federal and provincial governments to mobilize investments in alignment with the green transition.

Use of Taxonomies in the Financial Sector and Expectations for COP

Discussions delved into the application of taxonomies to assess ESG practices, drawing parallels with the EU’s three-tier system. There was a widespread acknowledgement of the necessity to move beyond net-zero, aligning taxonomies with other jurisdictions to prevent regulatory arbitrage. Participants expressed tempered expectations for COP 28 amid ongoing conflicts, emphasizing the ongoing focus on achieving a just transition.

Future Progress

The Green and Transition Finance Summit offered in-depth insights and a nuanced understanding of the challenges and opportunities associated with Canada’s green transition. With a unanimous call for coordinated efforts, standardized disclosures, and mobilized investments to promote sustainability in the Canadian business landscape, the summit established the foundation for the trajectory of the green and transition finance landscape in the coming years.

We would like to acknowledge that this summit took place on the traditional territory of the Algonquin Anishnaabeg People. The Canadian Chamber of Commerce recognizes and appreciates their historic connection to this place. We also value the contributions that Inuit, Métis and other Indigenous Peoples have made, both in shaping and strengthening this community, province and country.

2023 Executive Summit Series

Our Executive Summit Series gives us the opportunity to take a deep dive into issues our political leaders need to consider to ensure public policies drive business success.

Each event will ignite insightful conversations with some of Canada’s most influential business leaders and government officials, as we strive to meet our biggest challenges: the future of people, technology, trade and climate.

Gain More Impact

We are at our best as a network when we connect, learn and discover through the many in-person and virtual events, webinars and gatherings we host.

Thank You to Our Event Sponsors

Thank You to Our Excellence Level Partners

Related News

Freeze the Alcohol Escalator Tax: A Call for Fairness and Economic Recovery

The Business of Business: Supporting Small Business with TD’s Tara-Lynn Hughes