Blog /

Investing in Western Canada’s Trade Infrastructure

Investing in Western Canada’s Trade Infrastructure

Robin Guy is the Canadian Chamber’s Senior Director for Transportation, Infrastructure and Regulatory Policy, and leads the Western Executive Council....

Robin Guy is the Canadian Chamber’s Senior Director for Transportation, Infrastructure and Regulatory Policy, and leads the Western Executive Council.

As an export-dependent country in an increasingly connected and competitive global economy, Canada must continue expanding its export capacity. Western Canada provides crucial entry and exit points for Canadian goods moving to and from Asia-Pacific countries through many different modes, including marine, air, and land.

Extreme weather events and aging infrastructure remain challenges to ensure we can get products to markets. We have a serious infrastructure deficit in Canada, which will require us to perform triage today, to remain competitive tomorrow.

Canada’s infrastructure must be a genuine investment that is based on clear priorities and measurable economic returns. As we plan new critical trade infrastructure to move our people and goods, we need to build for the future and not simply address today’s needs. Above all, we require approval processes that are transparent and fair, but that also allow projects to be undertaken much more quickly and efficiently. We must act now and take decisions with purpose to ensure Canada does not fall further behind our competition.

It is essential that we avoid the temptation to spread whatever money is available like peanut butter across Canada. We must make the difficult decisions to develop a pipeline of projects that will help grow Canada’s economy. Infrastructure capacity takes time to build and we need to move now to reap benefits later. We cannot simply address existing gaps, but must look to our future needs to reach our potentials. This forward vision is essential to ensuring our transportation system can meet the future needs of our economy.

The capacity of Canada’s west coast to support long-term growth is quickly becoming constrained. Increased dwell time, additional anchorage requirements due to terminal congestion, a lack of warehousing and industrial lands could become the new normal for Canadian businesses in the coming years. Simply put, if we can’t move Canadian goods, we can’t sell them. Canada must invest in worthy trade infrastructures that promote the movement of goods in a reliable and timely matter. Only in this case will Canada be able to grow our economy.

The government sees the importance of these investments with continued funding of projects through programs such as the National Trade Corridors Fund. Through this program, we must create resiliency through tools such as twinning of rail in high congestion area, increase the capacity of our bridges, and protecting industrial lands around airports and ports of entry.

While the government has stepped up to the table, it must continue to show leadership. Investments made through the NTCF must be based on clear priorities with measurable economic returns. In addition, these priorities must be backed by data to ensure we can see the impact projects are having to strengthen our trade corridors and infrastructure.

The Canadian Chamber of Commerce is pleased to have contributed to the Canada West Foundation’s report, From Shovel Ready to Shovel Worthy: The Path to a National Trade Infrastructure Plan for the Next Generation of Economic Growth.

Related News

Canadian GDP for July: Defying expectations, a stronger start to the third quarter than anticipated, but a slowdown remains in clear sight

Time to put reports into action, Chamber tells House Agriculture Committee

The Canadian Chamber Appears Before Senate National Finance Committee on Bill C-59

Blog /

Labour Force Survey for April 2022: Not much changed last month, but more sick workers held back growth

Labour Force Survey for April 2022: Not much changed last month, but more sick workers held back growth

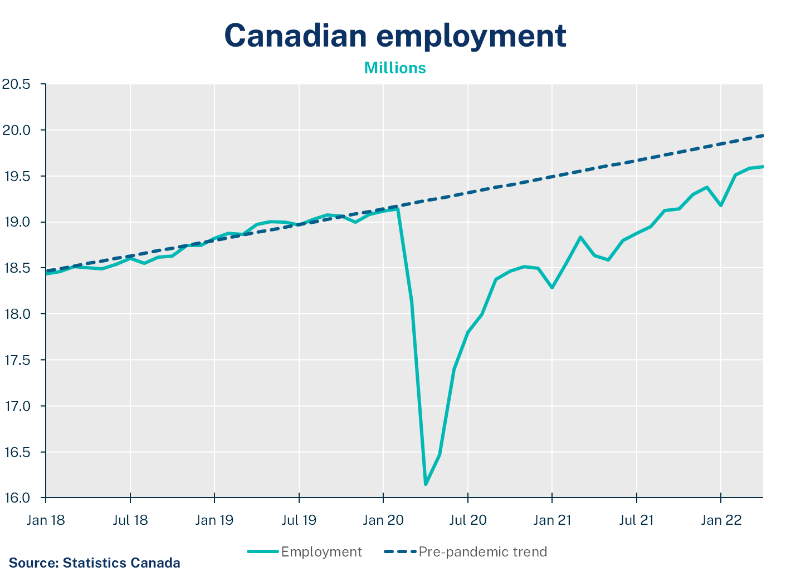

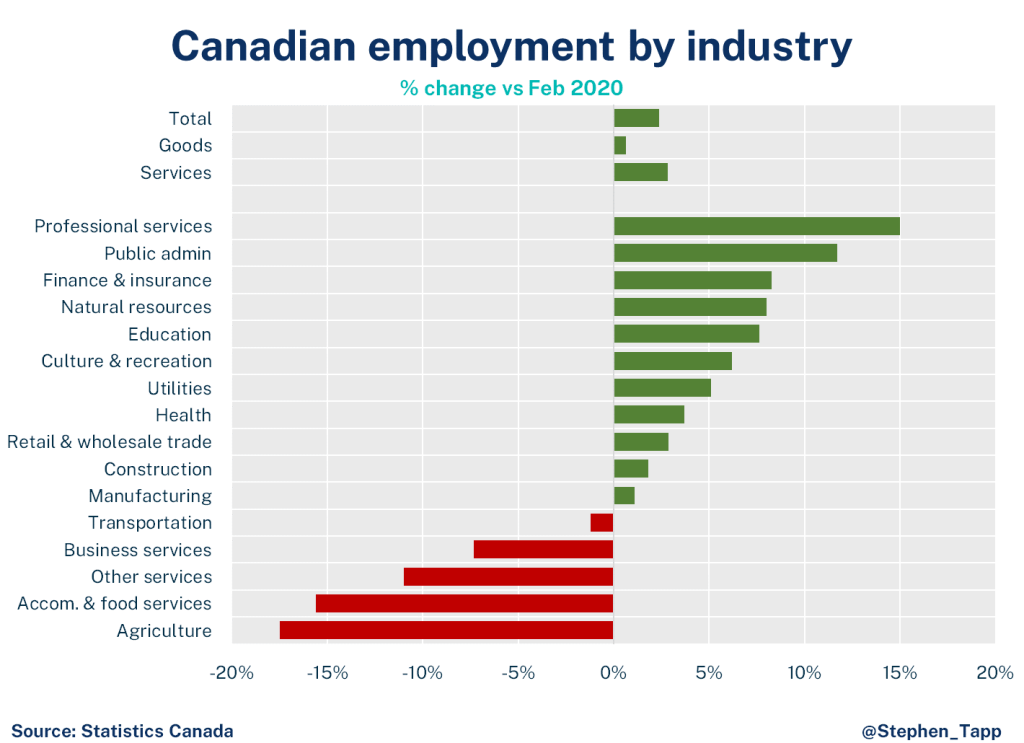

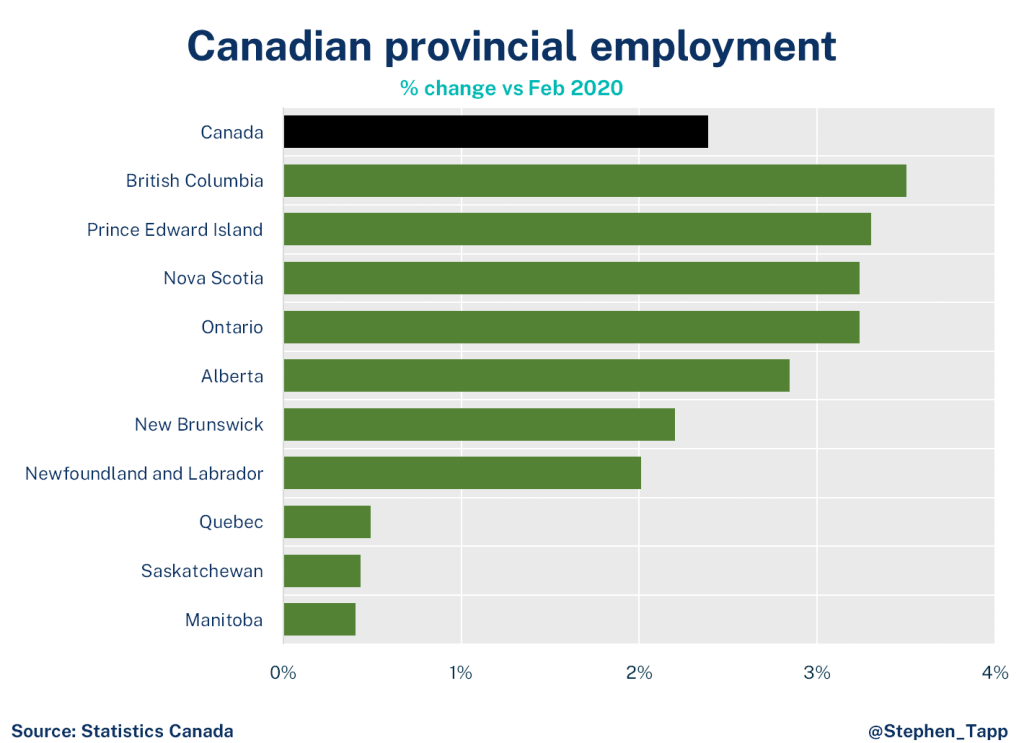

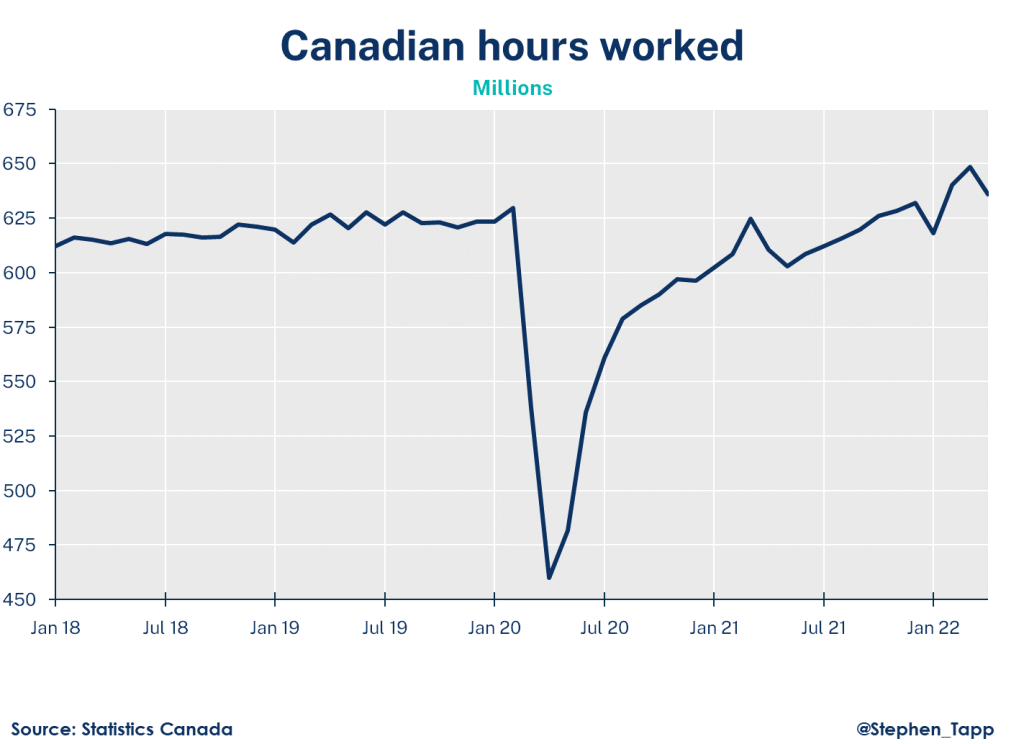

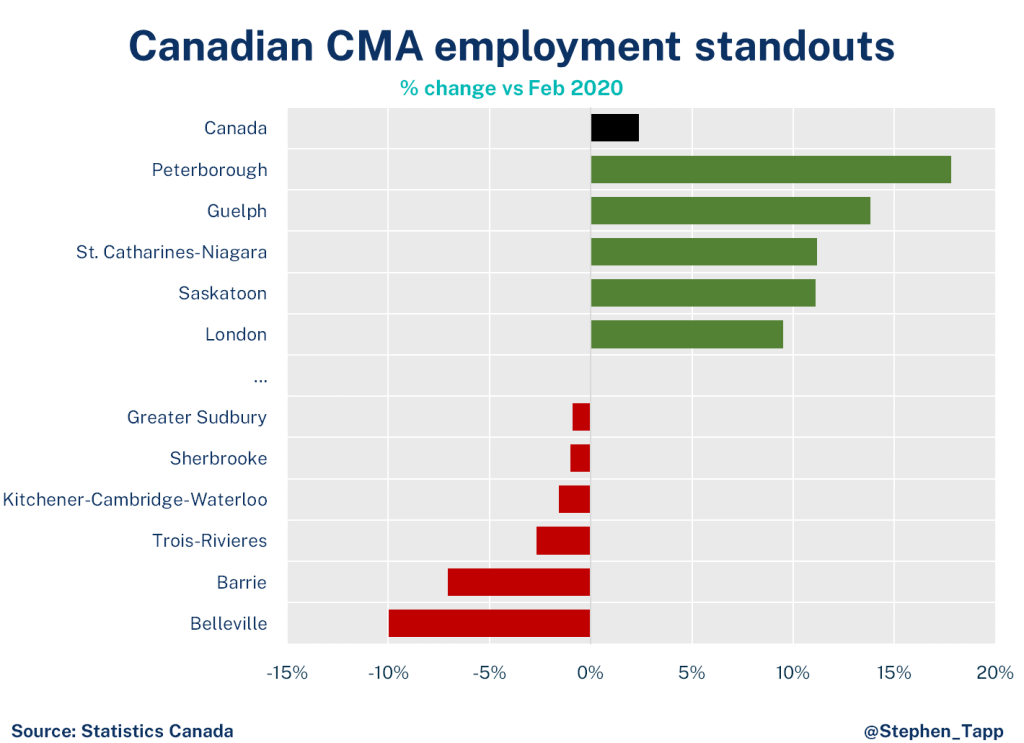

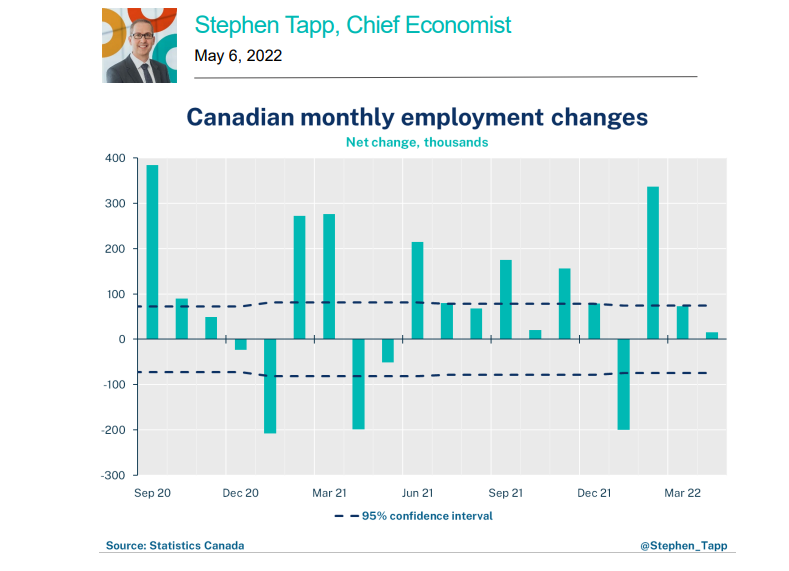

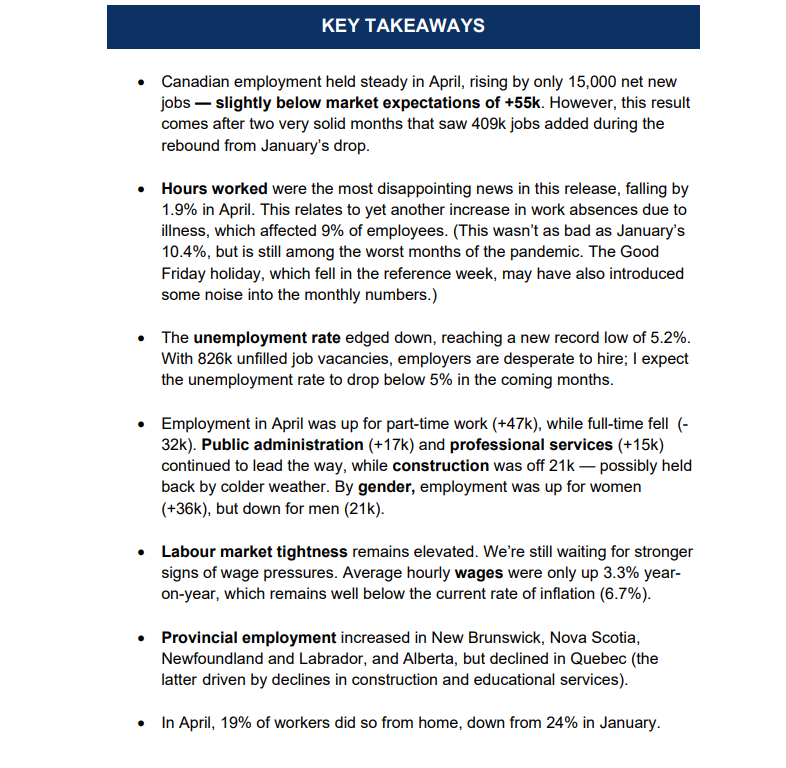

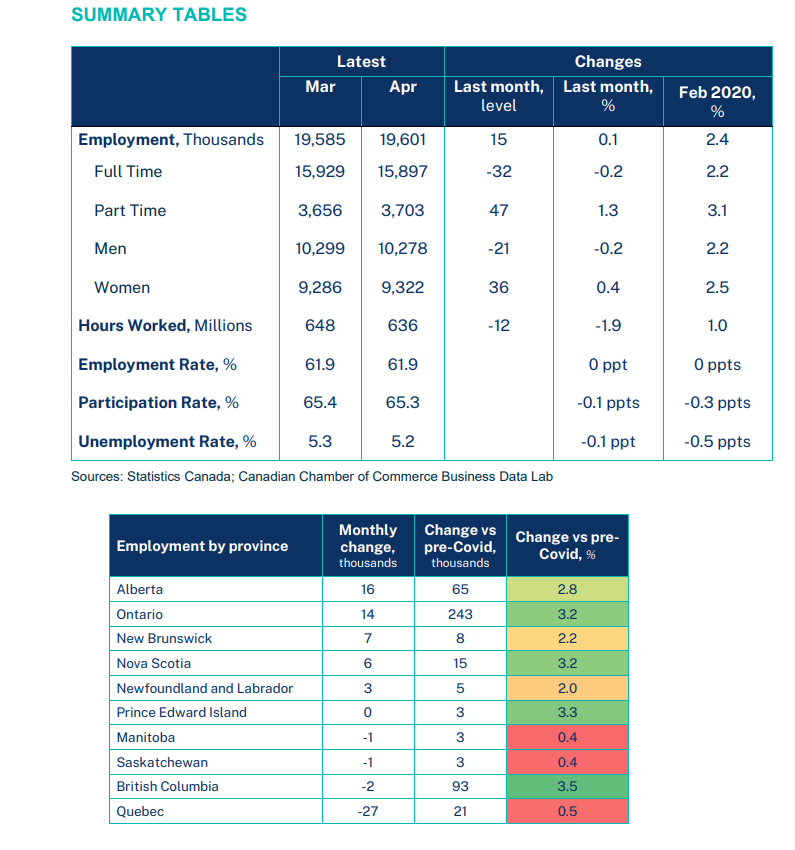

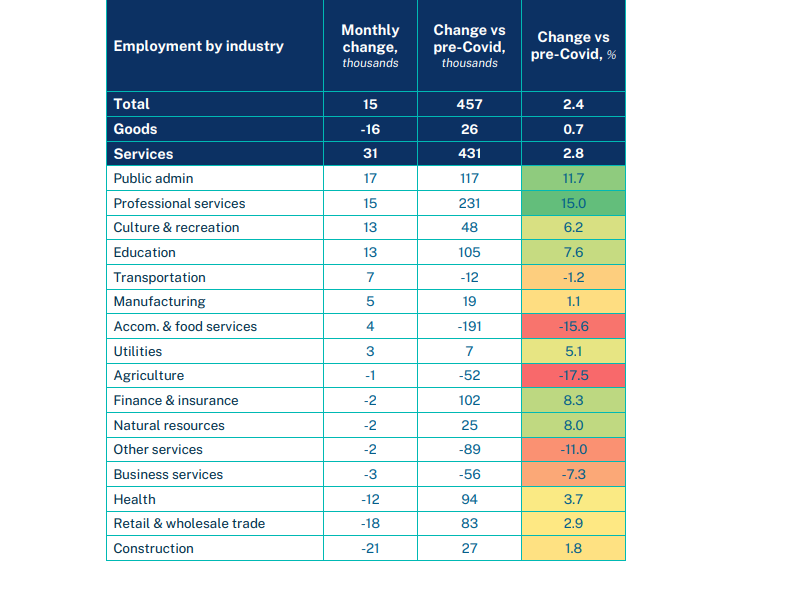

Canadian employment held steady in April, rising by only 15,000 net new jobs — slightly below market expectations of +55k. However, this result comes after two very solid months that saw 409k jobs added during the rebound from January’s drop.

More Labour Charts!

Related News

The Outstanding Honourees of the Canadian Business Leader Awards

Celebrating Success: Highlights from the Canadian Business Leader Awards

Canadian Chamber Appears Before OGGO Committee on Government Operations and Estimates

Blog /

10 Takeaways from BDL Consultations

10 Takeaways from BDL Consultations

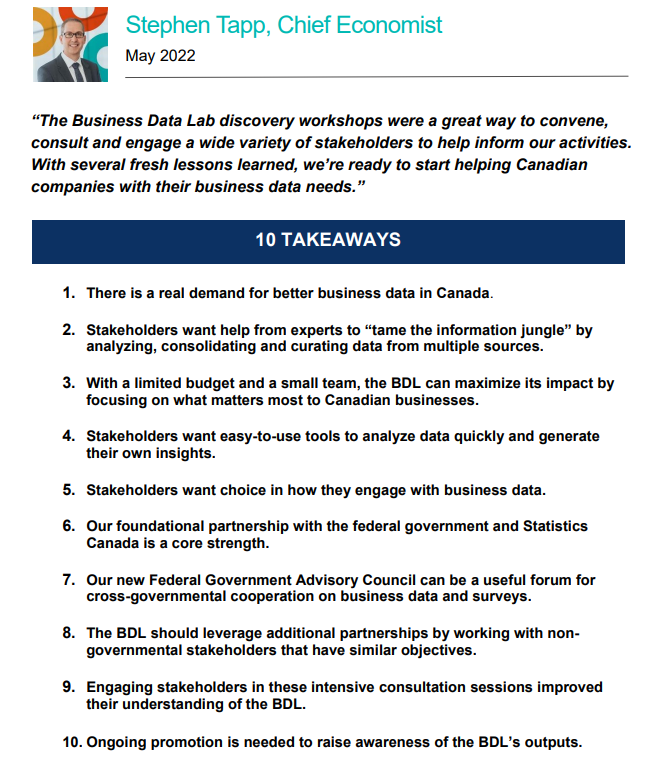

In February 2022, we launched the Canadian Chamber of Commerce Business Data Lab (BDL). After the launch, we held a series of BDL discovery sessions with stakeholders from across the country. Here are the 10 takeaways from these sessions.

In February 2022, we launched the Canadian Chamber of Commerce Business Data Lab (BDL). After the launch, we held a series of BDL discovery sessions with stakeholders from across the country. In total, we hosted six workshops with over eighty stakeholder groups, including those from:

- the Chamber Network;

- our new Federal Government Advisory Council; and

- diverse business community leaders.

For each group, we developed targeted survey questions to guide the discussions and collect structured feedback. The main objectives of these consultations were to:

- inform stakeholders about the BDL;

- understand stakeholders’ data needs and research plans; and

- identify gaps and opportunities to collaborate.

Here are my 10 takeaways from these sessions:

Takeaway 1: We’re onto something here.

There is a real demand for better business data in Canada. This was, of course, our initial hypothesis, but it’s nice to have this confirmed in our discussions. A major motivation for developing the BDL was to provide Canadian businesses with critical information to help them make better decisions and improve their performance. We foresee this happening in several ways. To give some illustrative examples, the BDL intends to:

- provide tools to help small businesses across Canada better monitor market conditions in their region;

- analyze business surveys each quarter to generate detailed insights and give leading indicators of future trends;

- assist businesses owned by under-represented groups by producing research focused on their specific needs and opportunities; and

- support understanding by the Chamber Network, policymakers, businesses, the media and the public by offering a more real-time and granular perspective of the business impacts of major economic shocks (such as supply chain disruptions, severe weather, pandemic health policies, etc.).

Takeaway 2: Help wanted.

Stakeholders want help from experts to “tame the information jungle,” by analyzing, consolidating and curating relevant business data from multiple sources. Emerging private sector data sources might be unknown to some stakeholders or are simply too expensive to obtain, analyze and sustain. By centralizing this work in the BDL, these activities can reduce duplication and save time and money for Canadian companies and the Chamber Network.

Takeaway 3: Focus on Canadian business concerns.

With a limited budget and a small team, the BDL can maximize its impact by attracting top talent and focusing its efforts on what matters most to Canadian businesses. While there are many areas of interest, stakeholders told us they want the BDL to focus on business-relevant topics, providing updates in real time and getting as granular as possible. Core topics at the top of most data “wish lists” are:

- local business conditions (such as economic activity, consumer spending, mobility, business openings/closings, obstacles and expectations, transportation and tourism); and

- local labour market information (employment, wages, job postings, market tightness, skills, immigration, demographics and housing).

Right after that is a second tier of emerging business issues that includes:

- environment, social and governance (ESG) metrics, such as greenhouse gas emissions, environmental practices for key industries and tracking “net-zero” progress;

- diversity, equity and inclusion (DEI) data on employment, business ownership and management of traditionally under-represented groups as well as intersectionality considerations; and

- the digital economy and innovation (digital adoption, online sales, business investment in technology and R&D).

Takeaway 4: Keep it simple.

Stakeholders want easy-to-use tools to analyze data quickly and generate their own insights. Participants were interested in data dashboards that bring together key metrics from different sources. Useful examples include the Alberta government’s Economic Dashboard and the Toronto Regional Board of Trade’s Recovery Tracker.

These kinds of tools allow users to navigate via point-and-click (rather than downloading data and writing their own source code), to see summary stats quickly and to develop relevant insights, including comparing regions. Stakeholders valued data simplicity, clarity of underlying data sources and methodologies, engaging visualizations, interactivity, having access to multiple layers of granularity and business relevance.

Takeaway 5: Give users options.

Stakeholders want choice and flexibility in how they engage with data. Stakeholders had a wide range of experiences and capacities in their internal ability to work with data. Therefore, to be successful, the BDL should meet users’ needs and capacities. In some cases, users want quick and easy statistics — say, to support their policy advocacy; in other cases, they want interactive, customizable tools to generate new insights and understand the broader market context in which their business operates. Users with internal expertise and the luxury of time want to download raw data to perform their own analysis. Additional distribution channels for data and insights to reach their intended audiences include social media, newsletters, reports, blogs, infographics, data visualizations, quotes, short videos, webinars and podcasts.

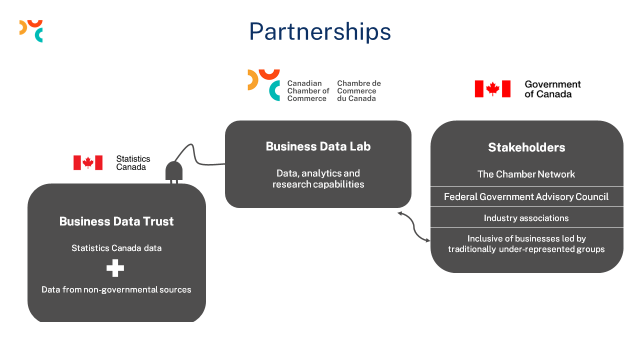

Takeaway 6: Build on Statistics Canada’s data strengths.

Our strong foundational partnership with the federal government and Statistics Canada is seen as a core strength. This provides data expertise, enhances the credibility of this initiative and allows us to collaborate on data collection (through acquisition) and, potentially, analysis. The BDL can also raise awareness and enhance the use of existing StatCan data by businesses — including the Canadian Survey on Business Conditions. Compared with StatCan, the BDL has more latitude to disseminate non-traditional, or “experimental,” data sources that can complement official statistics generated by the agency.

Takeaway 7: Collaborate across government.

Our new Federal Government Advisory Council can be a useful forum for cross-government cooperation on business data and surveys. This group consists of experts with unique perspectives on Canadian business activities, surveys and government programs for business. By bringing together representatives from10 organizations, we hope to promote collaboration, break down silos and reduce duplication of work across organizations. To highlight two examples:

- the vast majority (89%) of participants saw opportunities for better coordination of existing business surveys; “survey fatigue” — due to overlapping surveys across organizations with similar information aims — is imposing an additional response burden on business owners, which could reduce their willingness to participate in surveys;

- most respondents (80%) were interested in accessing BDL data to conduct analysis; as a result, the BDL could provide a forum to exchange research ideas, collect input on potential questions for StatCan’s quarterly business survey and help researchers across organizations to work together to build an evidence base to improve the design of government programs for businesses.

Takeaway 8: Leverage partnerships beyond government.

The BDL should leverage partnerships by working with non-governmental stakeholders with similar objectives. Partnerships can add value at all stages of production, from data sharing and analytics in the private sector, universities and think tanks, to joint reports, publications and events with the business community. As with our work with StatCan, we can achieve more by working together than we can independently.

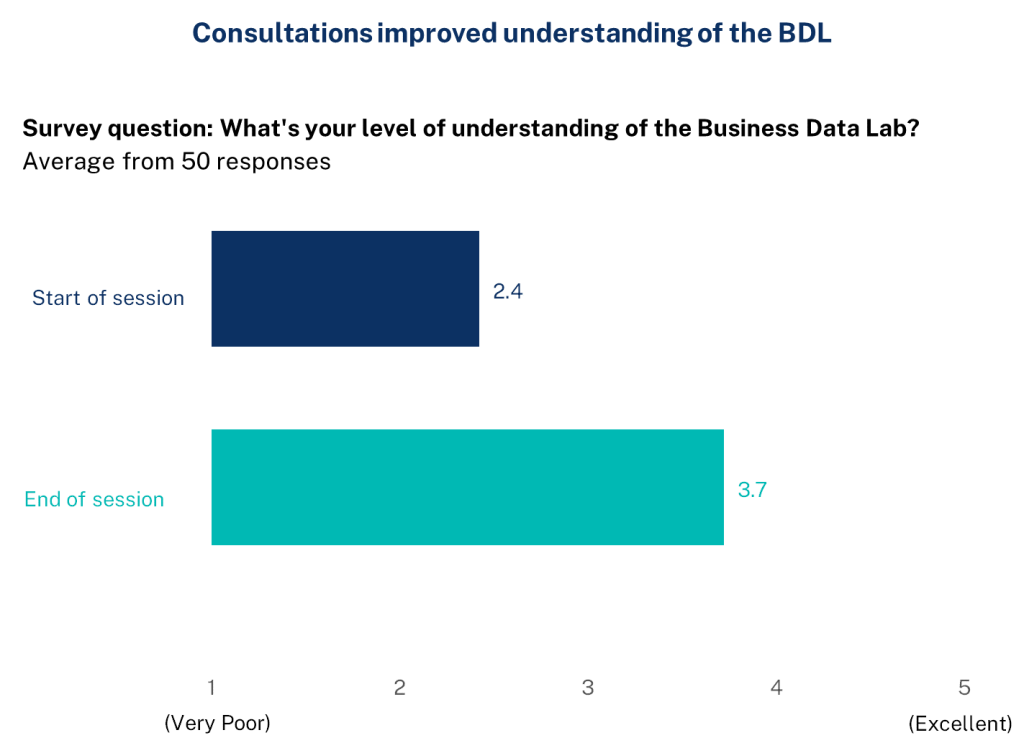

Takeaway 9: Engagement increases understanding.

Engaging stakeholders in these intensive sessions improved their understanding of the BDL. We hoped these sessions would allow us to connect with stakeholders, improve their understanding of our objectives and start a continuous feedback loop to improve our outputs to ensure we meet the needs of Canada’s business community and government stakeholders. We were pleased to see participants’ self-reported understanding of the BDL increase notably over the course of the sessions — rising from an average score of 2.4 to 3.7 (on a scale of 1 to 5, representing an increase of 54%).

Takeaway 10: Promote your work.

Ongoing promotion is needed to raise awareness of the BDL’s new outputs. The BDL intends to promote its outputs to potential users, including key influencers in niche networks on social media. We will develop great online tools and generate unique research insights, but stakeholders need to be aware of them before they can incorporate BDL outputs into their work routines.

These weren’t the only lessons we learned during these sessions.

To read more about our stakeholder discovery consultations, please see the full report here.

Related News

What We Heard at The State of Small Businesses in Canada Virtual Event

What We Heard: “Economic Reconciliation and Indigenous Entrepreneurship” Inclusive Growth Dialogue

Canadian GDP for August: It’s not all bad news

Blog /

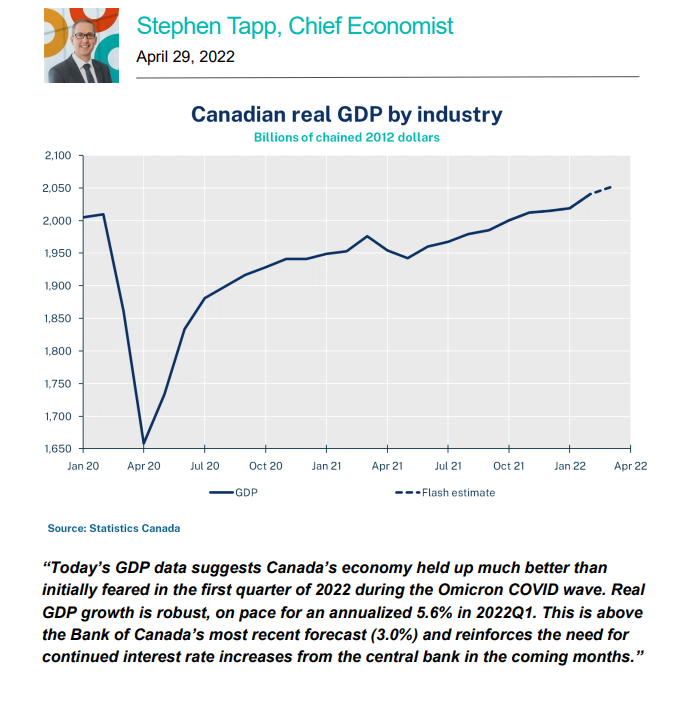

GDP by industry for February 2022: Canada’s economy performed better than expected during the Omicron wave

GDP by industry for February 2022: Canada’s economy performed better than expected during the Omicron wave

Today’s GDP data suggests Canada’s economy held up much better than initially feared in the first quarter of 2022 during the Omicron COVID wave.

Read Stephen’s full analysis here.

Related News

The Canadian Chamber Appears Before Senate National Finance Committee on Bill C-59

Celebrating Success: Highlights from the Canadian Business Leader Awards

The Outstanding Honourees of the Canadian Business Leader Awards

Blog /

Canadian Chamber encourages House International Trade Committee to set clear priorities for its Indo-Pacific strategy

Canadian Chamber encourages House International Trade Committee to set clear priorities for its Indo-Pacific strategy

On April 27, Mark Agnew, Canadian Chamber of Commerce Senior Vice President, Policy and Government Relations, appeared at the House...

On April 27, Mark Agnew, Canadian Chamber of Commerce Senior Vice President, Policy and Government Relations, appeared at the House of Commons Standing Committee on International Trade regarding its study into opportunities for Canada in the Indo-Pacific region.

Agnew suggested four important, though not all encompassing, areas of focus to guide the strategy: trade policy opportunities, to be clear-eyed regarding the challenges surrounding China, to be judicious in targeting specific markets and sectors, and supporting the role of business in bolstering trade relationships.

Mark Agnew’s opening remarks

Check against delivery

Chair and Honourable Members, thank you for the invitation to appear as part of your study into opportunities in the Indo-Pacific region. This is a timely study as the government continues work on its Indo-Pacific Strategy.

I would like to focus my few minutes on several non-exhaustive priorities that the government should consider as it develops its Indo-Pacific Strategy.

The first area is trade policy. We have a number of initiatives ongoing in the region that hold potential for opening new market access opportunities. This includes recently announced initiatives, such as trade negotiations with ASEAN and Indonesia, but also the potential for CPTPP expansion and opening opportunities in underutilized markets like Taiwan.

It is important to go into these discussions with a clear set of priorities. Some of these priorities for the Canadian Chamber include:

- Tariff liberalization for our key export interests;

- Robust digital trade chapters that ensure the protection of cross-border data flows and that data localization does not become a condition of doing business; and

- Enhanced regulatory dialogues to ensure that non-tariff measures, such as SPS regulations, do not become a barrier to trade

In the context of the CPTPP specifically, we urge the government to maintain the high standards of the agreement and not water down its provisions.

The second area is the approach to China. Although the government has committed to delivering an Indo-Pacific Strategy, the elements that pertain to China will be critical. It is important to be clear-eyed about the size of the market and of course the geopolitical challenges. How we engage with China needs to intelligently balanced considerations and it must be anchored around cooperation with allies.

The third key consideration is focus. The reality is that we live in a world of finite resources, financially and in terms of bandwidth to deliver. It would not be realistic to expect that Canada could make a push in all sectors in all countries. We will need to be judicious in how we select markets of focus and the priority sectors that are pursued.

The fourth and final area I want to mention is around the role of non-governmental entities in bolstering trading relationships through the development of on-the-ground connections. Businesses engage in commerce rather than governments, and in doing so they play a part in our footprint in the region. Governments should see trade missions and other activities that facilitate those connections as part of the broader set of foreign policy tools. I know that when I travel abroad, I represent not only the Canadian Chamber but also what foreign nationals perceive about Canada. Therefore, strong government-industry collaboration is critical and mutually reinforcing.

Thank you for your attention and look forward to your questions.

Related News

The Outstanding Honourees of the Canadian Business Leader Awards

Canadian GDP for July: Defying expectations, a stronger start to the third quarter than anticipated, but a slowdown remains in clear sight

Canadian Chamber Appears Before OGGO Committee on Government Operations and Estimates

Blog /

What is the Difference Between Upskilling, Reskilling, and Micro-credentialing?

What is the Difference Between Upskilling, Reskilling, and Micro-credentialing?

If you’re looking to advance your skills in your career but are feeling a little confused about the difference between...

If you’re looking to advance your skills in your career but are feeling a little confused about the difference between popular course phrases like ‘micro-credentialing’ and ‘rapid reskilling’ and wondering what will help you more, you’re not alone! These terms all sound quite similar and have intertwining meanings, but each serve their unique purpose. This blog will break down the key differences between the common skill boosters: upskilling, reskilling, and micro-credentialing, and when they are most valuable.

Upskilling

Upskilling typically refers to taking a particular skill set or job role and enhancing it! Upskilling is most common for pre-existing positions and or full teams at a given company and often leads to promotions within the same field of work. The purpose of upskilling is not to necessarily change one’s skills or approach, but to improve upon them to meet new industry or company standards. Upskilling is great when done with a full team, as it can boost team morale and help individual employees feel supported in their growth. A great opportunity for upskilling a team would be a marketing department in need to get more focused on digital marketing tools. Our corporate team trainingis an awesome tool for marketing teams looking to enhance their digital skills.

Reskilling

Reskilling and upskilling may sound similar but have some very key differences. Reskilling is the process of gaining new or different skills to shift your current job role. This could mean reskilling for your marketing role, to be specified in digital marketing such as SEO. Reskilling, similar to upskilling, is a great way to advance at your current company or into other professional roles as you grow in your career. As all industries, not just digital marketing, are constantly evolving, reskilling is a great, quick way to stay on top of changes and remain flexible within the job market.

Micro-Credentials

Now, how exactly do you re-skill or upskill? One of the best waysto do so is with micro-credentialing -typically very rapid, and short courses that help enhance a particular skill set. Think of reskilling and upskilling as the “what” and micro-credentialing as the “how”. Micro credentials are efficient ways to get expertise in a particular topic that is recognized within your industry.

This blog is provided by Jelly Marketing & PR. Jelly Marketing is an award-winning Digital Marketing & PR firm providing digital ads, social media, SEO, & public relations services to brands in Metro Vancouver, across Canada, and the United States.

Related News

What We Heard: “Economic Reconciliation and Indigenous Entrepreneurship” Inclusive Growth Dialogue

Canadian Chamber appears before Standing Senate Committee on National Finance.

MDR: What Is It? And Why Your Business Needs This Cyber Security Protection?

Blog /

Canadian Chamber’s Western Executive Council holds first in-person meetings

Canadian Chamber’s Western Executive Council holds first in-person meetings

A strong Western Canada is critical to a strong Canada, and we must act now to set up both the...

A strong Western Canada is critical to a strong Canada, and we must act now to set up both the region and the country for a successful future. It was with this spirit in mind that on April 19, the Chamber’s Western Executive Council held its first in-person meetings in Vancouver.

The Council started its day at the Port of Vancouver where members had a firsthand look at the opportunities and challenges facing Canada’s largest port. The tour, led by Port of Vancouver CEO Robin Sylvester, highlighted the importance of Canada’s Pacific Gateway in moving goods to and from Canada, and the need to continue to invest in trade infrastructure to grow our economy and protect our supply chains.

Following its visit to the Port, the Council held a lunch time discussion with the Hon. James Moore, P.C., where the former Minister of Industry and Regional Minister for British Columbia provided the Council with an outside government perspective on issues facing Western Canadian businesses.

The Council also engaged with Parliamentary Secretary to the Deputy Prime Minister and Minister of Finance, Terry Beech. Mr. Beech provided the Council an overview of Budget 2022 and his thoughts on how it will help grow Western Canada’s economy. Council members raised the importance of the federal government engaging western Canadian business, in addition to discussing its priorities such as housing supply, the getting Canadian natural resources to market, and ensuring the government looks to implement an economic lens to regulation.

The busy day wrapped up with Michael Doyle, President of the Vancouver Canucks, hosting fellow Council members at a Vancouver Canucks game.

The Council will next meet at the Chamber’s Hill Day on May 30 in Ottawa, followed by a June 14 gathering in Calgary.

Related News

MDR: What Is It? And Why Your Business Needs This Cyber Security Protection?

Time to put reports into action, Chamber tells House Agriculture Committee

The Outstanding Honourees of the Canadian Business Leader Awards

Blog /

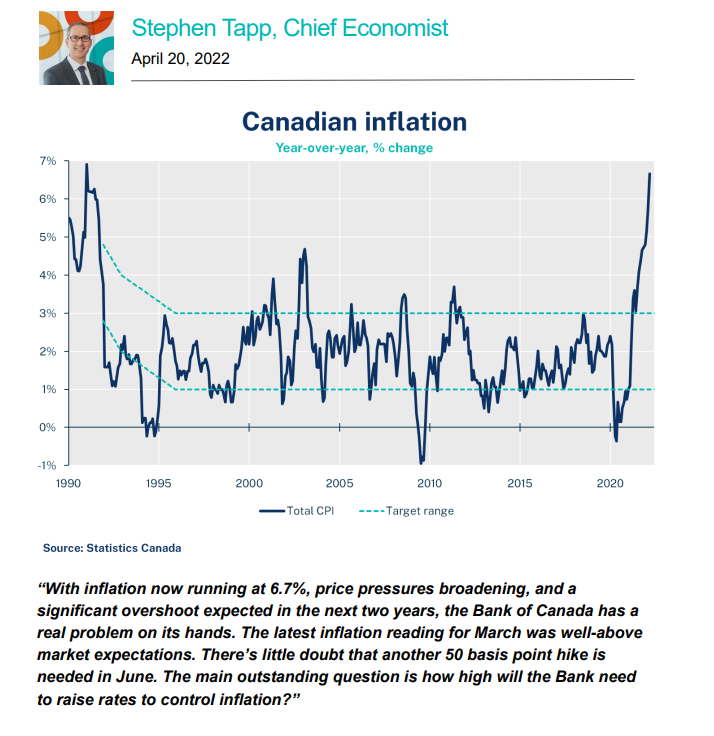

March 2022 Consumer Price Index data: Flashing red! At 6.7%, let’s hope Canadian inflation has finally peaked

March 2022 Consumer Price Index data: Flashing red! At 6.7%, let’s hope Canadian inflation has finally peaked

With inflation now running at 6.7%, price pressures broadening, and a significant overshoot expected in the next two years, the Bank of Canada has a real problem on its hands.

Check out Stephen Tapp’s full analysis here.

Related News

What We Heard at The State of Small Businesses in Canada Virtual Event

Nice Guys Finish First: Empowering Canadian Business with Negotiation Strategies

The Canadian Chamber Appears Before Senate National Finance Committee on Bill C-59

Blog /

The Business of Business – The “Green Skills Revolution” with RBC’s Cynthia Leach

The Business of Business – The “Green Skills Revolution” with RBC’s Cynthia Leach

Our President & CEO Perrin Beatty is joined by Cynthia Leach, the Senior Director of Economic Thought Leadership at RBC.

Our President & CEO Perrin Beatty is joined by Cynthia Leach, the Senior Director of Economic Thought Leadership at RBC to talk about Canada’s climate journey and what’s in store for Canadian businesses as we transition towards a net-zero future and economy.

Related News

Canadian GDP for August: It’s not all bad news

Canadian GDP for July: Defying expectations, a stronger start to the third quarter than anticipated, but a slowdown remains in clear sight

Canadian Chamber of Commerce Appears Before Standing Committee on Natural Resources

Blog /

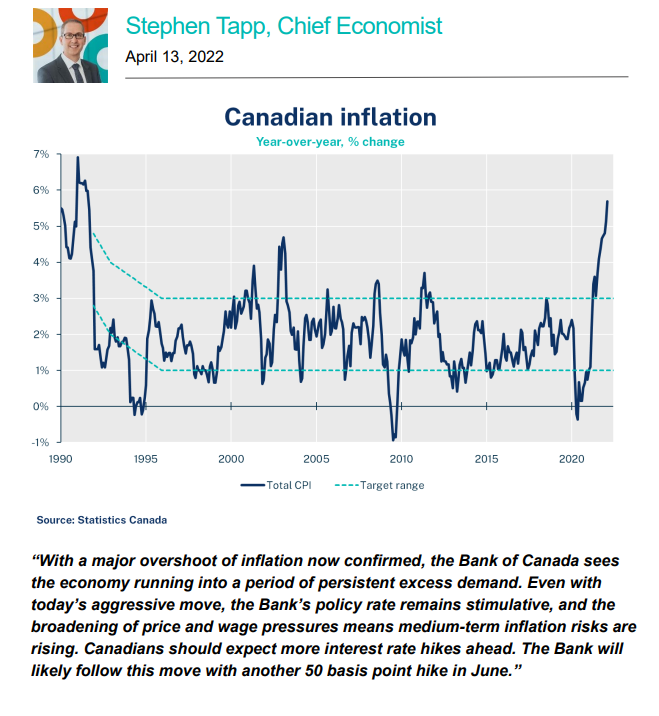

The Bank of Canada is behind the curve, starts raising rates more aggressively to control inflation

The Bank of Canada is behind the curve, starts raising rates more aggressively to control inflation

With a major overshoot of inflation now confirmed, the Bank of Canada sees the economy running into a period of persistent excess demand. Even with today’s aggressive move, the Bank’s policy rate remains stimulative, and the broadening of price and wage pressures means medium-term inflation risks are rising.

Check out the rest of Stephen Tapp’s analysis here.

Related News

Canadian Chamber Appears Before House of Commons Standing Committee on International Trade

Canadian Chamber to House of Commons Standing Committee on Transport, Infrastructure and Communities: We need to see long term investment in Canada’s trade infrastructure.