Blog /

Exploring Opportunities in the Indo-Pacific: Insights from our “Gateway to the Indo-Pacific” Event

Exploring Opportunities in the Indo-Pacific: Insights from our “Gateway to the Indo-Pacific” Event

The event served as a dynamic forum for delving into the diverse business prospects within this rapidly growing region.

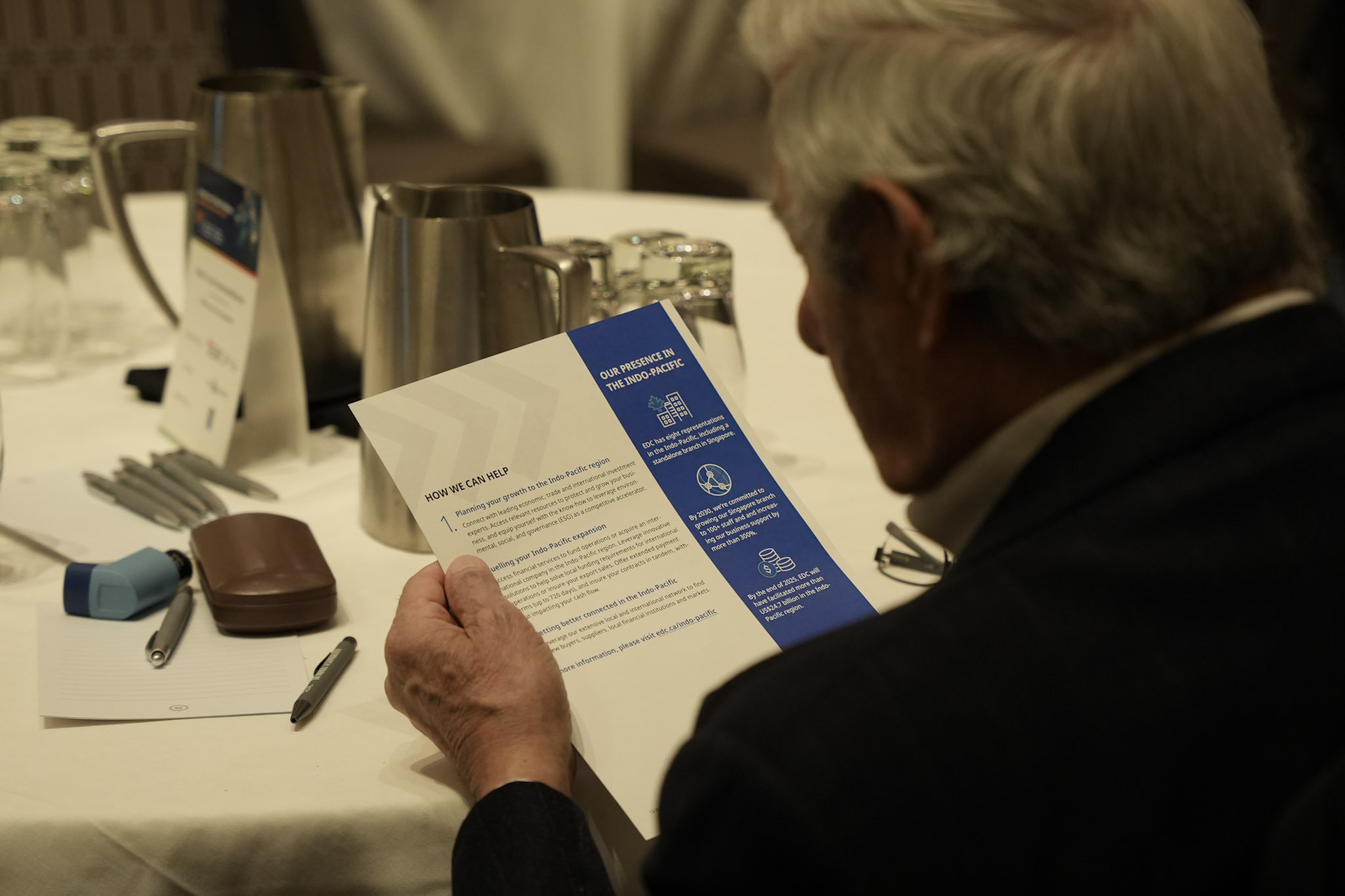

On April 10, the Canadian Chamber of Commerce, in collaboration with Export Development Canada (EDC), hosted the “Gateway to the Indo-Pacific” event in Montreal, Quebec. The event served as a dynamic forum for delving into the diverse business prospects within this rapidly growing region.

With a focus on key sectors such as agri-food, infrastructure, clean technology and advanced manufacturing, the event highlighted the vast potential available to Canadian businesses looking to expand their horizons.

Fireside Chat: Why Indo-Pacific?

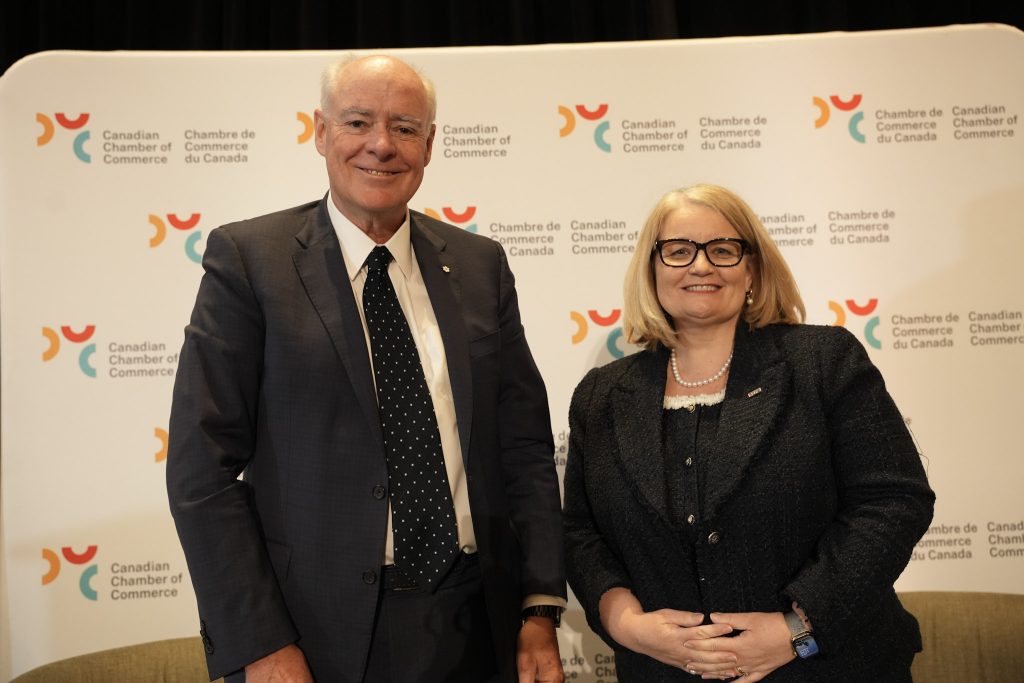

The event kicked off with a fireside chat between the Canadian Chamber’s President and CEO, Perrin Beatty, and EDC’s President and CEO, Mairead Lavery. They discussed why the Indo-Pacific is such an attractive market, citing its 40 markets, $47 billion of economic activity, growing middle class and significant demand. They also explored the potential for Canada in sectors like energy, food, raw materials, manufacturing, technology and infrastructure.

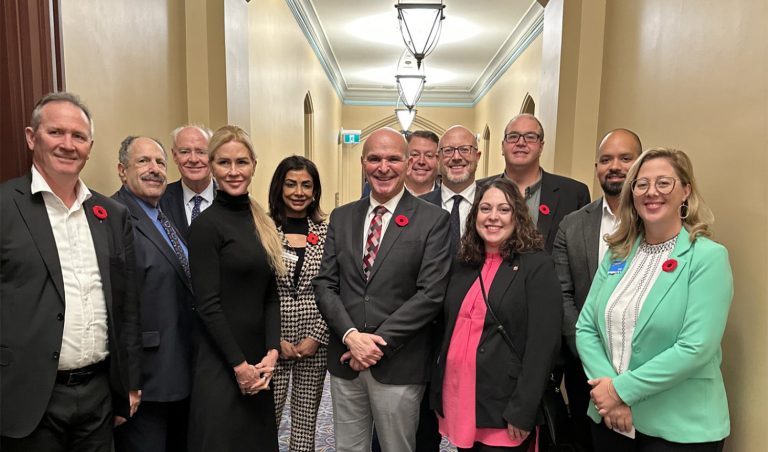

Panel 1: Choosing the Right Market and Entry Strategy in the Indo-Pacific

The first panel featured industry experts such as Mélissa Prophète from Investissement Québec International, Guillaume Brossard from the Port of Montreal, Jeff Mahon from Strategy Corp & Canada West Foundation, and Nigel Neale from Global Affairs Canada. They discussed the challenges of doing business in the Indo-Pacific, emphasizing the importance of understanding market dynamics, diversifying market presence and managing geopolitical risks. The panel also highlighted the untapped potential of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the role of the Trade Commissioner Service in navigating regulatory variations.

Panel 2: Canada’s Contribution to EV Manufacturing in the Indo-Pacific

The second panel focused on Canada’s role in EV manufacturing in the Indo-Pacific. Experts such as Sven List from Export Development Canada, David Anonychuk from SGS, Leigh Clarke from E3 Lithium, Corinne Havard, and A.J. Nichols discussed the opportunities for Canadian companies to supply vital materials to EV battery manufacturers in the region. They emphasized the need to build government relationships and strategies for market access and capital confidence.

Panel 3: Seizing Agri-Food Opportunities in the Indo-Pacific

The final panel, including René Roy from the Canadian Pork Council, Sarah Fedorchuk from The Mosaic Company, Solange Henoud from Lallemand Health Solutions, Brian Innes from Soy Canada, and Jeff Nankivell from the Asia Pacific Foundation of Canada, explored the agri-food opportunities in the Indo-Pacific. With a growing middle-income population, there is increasing demand for high-quality, nutrient-rich foods. Canadian agriculture is uniquely positioned to meet this demand, with its high regulatory standards, transportation capabilities and commitment to sustainability.

The event also showcased resources from Export Development Canada to support Canadian businesses in the region:

- India Premium Guide

- Doing Business in Australia

- EP12 Gazing east: Canada’s markets of the future

- Canadian seafood exporters: Casting a wider net in the Indo-Pacific

- Three Farmers Foods sees big potential in the Indo-Pacific

- Exporting to India: Top 12 etiquette tips

- EDC and PT Sarana Multi Infrastruktur (Persero) partnership to accelerate Indonesia’s energy transition and infrastructure development

- Renewable energy sector opportunities rage in Australia

- Market intelligence for Indo-Pacific

- How Canadian exporters will benefit from our Indo-Pacific strategy

- Doing business in India: Tips for importing and exporting

- Doing business in South Korea: Tips and Insights

- Doing business in Singapore

- Agri-food export markets in Indo-Pacific

- 3 markets to watch: Vietnam, Thailand and the Philippines

- Market of opportunity: Unleashing Indonesia’s potential

- Cultural tips for doing business in South Korea

- Singapore business FAQs and export tips

- Sectors in Focus: Winter 2023 (Agrifood in the Indo-Pacific Spotlight)

- E-commerce grocery platforms deliver growth across the Indo-Pacific

Thank You to Our Sponsors

Related News

Freeze the Alcohol Escalator Tax: A Call for Fairness and Economic Recovery

What We Heard at The State of Small Businesses in Canada Virtual Event

Joint letter from 80+ organizations regarding proposed anti-replacement worker legislation

Blog /

13 Recommendations for Making Canada’s Critical Minerals Industry More Attractive to International Investment: New Report

13 Recommendations for Making Canada’s Critical Minerals Industry More Attractive to International Investment: New Report

Our new report identifies gaps in Canada’s current policy suite meant to attract investment for critical minerals, and provides recommendations to the federal government on how Canada can better compete for international investments in this important and rapidly growing sector.

The international need for critical minerals is huge. Global investment in the next decade will be measured in the hundreds of billions of dollars. But while returns can be substantial, mining and minerals projects are generally seen as high-risk investments since most exploration projects never generate revenue. To encourage and support this important industry, investment incentives are a necessary measure.

Canada has inherent advantages in the critical minerals space — world-leading deposits of critical minerals, good governance, clean energy and social cohesion. However, prior to the development of the Canadian Critical Minerals Strategy in 2022, Canada’s activities have been smaller than those of jurisdictions with more mature plans.

Our new report, Investment Incentives for Critical Minerals in Canada, identifies gaps in Canada’s current policy suite meant to attract investment for critical minerals, and provides recommendations to the federal government on how Canada can better compete for international investments in this important and rapidly growing sector.

Looking at mechanisms from other jurisdictions is useful as they can offer additional approaches that Canada might take to support critical minerals. As such, this report also compares investment incentives across four jurisdictions that each have their own list of critical minerals and overarching strategies: Canada, the United States, the European Union and Australia.

Investment Incentives

Governments encourage international investment in several ways:

- Fiscal incentives include tax holidays, reduced tax rates and tax deductions or credits on equipment.

- Financial incentives include various grants and loans on new construction or mechanisms like subsidized government insurance.

- Other incentives include subsidized public infrastructure, market preferences and regulatory concessions.

- Subsidized infrastructure: the public provision of roads, utilities and other services that help reduce costs to the investor.

- Market preferences: preferential treatment in government procurement or other forms of preferential market access.

- Regulatory concessions: exemptions or reductions in regulatory requirements such as environmental or labour regulations.

For the comparison of fiscal, financial and other incentives across the four jurisdictions, read the full report.

Recommendations

A subset of six of Canada’s 31 critical minerals was prioritized in the Canadian Critical Minerals Strategy. The strategy budgets around $8 billion over eight years to build on existing programs and create new mechanisms.

The Canadian Critical Mineral Strategy provides ambitious and comprehensive direction to support international investment in critical minerals in Canada. Yet, most efforts suggested are relatively new and need elaboration.

This report offers 13 recommendations categorized under three themes that build on the recommendations previously made by the Canadian Chamber in 2022.

Making Decisions

- Create our own critical minerals goals. Plans described in the Canadian Critical Minerals Strategy urgently need goals, timelines and accountability structures. Details and commitments will bolster the confidence of international investors in Canada.

- Obtain faster and consistent approvals for mining. There is a broad consensus that current timelines of 10–15 years need and can be shortened without losing requirements for good planning, environmental protection and Indigenous consent.

- Build a critical minerals digital information hub for Canada. Ease of access to high quality and current information will improve the timelines for planning and permitting processes, helping stakeholders in their own assessments and investment decisions.

- Embed Indigenous reconciliation in critical minerals development. Areas for action include building Indigenous leadership capacity in the industry and updating economic and legal frameworks in Canada’s mineral resource sector.

Leveraging Opportunity

- Modernize our workforce for critical minerals. Our critical minerals strategy identifies the need for a new diverse and inclusive workforce, but more details are required to define and address labour challenges.

- Support small minerals companies. Most critical minerals discovery and early-stage validation is done by junior mining companies, but junior firms are often ill-equipped for the social and environmental assessments needed for project planning and acceptance. The government can provide financial and service support.

- Fill the midstream gap for critical minerals production. Canada can fill the midstream production gap with targeted investment stimulus.

- Recognize equipment manufacturers and minerals service providers. Critical minerals development requires equipment, reagents and services for exploration, mining, metallurgy and processing.

Thinking Ahead

- Fixing the existing value chain misalignment. The upstream, midstream, downstream and recycling stages of critical minerals each operate on a different schedule. The coordination and connection between stages is a role for international and domestic governments to fill.

- Strengthen Canada’s financial institutions for critical minerals. Canadian banks are major lenders to minerals projects worldwide. The Canadian government can strengthen these institutions to advance critical minerals development and attract international financing.

- Add demand-side incentives. Canada’s strategy currently gives scant attention to demand-side measures like direct government purchasing, mineral stockpiling, price guarantees or de-risking company offtake contracts.

- Lead on international ESG standards. Sustainability standards programs provide an external reference of acceptability for investors, support the brand value of end products, and help authorities make approval decisions confidently and more rapidly.

- Coordinate investment criteria with Canadian allies. Aligning incentives with like-minded nations can facilitate and encourage responsible investment. Allie nations are reaching outside their borders for new critical minerals, and Canada can follow suit.

The urgency for Canada to act on its natural advantages in critical minerals is driven by our own environmental sustainability expectations, but also by the need to compete with jurisdictions that are more advanced than us in their incentive programs. It’s important to the future of the industry and our economic prosperity that Canada develops expeditious and competitive mechanisms to secure investment for all stages of the minerals development value chain.

For information on the Canadian Chamber’s advocacy in the critical minerals space, visit our Critical Minerals Council page.

Related News

Driving Net-Zero Success: Highlights from the Ready to Compete Report

Building Your Toolkit: Scaling for Success in a Regulated Industry

Canadian Chamber recommends responses to US Inflation Reduction Act before House Trade Committee

Blog /

Policy Matters: 3 Priorities for International Trade

Policy Matters: 3 Priorities for International Trade

International trade matters to Canada.

In 2022, imports and exports accounted for two-thirds of our gross domestic product (GDP). That’s why the decisions we make on trade will affect our prosperity, our quality of life and opportunities for Canadian businesses.

Recently, global crises have caused governments to focus on strengthening international supply chains and economic ties with partner countries. This shift presents a significant opportunity for Canada to unleash its trading potential and meet the global demand for essential goods.

We have strategic advantages in areas such as energy, critical minerals, fertilizers and agriculture. But to benefit economically from our natural wealth, as well as fulfill our responsibility to partner nations, we need to be proactive and strategic in our engagement with our trading partners, while also ensuring our trade infrastructure is ready to support an increase in activity.

Canada is the second largest exporter of

fertilizer and the fifth largest exporter of agriculture

and agri-food products in the world.

To make this our moment, Canada should prioritize the following three measures:

1. Strengthen our Strategic Relationship with the United States

At a time when governments and businesses around the world are looking for stability and predictability in supply chains and trading partners, North America — and Canada in particular — could be a leader.

Leveraging USMCA (Canada’s trade agreement with the United States and Mexico) has the potential to strengthen supply chain integration. USMCA’s existing framework provides a solid basis for a “friendshoring” agenda that bolsters North American manufacturing capacity, economic security and overall global competitiveness.

According to the World Economic Forum, friendshoring

“refers to the rerouting of supply chains to countries perceived

as politically and economically safe or low-risk, to avoid

disruption to the flow of business.”

In 2026, the three countries will indicate whether we want to continue this vital agreement. But Canada can’t wait until then to appeal to the United States. A coordinated effort by all levels of Canadian government as well as the private sector will be important to demonstrate to the United States why a continued, strategic and healthy relationship with Canada is important.

For that reason, the Canadian Chamber launched a Canada-U.S. Engagement Plan in February 2024. The plan will provide Canadian businesses with more opportunities to constructively engage with policymakers and business counterparts in the United States through four business-led trade missions to the United States in 2024. You can read about the first one here.

2. Help Canadian Businesses Engage with Partners in the Indo-Pacific Region

Representing four billion people, 40 economies and $47 trillion in economic activity, the Indo-Pacific is the world’s fastest growing economic region.

Canada’s future trade performance will heavily depend on our ability to capitalize on the immense economic opportunities posed by the region. Our partners in the region need Canada to help fill the urgent and growing gap in energy, critical minerals, food and fertilizers.

The Canadian business community can lead the way in being a more proactive and engaged partner in the region. However, ensuring Canada’s success in the region will require that government work collaboratively with businesses in order to address regulatory challenges, manage geopolitical risks, and understand market dynamics and entry strategies. Taking advantage of this opportunity will require the Canadian government to closely consult and collaborate with the private sector in the ongoing implementation of the Indo-Pacific Strategy in to ensure that international trade policies are aligned with business realities.

3. Prepare for Prosperity by Ensuring We Have Reliable Supply Chains and Trade Infrastructure

We have some work to do here at home if we’re to be ready for the increased trade that engaging with the United States and Indo-Pacific region will bring.

If recent major events, like the pandemic, wars, floods, wildfires and labour disruptions have taught us anything, it’s that our supply chains are only as strong as their weakest link.

By twinning rail capacity, increasing industrial lands around airports and ports, and investing in roads, warehousing, and bridge capacity, we can ease the burden on our infrastructure and reduce the economic consequences of climate events and labour disruptions.

The federal government can help bolster trade infrastructure and ensure reliable supply chains by:

- Collaborating with provinces, the private sector, and Indigenous communities to address regional needs.

- Committing to long-term investment through a Canada Trade Infrastructure Plan.

- Expanding abilities to head off preventable threats to supply chains by considering new dispute resolution tools and withdrawing anti-replacement worker legislation.

- Acting to reduce long-standing barriers to interprovincial trade.

The Canadian Chamber’s Work

Our collective long-term prosperity is closely tied to how we engage with the world, which is why the Canadian Chamber is a longstanding advocate of unlocking Canada’s international potential.

In 2023, we assembled our first Gateway to the World (GTW) team. The team is developing and executing on a strategy that will position the Canadian Chamber as the indispensable organization for Canadian companies of all sizes wanting to engage in international policy or global trade and investment.

Related News

Western Executive Council Headed East for Ottawa Meeting with Ministers

Protecting the Decision-Makers

The Value of “Right-Sizing” Advice

Blog /

Five Reasons Why Canadian Businesses Should Expand to the Indo-Pacific

Five Reasons Why Canadian Businesses Should Expand to the Indo-Pacific

If there’s ever a time to tap into this market, it’s now. But how do you start? Which sectors are emerging in the region? And what strategies can you employ to expand your business’s presence?

The Indo-Pacific region presents Canadian businesses with compelling opportunities for global expansion. Spanning from the eastern shores of Africa to the western coast of the Americas, this dynamic region is a goldmine of diverse markets waiting to be tapped. As Canadian businesses look to diversify and grow, here are five reasons why expanding to the Indo-Pacific should be a top priority:

- Vast Market Potential: The Indo-Pacific region is home to some of the fastest-growing economies in the world, including China, Japan, South Korea and India. With a burgeoning middle class and increasing disposable incomes, these markets offer a vast consumer base eager for Canadian goods and services.

- Strategic Location: Situated at the crossroads of major trade routes, the Indo-Pacific region provides a strategic gateway to global markets. By establishing a presence in key hubs such as Singapore, Hong Kong or Mumbai, Canadian businesses can enhance their access to markets in Asia, Africa and beyond.

- Diverse Investment Opportunities: From infrastructure development to technology, health services, natural resources and agriculture, the Indo-Pacific region offers a wide array of investment opportunities across various sectors. Canadian businesses can leverage their expertise and innovation to tap into these growing markets.

- Cultural and Commercial Links: Canada shares historical ties and cultural connections with many countries in the Indo-Pacific region, providing a strong foundation for business relationships. These connections can facilitate market entry and help Canadian businesses navigate the local business landscape.

- Strategic Partnerships: By expanding to the Indo-Pacific, Canadian businesses can forge strategic partnerships with local companies, governments and institutions. These partnerships can provide access to local networks, resources and market insights, helping Canadian businesses succeed in the region.

Today, the Indo-Pacific contributes over one-third of all global economic activity. By 2040, it’s expected to surpass 50%, and by 2030, it will be home to two-thirds of the global middle class.

If there’s ever a time to tap into this market, it’s now. But how do you start? Which sectors are emerging in the region? And what strategies can you employ to expand your business’s presence?

Get all the answers from Indo-Pacific experts at our Gateway to the Indo-Pacific event, taking place in Montreal on April 10 in collaboration with Export Development Canada.

This event is free to attend. Register now to secure your spot!

You can also check out EDC’s Indo-Pacific Market Intelligence Hub for insights and analysis to help plan your global expansion.

Related News

Economic Outlook | June 2023

Critical Minerals Executive Summit Wrap-Up

Ask Your MP to Support Farmers and Vote in Favour of Bill C-234

Blog /

How Petro-Canada is “Building for the Future”

How Petro-Canada is “Building for the Future”

This blog was provided by our partners at Suncor.

This blog was provided by our partners at Suncor.

Don’t be surprised if you pull into your local Petro-Canada station only to see a “Building for the future” sign posted, more commonly known as “Closed for renovations.”

“The Petro-Canada station where I often stop is being re-built from the ground up,” notes Colleen Gray, an executive assistant at Suncor who frequents a station on Macleod Trail, a busy route in Calgary. “I’m excited to see the changes.”

Just like popular renovation shows where homeowners make changes to maximize their home’s space and add functionality, many Petro-Canada retail stations are undergoing similar makeovers to offer more value to customers.

“The majority of Suncor-owned Petro-Canada stations across Canada will be transformed over the next few years to serve our customers better,” explains Murray Osbaldeston, Director of Asset Management for Petro-Canada. “This is the fastest and largest scope of site transformations for Petro-Canada ever.”

Some sites will be re-built entirely to add a quick service restaurant, car wash, convenience store or all three, which is what’s known as “a full offer” site. Other sites will undergo smaller, but important enhancements such as updating an existing quick service restaurant, the gas bar (pumps) or canopy (the cover above the pumps). To ensure we have the most efficient and resilient sites for the future, some sites will be closed where the location or size of the site prevent us from adding valuable services and amenities customers want.

“We’ve learned that our customers appreciate a site with a ‘full offer’,” says Shannon Wing, GM of Retail Sales & Operations for Petro-Canada. “They can fill or charge up, grab a bite to eat, get a car wash and pop into a convenience store all in one stop.”

Transforming our physical sites is one of many ways we’re improving the Petro-Canada network. Other recent examples include opening retail fuel stations in Newfoundland and Labrador with an operating partner, and entering into a long-term partnership with Canadian Tire that will provide millions of Canadians with more value through our respective loyalty programs and make Suncor the primary fuel supplier to Canadian Tire’s Gas+ sites over time.

“It’s an exciting time for Petro-Canada,” adds Shannon. “We’re being thoughtful about when and where to temporarily close sites for renovations to minimize disruption to our customers and manage our costs carefully. Thanks for your patience if your local Petro-Canada is undergoing these changes — I promise it will be worth the wait.”

Related News

September 2022 Labour Force Survey: The “cooling-off period” continues

Policy Matters: Canadian Business Is an Integral Part of the Economic Solution

Navigating the Skies: 6 Takeaways from Our Aviation Executive Summit

Blog /

Policy Matters: Canadian Business Is an Integral Part of the Economic Solution

Policy Matters: Canadian Business Is an Integral Part of the Economic Solution

Canada must pursue economic growth if we are to maintain our standard of living and continue to provide the services Canadians require.

The federal budget sets the economic tone for the year — but before it’s released, Canadians have an opportunity to share their ideas on what should be prioritized in pre-budget consultations.

These consultations can be as simple as an individual answering a questionnaire or as in-depth as an organization sending a formal written submission. Pre-budget submissions are important because government needs to hear from stakeholders who have real-world experience in the day-to-day function of the economy.

Each year, the Canadian Chamber of Commerce, on behalf of our broader membership of 200,000 Canadian businesses, sends an in-depth submission to the government’s Standing Committee on Finance (which we did in August 2023), followed by a letter to the Minister of Finance (which we sent in February).

Submitting our recommendations is a chance to help ensure that the federal budget rightfully and meaningfully considers the needs of Canadian businesses by investing in long-term economic measures like infrastructure, cybersecurity, talent and innovation.

Economic Growth Driven by the Private Sector

Our vision is for Canadian businesses to be viewed by government as an integral part of the economic solution. After all, business success leads to economic prosperity, resulting in a better life for all Canadians.

Government stepping aside to allow the private sector to lead economic growth, instead of spending more money to create new programs, is particularly critical at a time when Canadians are struggling with unaffordable housing markets and the high cost of living. Many of the measures we included in our pre-budget submission, including regulatory reform and dismantling internal trade barriers, will cost the government little or nothing but will generate future prosperity and ease the burden on both businesses and Canadians.

We see Budget 2024 as an opportunity to attract the investment needed for strong, sustainable economic growth and a successful net-zero transition, while also fostering businesses of all sizes.

How can we get there?

In our letter to Deputy Prime Minister Chrystia Freeland, we put forward 17 policy recommendations under five larger themes. We’ve highlighted the major points from each theme below.

Ensure Reliable Supply Chains

Two-thirds of Canada’s gross domestic product (GDP) is based on trade activity, but successful trade requires reliable supply chains. However, as we learned in 2023, supply chains are only as strong as their weakest links.

Frequent floods and wildfires last year revealed the fragility of many of Canada’s supply chains. At the same time, key points in our trade corridors experienced repeated or prolonged strikes, putting further strain on the entire system and wracking up economic costs. The Government of Canada estimated that a full shutdown of the Port of Montreal during a 2023 strike cost the Canadian economy $100 million a week! Reliable infrastructure and supply chains will help alleviate some of the frustration Canadians are feeling about the affordability crisis since they’ll ensure that products move and prices are stable.

In our pre-budget submission, we recommend government:

- Commit to long-term investment through a Canada Trade Infrastructure Plan.

- Expand abilities to head-off preventable threats to supply chains, like recurring labour disruptions.

Ease the Burden of Doing Business

The right policy environment can help businesses succeed in today’s rapidly changing global landscape. Governments in the past have attempted to regulate our industries into being competitive, but this has had the opposite effect — investment is no longer incentivized, and entrepreneurs and owners experience extra hurdles and costs when trying to start or grow their businesses.

Government and businesses working together to modernize our regulatory system will foster an economy that values innovation and growth, while also retaining the next generation of entrepreneurs and talent and ensuring Canada remains an attractive destination for investment.

We recommend government:

- Accelerate regulatory modernization and include an economic and competitiveness lens when developing new regulations.

- Act to reduce interprovincial barriers to potentially increase GDP growth by up to 8%.

- Stop introducing new taxes. As Canadians and businesses across the country struggle with an increased cost of living, now is not the time to increase taxes.

- Develop targeted and strategic support for struggling small- and medium-sized enterprises.

Make Pragmatic Investments in Net-Zero

The economy and the environment should advance in lockstep. Our resource sector — natural gas and oil, hydro, mining, and forestry — can deliver low-emission energy and other products to meet global needs, while developing new clean technologies that deliver emission reduction. This is something to be proud of.

We recommend government:

- Develop a cohesive national energy strategy that recognizes the need for specific regional and provincial approaches.

- Facilitate the transition to net-zero through commitments to carbon capture and storage projects, carbon contracts for difference, and long-term major infrastructure projects that will allow us to decarbonize our energy sector.

- Incentivize partnerships with Indigenous communities that advance decarbonization projects and support economic reconciliation.

Enable an Innovative Economy

Canadian businesses are well-placed to lead in high-growth sectors. According to a 2023 report by Deloitte, Canada ranked first out of all G7 nations in artificial intelligence (AI) talent concentration, and we came second in number of AI patents filed. However, to maintain this competitive edge, we must capitalize on our advantages in AI, cybersecurity, and digital health.

We recommend government:

- Protect critical infrastructure, supply chains and businesses from cyber threats by investing in IT and operational technology security.

- Encourage value-added agricultural processing to help Canada meet global food demand.

- Continue to support a resilient and globally competitive life sciences sector by building on the biomanufacturing and life sciences strategy.

- Support and incentivize AI adoption and implementation in business operations and processes to improve the efficiency and productivity of Canadian businesses.

- Continue the greater democratization of data by renewing the Business Data Lab.

Attract, Develop and Retain Talent

The Canadian labour shortage, recruiting new employees and retaining skilled employees are among the top 10 business obstacles expected in the short-term according to the 2023 Q4 Canadian Survey on Business Conditions Report from the Business Data Lab. Canada needs a forward-looking national workforce strategy to attract, retain and develop a skilled and resilient workforce that is ready to respond to today’s labour needs and successfully navigate to the net-zero demands of the future.

We recommend government:

- Address workforce gaps through skills-based immigration programs that are aligned with regional labour needs.

- Enhance upskilling and reskilling programs and supports to meet labour market needs.

- Expedite foreign qualification recognition in priority sectors like agriculture, childcare, construction, healthcare and transportation.

Moving Forward

As we await the release of Budget 2024 on April 16, it is encouraging to see that many of our recommendations were reflected in the Standing Committee on Finance’s report, Shaping Our Economic Future: Canadian Priorities, that was tabled in the House of Commons on February 26.

The report makes public the committee’s findings and recommendations from the pre-budget consultations in advance of the 2024 budget.

Collaboration between government and the business community is more critical than ever. A successful partnership must be founded on the understanding that business as part of the economic solution will allow us to respond effectively to current economic challenges. The government’s response will determine whether we remain a reliable country for trade, investment and business and support a better life for all Canadians.

Related News

Connecting, Networking and Celebrating with the Canadian Chamber Network

Advancing Canada’s Economic Competitiveness: The Chamber’s Alex Gray’s Addresses the House of Commons Standing Committee on Finance

Improve Your Cybersecurity Posture in 2023

Blog /

Getting Squeezed: New Report from the Business Data Lab Breaks Down the Effects of Inflation and Rising Costs on Canadians

Getting Squeezed: New Report from the Business Data Lab Breaks Down the Effects of Inflation and Rising Costs on Canadians

Businesses and households across the country are suffering from an affordability crisis driven by inflation and rising costs.

In 2022, inflation spiked at over 8% — the highest it’s been in the last 40 years. Because of this overshoot, consumer prices in Canada are now 7% higher than they would have been if inflation had grown at the 2% target rate since the start of the pandemic. According to a new report from the Business Data Lab (BDL), the result is that homeowners, consumers and business owners across the country are feeling the squeeze of high interest rates and housing and energy costs.

The report, Getting Squeezed: The Impact of Rising Prices for Housing and Energy, Interest Rates and Costs on Canadian Consumers and Businesses, answers the following questions:

- How have recent increases in housing and energy costs affected consumer spending?

- Are there notable differences in the impact on consumer spending across regions?

- Are these trends systemically related to business sales and sentiment across regions?

Let’s look at some key findings from the report.

The Situation

Since March 2022, Canada’s central bank has raised interest rates to try and control inflation, which increased borrowing costs for consumers and businesses. Higher interest rates make it more expensive to pay off debt (including mortgages), borrow to buy big ticket items and run a business. With greater debt service obligations, consumers have less money available for discretionary spending on other goods and services, which drives down business sales.

Looking back at longer-run inflation drivers, the BDL report finds that over the past two decades, housing and energy costs have increased at a faster rate than overall prices in all regions of the country.

Housing Costs

Canada’s housing market is the most unaffordable it’s been in over 30 years. For the typical Canadian household, this means that all-in housing-related expenses (which includes mortgage payments and utility fees) have ballooned to represent 55% of disposable income. The higher this percentage, the more difficult it is to afford a home.

Mortgages

The 5-year fixed mortgage rate has risen significantly from 1.9% in 2021 to more than 5.5%. Looking ahead, with almost 60% of all outstanding mortgages — representing $900 billion — up for renewal in the next three years at higher interest rates, this is expected to act as a significant drag on consumer spending.

Energy Costs

Like housing, energy costs have also risen faster than other consumer items across provinces over the long run, with energy prices being more volatile.

Impact on Consumers

Across income levels, over half of Canadians are concerned about the cost of living and most (54-64%) are reducing their spending to protect against high inflation, especially lower-income households. BDL analysis finds that consumers in regions with greater housing affordability challenges, such as British Columbia and Ontario, have cut back more on their spending than consumers in more affordable regions.

Impact on Business

According to the Getting Squeezed report, inflation, input costs and interest rates/debt costs are the top three obstacles expected by businesses in the next three months. Small businesses in particular are struggling with fuel and energy costs, wages, and taxes and regulations.

With consumers spending less, business sales are suffering, leading to lower business sentiment. BDL finds that in regions with the most unaffordable housing markets, businesses are more pessimistic about their sales, and are also less optimistic about their outlook for the year ahead.

What mechanisms could be causing this?

- When consumer costs for housing and/or energy rise faster than overall inflation, consumers adjust by reducing their spending on discretionary items like travel, entertainment, and eating out, which reduces business sales and lowers business sentiment.

- When interest rates rise, consumers need to spend more on debt servicing. Consumers adjust by reducing their spending on big ticket items typically purchased by borrowing, such as housing, home furnishings and cars, which reduces business sales and lowers business sentiment.

Looking Ahead

The bottom line is that Canada’s affordability crisis is bad for both households and businesses. Communities across the country can’t wait for the prospect of lower interest rates to solve the crisis. Proactive attention must be paid to Canada’s economic health, with special consideration given to announced legislation and new regulations that could further aggravate the situation.

Related News

Policy Matters: The National Day for Truth and Reconciliation

Canada’s talent crisis needs action from government

Highlights from our Executive Summit Series 2022

Blog /

Responding to a Cyberattack: What Businesses Should Know

Responding to a Cyberattack: What Businesses Should Know

This blog was provided by our partners at Field Effect.

This blog was provided by our partners at Field Effect.

Many organizations tend to think of cybersecurity incidents as only sophisticated, complex attacks on large organizations. But cybercriminals are largely financially motivated, targeting any organization in search of monetary gain, no matter employee count.

It’s crucial that all organizations think about their cybersecurity and how they would react to an incident before it happens. How will you respond if—when—you learn of suspicious activity? What’s your first step? Can you carry out the investigation and restoration in-house, or do you have third-party experts on standby?

In the end, incident response is a major undertaking. Not only does it involve mitigating and removing the threat entirely, but better protecting your business to avoid compromises in the future.

Incident response: Key steps of the forensic investigation

The incident response process can vary, but in the end, it strives to answer these questions:

What?

It’s important to figure out exactly what happened. What did the cybercriminal do? What business processes are affected? Was any of the company’s data taken during the incident?

When?

We also want to create a timeline for the attack. When did the attack start, how long did the cybercriminal have access to the environment, and what was the last activity?

Where?

To make recovery as seamless as possible, it’s key to determine which systems were impacted, and what needs to be rebuilt. Was the whole network affected, or just a specific user account or system?

How?

This is a big one: figuring out how the cybercriminal conducted their attack. What was the root cause of the compromise? Can we determine their activity—commonly called their tactics, techniques, and procedures (TTPs)—or other indicators of compromise (IoCs)?

This step is typically the most time-consuming, but it’s often the most critical from an incident response standpoint. The goal is to be able to identify how the cybercriminal originally got into the network, how they moved around after, and whether they stole any data.

Why?

Why did the cybercriminal conduct the attack? Often, the answer is money. This is why ransomware attacks—when the cybercriminal locks or steals data and demands payment for the data’s safe return—are such a common attack type.

What about after the cybersecurity incident?

While answering the questions above, there will be a point where the incident is considered contained, and the process of remediation and restoration can begin. Any security gaps which allowed the attacker in will be fixed and work can get started on bringing business practices back online.

But this step also includes improving your cybersecurity for the future by putting the right security solutions, policies, and processes in place. After all, incident response is not just about fixing an attack, but helping to prevent future ones.

What about before?

The good news is you can also take steps to reduce your risk of an attack before it happens.

Educating staff, adopting the right policies, having an incident response plan in place, and implementing a sophisticated cybersecurity solution are all core ways to proactively reduce your risk of an attack, as well as being better prepared to respond and recover when one does happen.

Whether you need incident response help now or want to kickstart your cybersecurity strategy, visit https://fieldeffect.com to explore our cybersecurity solutions and services.

Related News

Canadian Chamber shares post-budget comments on the general anti-avoidance rule (GAAR)

Small Business Month 2023 – Our Chamber Network’s Testimonials

The Value of Compliance: The Importance of Origin in International Trade

Blog /

Two years in, the Russian invasion of Ukraine remains an affront to humanity

Two years in, the Russian invasion of Ukraine remains an affront to humanity

The starting point for ensuring a better future for Canadians and Ukrainians is to recognize how much has changed.

Today, on the two-year anniversary of Russia’s illegal invasion of Ukraine, the Canadian Chamber of Commerce reiterates our deep dismay that Ukraine’s sovereignty is still under attack and the Ukrainian people must still live under siege. The Putin government’s brutal invasion violates both the rule of law and the international norms on which democratic societies and free economic systems rest.

The starting point for ensuring a better future for Canadians and Ukrainians is to recognize how much has changed. The world is a fundamentally more dangerous place as democracies find themselves under assault from increasingly assertive undemocratic regimes.

This conflict presents serious choices for our political leaders, for businesses and for citizens, both here in Canada and among our democratic allies.

If it was ever more than a dangerous illusion for Canadians to believe that our geography makes us safe from the conflicts that tear apart countries in other parts of the world, there is certainly no room for complacency now. We do not live on an island where what we hold most dear is secure while the lives and freedoms of others are stolen from them.

Canada was the first Western nation to recognize Ukraine’s independence in 1991. Since then, we have enjoyed close trade relations with Ukraine, and Canada has benefited from the over one million Canadians who are of Ukrainian heritage. We have been both the benefactor and the beneficiary as Ukrainians have chosen to make new lives here.

What is taking place in Ukraine is first and foremost a human tragedy, but it has important economic consequences as well. Canada’s relationship with Ukraine is both strategic and mutually beneficial. We play a significant and important role in each other’s economies. Over the decades, Canada’s economy and population have profited from hundreds of millions of dollars of Ukrainian technology and products, in addition to our own pharmaceutical, machinery and aquaculture exports to that country.

It is in Canada’s best interest to maintain this relationship, which is why the Canadian Chamber wholeheartedly supports the legislation passed earlier this month to update Canada’s free trade agreement with Ukraine. This legislation underscores Canada’s commitment to our long-standing friend and acknowledges our decades of trade. It positions us to support Ukraine in its economic recovery and further its physical, economic and energy security. And highlights the need for strategic, long-term investment in trade infrastructure to strengthen Canada’s vulnerable supply chains so Canada, Ukraine and other partners can continue successful trade even during times of geopolitical crisis.

The Canadian Chamber supports efforts by Canada and its allies to end the conflict. We express our continued solidarity with the Ukrainian people and the Ukrainian business community during these tragic times. Let us work with our democratic partners around the world so we will never have to mark another such anniversary.

This article originally appeared in iPolitics.

Related News

ESG Trends to Watch in 2023: ESG Liability for Canadian Companies, Directors and Officers

Canadian Small Business Cybersecurity Survival Guide

Canadian Chamber brings net zero recommendations to Senate Energy, Environment and Natural Resources Committee

Blog /

Policy Matters: Advancing Canada’s Agriculture and Agri-Food Sector

Policy Matters: Advancing Canada’s Agriculture and Agri-Food Sector

Any strategic vision Canada has for the agri-food sector must facilitate access to expanding global markets, positioning us as the solution to the urgent global demand for food.

There has never been in a time in recent history when food insecurity and food inflation are of more importance to world governments. In the next 40 years, the world will need to produce the equivalent of all the food produced in the last 10,000 years.

Canada’s agriculture and agri-food sector has the potential to singlehandedly meet this demand — with the right investment. We are one of the few countries with an export-oriented industry, selling upwards of 70% of crops like soybeans, wheat, canola and pulses to other countries.

Any strategic vision Canada has for the agri-food sector must facilitate access to expanding global markets, positioning us as the solution to the urgent global demand for food, while also allowing us to achieve our ambitious objectives for increasing domestic and export sales by 2025.

In addition to contributing to our economic prosperity, Canada can use our agri-food sector to increase our global influence at a time when the world is undergoing major shifts in the post-WWII international order. Because, despite how drastically things have changed in the past few years, the world will always need food.

Challenges and Opportunities for Canada’s Agriculture and Agri-Food Sector

The agriculture and agri-food sector is an economic powerhouse, supplying approximately 2.3 million jobs and contributing $143.8 billion (7.4%) to Canada’s GDP, and its continued competitiveness and sustainability are vital to a prosperous future for generations to come.

There may be significant challenges to overcome before we can take full advantage of this pivotal economic opportunity, but with the right government investment and supports, we will be able to expand and amplify the sector both domestically and internationally.

Infrastructure

The growth of the agriculture and agri-food sector relies on having reliable physical and digital infrastructure.

Physical Infrastructure

Expansion of Canada’s agriculture and agri-food industry is largely dependent on our ability to move goods efficiently and reliably to international markets. Unfortunately, as the events of 2023 demonstrated, our trade infrastructure is vulnerable to extreme weather events and labour disruptions.

The infrastructure challenge requires us to be especially forward-thinking and invest in worthy, strategic and long-term trade and transportation infrastructure. Increasing bridge capacity to reduce congestion in high-traffic areas will help relieve some of the pressure. As will government policies that mitigate the negative consequences of labour disruptions at ports.

According to recent data analysis by Scotiabank Economics, “Canada is losing more hours worked to striking workers than it lost at any point during pandemic restrictions.” Replacement workers allow organizations in sectors like trucking, rail, ports, telecom, and air to maintain a basic level of “lights on” continuity that preserves supply chains and critical services for Canadians, including fertilizer deliveries that sustain our food supply — and other nations’. The anti-replacement worker legislation that is being considered by government will provide an encouragement to strike rather than to bargain collectively. In fact, research from the C.D. Howe Institute found that anti-replacement worker legislation increases the frequency and length of strikes and even reduces hourly wages.

Digital Infrastructure

On the digital side, the agriculture and agri-food sector has invested in solutions to address consumer demand and make supply chains more efficient, which has the added benefit of reducing operating costs and improving the sustainability and environmental footprint of the sector. But challenges arise when it comes to unreliable transportation systems and lack of supply chain transparency, making end-to-end digitization of Canada’s national transportation network more important than ever. Government investments in digital infrastructure will permit real-time data sharing in all aspects of the supply chain and increase visibility to prevent reliability issues.

Policy Recommendations

- Commit to long-term investment through a Canada Trade Infrastructure Plan. Canada must build and maintain trade infrastructure that reliably and efficiently transports goods to and from market.

- Abandon anti-replacement worker legislation. Any actions that introduce more volatility and disruption to supply chain processes will only raise costs for Canadians and businesses, and further undermine our trading relationships.

- Address transportation bottlenecks and supply chain vulnerabilities by coordinating strategic and sustained investments in trade-enabling infrastructure, and in digital processes to optimize delivery, particularly for rural and remote communities.

Commercialization

Canada is the fifth largest exporter of agriculture and agri-food products in the world. Too often, Canada ships its unmodified agricultural commodities abroad to be processed by another country and then sold back to Canada as a new product. By developing our domestic processing and manufacturing capacity, we can make these value-added products in Canada and sell them globally at a higher price than we can our raw commodities, leading to more jobs and economic activity.

Policy Recommendations

- Strengthen investment in agriculture. Partner with businesses on research, product development and the commercialization of the agri-food sector, while developing policy mechanisms and supports to incentivize private-sector research and development investment.

- Encourage value added agricultural processing. Increased capital investment in agricultural processing would help Canada meet global food demand, while promoting value-added economic activity in commodities bound for export.

- Identify agriculture and agri-food as a key economic growth sector and take a whole-of-government approach to implementing policies that promote long-term growth for the industry.

Innovation and Productivity

Innovation — the significant improvement of a product, system, or process — and new technologies are needed to maintain or increase the productivity of Canada’s agriculture and agri-food sector. But as with many other industries across Canada, the sector is facing ongoing and chronic labour shortages. Businesses are being forced to rethink their operations and consider less labour-intensive ways of running their operations, like automation and robotics, but this high level of technology requires specialized skillsets to fix and operate as well as access to broadband internet, both of which can be a barrier, especially in remote rural regions.

Despite these challenges, the sector is already using innovative techniques and technology to improve productivity, disease resistance and harvests, including:

- Seed technology: Seed is the starting point for agriculture and Canada is known for its innovation in the sector, producing seed that results in higher yield potential, greater disease resistance and improved quality.

- Crop rotation: Crop rotation involves switching out what kind of crops are grown on a plot of land every few years. Having these diversified rotations can help with insect and disease management. Results from two long-term studies on corn in North America showed, “that increasingly diversified rotations improved corn yields across all growing conditions, including during growing seasons with extended droughts.”

- Precision agriculture: A management method that uses different technology, as well as data and analytics, to increase efficiency, production and sustainability.

Further development and application of these and other innovations will provide Canadian producers with a competitive edge.

Policy Recommendations

Policy changes that incentivize private-sector investment by targeting research and development as well as promote collaboration between the agri-food sector and public innovation programs in Canada will transform our ability to create and retain innovations that can increase the agriculture sector’s competitiveness.

- Prioritize the allocation of spectrum through measures such as increasing the quantity of spectrum available and subsidizing rural deployment. For Canadian businesses to remain globally competitive, they need to be able to access wireless services, use the power of the Internet of Things (IoT) and artificial intelligence, and benefit from deployment of 5G networks.

- Develop mechanisms, policy, and support to incentivize private-sector research and development investment that will increase short-term resilience and long-term competitiveness.

- Incentivize investments in labour-saving technology to address the growing labour shortage in the agri-food sector.

Regulatory

Although a 2018 Economic Strategy Table on Agri-food called for an agile regulatory regime that is robust, flexible and based in evidence to help clear up the red tape, the issue remains. A regulatory system that is informed by economic realities and driven by data and evidence that prioritize health, safety, and sustainability will greatly improve our ability to get crops where they need to go — domestically and internationally. Another meaningful step would be to ensure that regulators consider the impact on businesses, innovation and growth when developing new rules and systems.

Policy recommendations

- Add an economic and competitiveness mandate for regulators. An economic mandate for regulators would encourage manageable regulations that support economic growth and consider our competitiveness in the global marketplace.

- Ensure regulatory alignment. Government must look to ease the regulatory burden facing Canadian business, and work with industry and our international trading partners to ensure regulatory efficiency and alignment.

- Modernize Canada’s regulatory regime by committing to evidence-based, data-driven regulation and applying an economic lens to all regulatory mandates.

The Future of Agriculture and the Agri-Food Sector

This could be Canada’s moment to realize the full economic potential of our agriculture and agri-food sector and provide for future generations of Canadians as well as our international partners.

To get there, the sector needs help that can only come from the government collaborating with the private sector on solutions to meet the challenges facing the industry today. Solutions that take a holistic approach to policy implementation by including agriculture and agri-food businesses in economic and environmental consultations and programs.

Related News

Life Sciences Summit: Accelerating Canada’s Health Data Ecosystem

Policy Matters: 3 Priorities for International Trade